|

| Gold V.1.3.1 signal Telegram Channel (English) |

Rising Inflation, Import Tariffs, and Job Market Slowdown: What It Means for the US Economy and Investors

Rising Inflation, Import Tariffs, and Job Market Slowdown: What It Means for the US Economy and Investors

2025-08-03 @ 22:00

A recent uptick in inflation and concerning job market signals have sparked unease on Wall Street, raising questions about the trajectory of the US economy. Inflation climbed to 2.7% in June, marking the second consecutive month of acceleration and reaching the highest level since February. This momentum follows a period of relative price stability but is now being jolted by newly imposed tariffs that are raising import costs across a range of products, including furniture, toys, recreational goods, and automobiles. Higher gasoline prices are further pushing household expenses upward.

More worrisome for economists and investors is the underlying trend in the core Consumer Price Index, which strips out volatile food and energy costs. This gauge advanced to 3% in June after remaining at 2.8% for three months, indicating that inflationary pressures are broadening beyond just energy and food sectors. Monthly core CPI growth of 0.3%—the sharpest movement in five months—suggests that businesses are increasingly passing tariff-related costs on to consumers.

In the labor market, fresh data is tempering optimism. While job openings persist, some sectors are showing slower hiring, with wage gains losing momentum. These shifts combine with higher consumer prices to fuel worries about household budgets and the potential for softer consumer spending ahead.

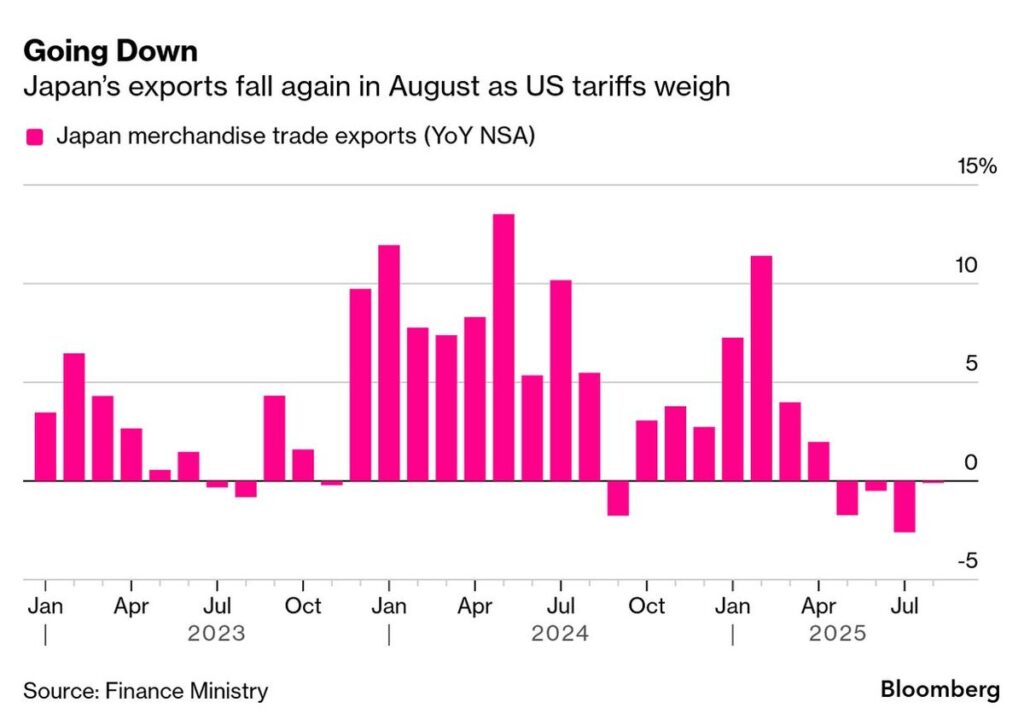

Together, rising import tariffs and inflation are heightening fears of stagflation—a situation where high inflation is accompanied by slowing economic growth and fragile employment. For investors and financial observers, the coming months will be critical in monitoring whether inflation remains contained or pressures the Federal Reserve to modify its interest rate policy. Watch this space for further updates as economic data unfolds and the impacts ripple through financial markets and Main Street alike.