|

| Gold V.1.3.1 signal Telegram Channel (English) |

James Hardie Stock Plummets 35% Amidst US Housing Market Slowdown and Integration Challenges

2025-08-21 @ 02:00

James Hardie Faces Historic Stock Collapse Amidst U.S. Housing Market Turmoil

James Hardie Industries, a global leader in building materials, has suffered a dramatic 35% plunge in its stock price—the company’s largest single-day drop in over fifty years. This sharp decline has sent shockwaves through both the construction sector and wider financial markets, prompting investors and analysts alike to scrutinize the factors behind this unprecedented sell-off.

The immediate catalyst for the drop was the company’s latest quarterly earnings, which revealed a series of discouraging figures. Net profit for the period sank 28% year-over-year, while net sales fell 9%. Most alarming was the 12% decline in sales of their flagship fiber cement products in North America—the company’s core market. These numbers underscored what CEO Aaron Erter described as “uncertainty” and “affordability challenges” rippling through the U.S. housing market.

According to Hardie’s leadership, the slowdown in single-family home construction was especially pronounced in southern regions like Texas, Florida, and Georgia. Persistently high interest rates have stifled housing demand across the country, deterring both new homebuyers and current homeowners from embarking on large-scale remodels or construction projects. In his earnings call, Erter noted that consumers are increasingly deferring major renovation projects, such as re-siding homes, due to tighter budgets and a reluctance to take on new debt.

The challenging demand environment comes at a particularly inopportune time for James Hardie. The company had recently acquired AZEK Company, a move that was intended to capitalize on expected U.S. housing market resilience. The $8.75 billion acquisition was seen as a strategic investment, but integration costs have proven burdensome, further eroding profit margins. With the market in flux, the integration—which might have been seamless in more favorable conditions—now appears to be weighing heavily on the company’s financial health.

Investor reaction was swift and brutal. The stock’s collapse wiped out over a third of James Hardie’s market value in a matter of hours, plunging shares to their lowest level in two and a half years. The sell-off was remarkable not just for its scale but also its context: even as other building materials and home improvement stocks have faced pressure this year, none have suffered a single-day rout of this magnitude.

The selloff wasn’t contained to James Hardie alone. The broader building materials sector reflected similar, if more muted, volatility. Sector leaders like Owens Corning also saw share prices fall, and Lowe’s strategic acquisition of Foundation Building Materials suggests escalating competition for the professional contractor segment. Investors appear to be growing increasingly cautious, favoring companies with stable, predictable demand rather than those exposed to housing market swings.

Analysts were quick to adjust their outlooks. The company’s operating profit plunged by nearly 29%, and its lowered guidance for future quarters has added to investor anxiety. Some experts now question the cyclical sensitivity of James Hardie’s business model, especially given its dependence on North American homebuilding trends. As long as affordability remains strained and homeowners postpone renovations, growth prospects look muted.

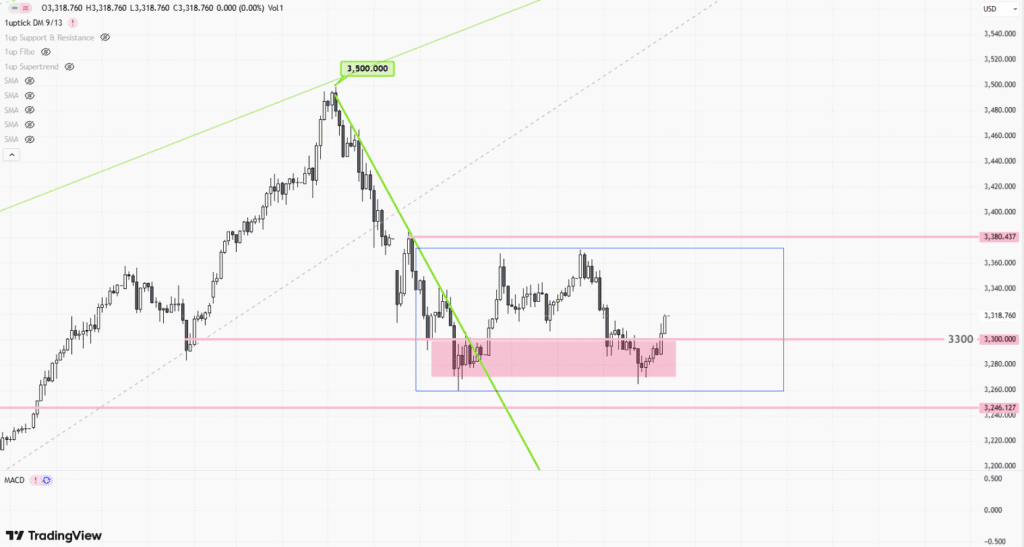

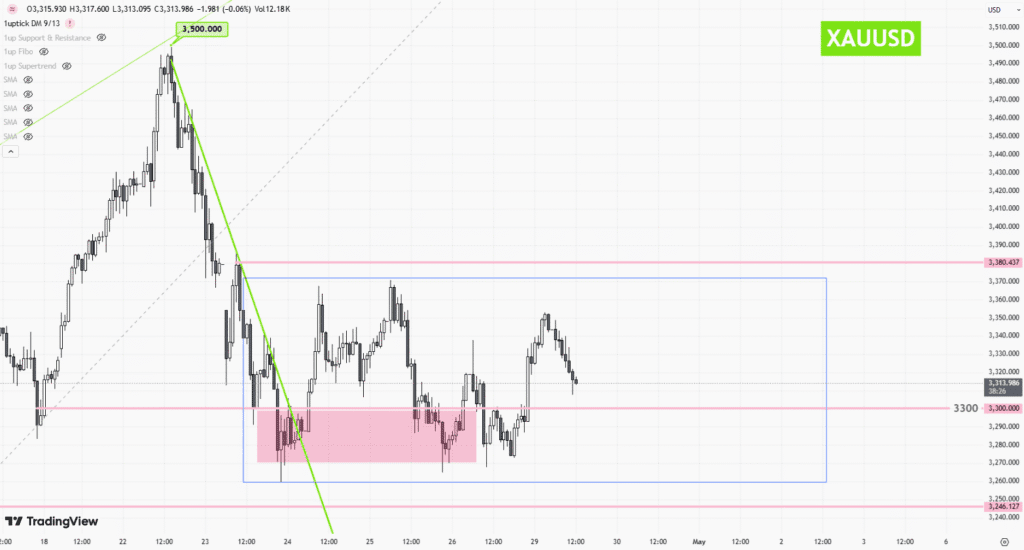

Technical indicators also mirror investor sentiment. The stock now trades well below its 200-day moving average, signaling a potentially oversold condition but also reflecting broader uncertainty about future price moves. While some traders may see an opportunity for short-term gains if the stock consolidates, others remain wary of catching what could be a falling knife.

Looking ahead, James Hardie’s story is emblematic of the broader challenges facing building materials suppliers in today’s economic climate. High interest rates have cooled off both real estate transactions and large home improvement projects, leaving companies across the sector scrambling to adapt. For James Hardie specifically, addressing the integration challenges stemming from the AZEK acquisition will be crucial, as will restoring investor confidence against the backdrop of a tough macroeconomic landscape.

In the short term, all eyes will be on how the company recalibrates its strategy, manages costs, and positions itself for recovery should the U.S. housing market find firmer footing in the months to come. Until then, the case of James Hardie stands as a stark reminder of just how rapidly sentiment and stock values can shift in response to changing economic winds.

![[Daily Closing 🔔] Gold – Gold Prices Slip as Markets Await Key U.S. Economic Data Release](https://int.1uptick.com/wp-content/uploads/2025/04/2025-04-30T034839.563Z-file.jpeg)

![[Gold price weekly] – Volatile Consolidation Driven by Multiple Factors](https://int.1uptick.com/wp-content/uploads/2025/04/2025-04-28T055444.196Z-file-1024x551.png)