|

| Gold V.1.3.1 signal Telegram Channel (English) |

Navigating Market Volatility: How Economic Shifts, Central Banks, and Geopolitical Risks Impact Your Investments

2025-08-26 @ 14:00

The financial world can turn on a dime, often shifting in response to global events, unexpected news, and investor sentiment. Recently, the markets have become increasingly turbulent as concerns grow about the health of some of the world’s largest economies. Let’s break down the latest developments and what they could mean for your finances.

Nervous Markets Respond to Economic Data

Stock markets worldwide have seen significant volatility as new economic data points to a slowdown. Investors have been jolted by fresh figures from the United States and China—two economic heavyweights whose performance often dictates global trends. In the US, recent reports suggest consumer confidence is waning, retail sales are losing momentum, and job growth is starting to decelerate. This shift has unsettled markets that were previously buoyed by hopes of a strong economic comeback.

China, traditionally a driver of global growth, has also shown signs of strain. Manufacturing output has disappointed, and a cooling property market is raising concerns about default and financial contagion. Chinese policymakers are under pressure to introduce support measures to stabilize their economy and reassure global investors.

Key Sectors Take a Hit

As economic worries grow, certain sectors have felt the chill more acutely. Technology stocks, which surged during the pandemic, have faced sharp corrections. Concerns about future profitability and changing consumer behavior have spooked investors. Financial stocks, particularly banks with exposure to international markets or to troubled sectors like real estate, have also declined.

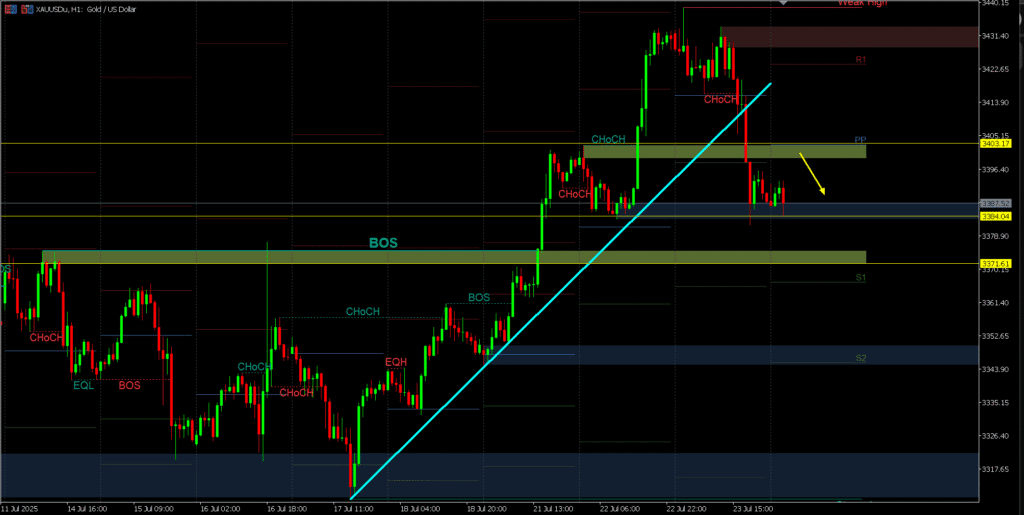

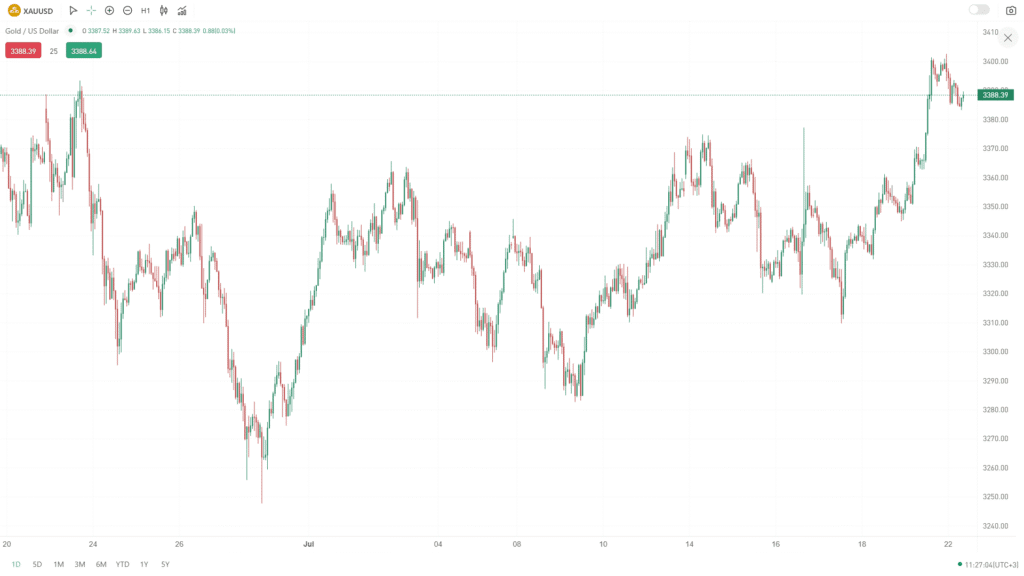

Commodities provide a telling barometer of global confidence. Oil prices dropped amid fears that slower economic growth will crimp energy demand. Meanwhile, gold—often seen as a safe haven—has attracted interest from risk-averse investors, causing its price to rise.

Central Banks Face Difficult Choices

Much of the anxiety in markets centers around how central banks will respond. The US Federal Reserve and other central banks have spent the past couple of years raising interest rates to combat inflation, but higher rates can also slow borrowing, investment, and growth. With signs of economic weakening, there is mounting speculation about whether the Fed and its counterparts will pause or even reverse rate hikes.

If inflation proves persistent, policymakers will be reluctant to loosen their stance too quickly. However, an economic downturn could force their hand, prompting cuts to support growth. The timing and scale of such decisions will directly impact stock markets, currency values, and loan interest rates—affecting everything from mortgage payments to business investment across the globe.

Geopolitical Tensions and Investor Sentiment

On top of economic worries, ongoing geopolitical tensions are fanning the flames of market uncertainty. The war in Ukraine, trade disputes, and friction between the US and China all add layers of risk for global investors. Each flare-up can trigger sudden swings in asset prices as traders try to gauge the potential fallout.

Investor sentiment is finely balanced on a knife-edge. While some see the current market weakness as a buying opportunity—hoping central banks will ease and revive growth—others are wary, anticipating further hardship ahead. This mix of fear and opportunism is reflected in daily market swings.

How Should Investors Respond?

Navigating these choppy waters requires a cool head and a long-term perspective. Here are some strategies that can help:

- Diversify Your Portfolio: Spread investments across asset classes, sectors, and regions to reduce risk.

- Review Risk Tolerance: Make sure your investments align with your appetite for risk, especially if volatility increases.

- Stay Informed: Keep up with market news and central bank signals to understand what is driving sentiment.

- Focus on Quality: Companies with strong balance sheets, resilient earnings, and solid management often weather downturns better.

- Avoid Emotional Decisions: Selling in panic or rushing to chase quick rebounds can harm long-term returns.

Looking Ahead

While recent data has rattled markets, periods of volatility are a natural part of investing. Economic cycles ebb and flow, shaped by a complex web of factors. History shows that opportunities can emerge even in uncertain times for those who remain patient and adaptable.

Ultimately, the key is to build a robust investment plan that accounts for the unexpected and to avoid being swayed by headlines alone. Whether central banks pivot, economies recover, or new challenges arise, maintaining perspective can help investors ride out the storm and come out stronger on the other side.