|

| Gold V.1.3.1 signal Telegram Channel (English) |

Nvidia’s 2025 AI Surge: Breaking Records and Leading the Future of Semiconductor Innovation

2025-08-19 @ 16:00

Nvidia: Riding the AI Wave to Record Highs in 2025

Nvidia, the global leader in AI and graphics processing technology, has experienced a remarkable journey across 2025, redefining what investors and the tech industry have come to expect from a semiconductor giant. Its trajectory this year highlights the volatility and vast potential inherent in the ongoing artificial intelligence revolution.

Early Year Volatility and Market Correction

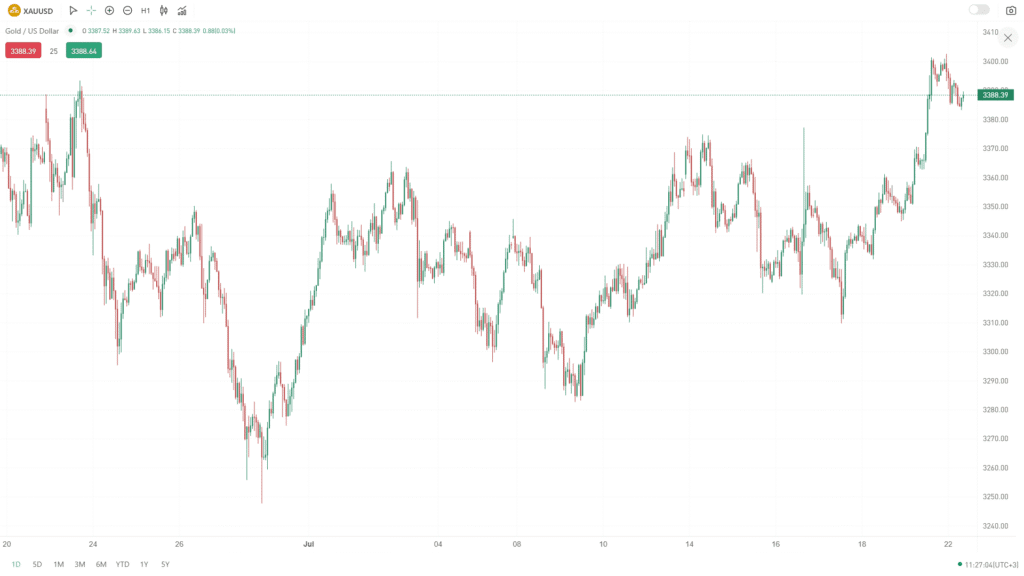

The year began with exuberance for Nvidia, as its stock continued to ride the momentum from previous years, hitting a then-record high. However, by spring, shares dipped significantly as broader US markets corrected. Contributing factors included an overheated market that had rallied impressively for two straight years, concerns over tariffs, and persistent AI-related uncertainties, particularly surrounding regulatory risks and export restrictions.

One notable event was increased scrutiny and temporary export bans affecting Nvidia’s advanced H20 AI chips, which are crucial for data centers and machine learning applications in key international markets like China. At the same time, tech investors fretted about a possible slowdown and escalating competition in the AI space, triggering a temporary loss of confidence and a dip in Nvidia’s stock price.

Resurgence Driven by Policy and Infrastructure

The landscape shifted dramatically midyear when the US government chose to lift its export restrictions on Nvidia’s H20 chips bound for China. This pivotal policy reversal, combined with a surge in global capital spending on AI infrastructure—from cloud giants expanding their data centers to enterprises boosting digital transformation—translated into a rapid recovery for Nvidia shares.

By July, Nvidia’s stock not only recovered but surged to fresh all-time highs, closing at unprecedented levels. This resurgence pushed Nvidia’s market capitalization past the historic $4 trillion mark, making it the first company to achieve this milestone. Such rapid growth underscores Nvidia’s critical role at the heart of the AI revolution, as its GPUs and software platform remain foundational to next-generation computing.

Competitive Landscape and Strategic Focus

Despite spectacular growth, Nvidia continues to face headwinds. The company’s heavy reliance on several large customers places it at risk should buying patterns shift or if other semiconductor and cloud players succeed in building credible alternatives. Emerging competition from in-house chips developed by tech giants and startups alike serves as a persistent reminder that dominance in the tech sector is never guaranteed.

Nonetheless, Nvidia’s swift responsiveness—ramping up new chip releases, deepening CUDA software ecosystem integration, and expanding into emerging fields like robotics, autonomous vehicles, and quantum computing—has cemented its role as a strategic partner for big tech. Companies such as Alphabet and Tesla are moving rapidly toward commercializing autonomous vehicles, while Microsoft, Alphabet, and Amazon are developing their own quantum computing initiatives, all with Nvidia’s platforms as a vital backbone.

Valuation and Investor Perception

Investors remain focused on Nvidia’s valuation, with the company trading at a forward price-to-earnings ratio that, though high by broad market standards, appears justified by its staggering growth rate and outsized influence on AI adoption. Historical data shows that on the rare occasions when Nvidia’s valuation has slipped to more modest levels, investors have seized the opportunity, repeatedly driving the stock back up on renewed optimism over its long-term prospects.

Looking Ahead: Catalysts and Risks

Looking toward the back half of 2025 and into 2026, Nvidia faces a market watching keenly for new growth catalysts. Quarterly results and company guidance about future capital expenditures in hyperscale data centers could be decisive. If enterprises continue ramping up investments in AI infrastructure, it could spark another rally in Nvidia’s stock.

The key risk remains whether Nvidia can maintain its dominance as big customers explore internal solutions and regulatory regimes grow stricter on AI exports. Yet, as AI workloads become increasingly sophisticated—enhancing everything from robotics to quantum computing—Nvidia’s integration with leading-edge technologies positions it advantageously for the next phase of digital transformation.

Conclusion

Nvidia’s roller-coaster performance in 2025 demonstrates both the opportunities and challenges in the rapidly-evolving AI industry. While volatility may persist as the market digests new developments, few companies are as critical to the infrastructure underpinning artificial intelligence as Nvidia. Its prospects remain intimately tied to the pace and scale of AI adoption across industries, making it a perennial contender for long-term investors and a company to watch as the digital era continues to unfold.