|

| Gold V.1.3.1 signal Telegram Channel (English) |

Trump’s Controversial AI Windfall Tax on Nvidia and AMD: Constitutional Challenges and Market Impacts

2025-08-12 @ 14:02

Title: Trump’s Proposed “AI Windfall Tax” on Nvidia and AMD Sparks Constitutional Debate

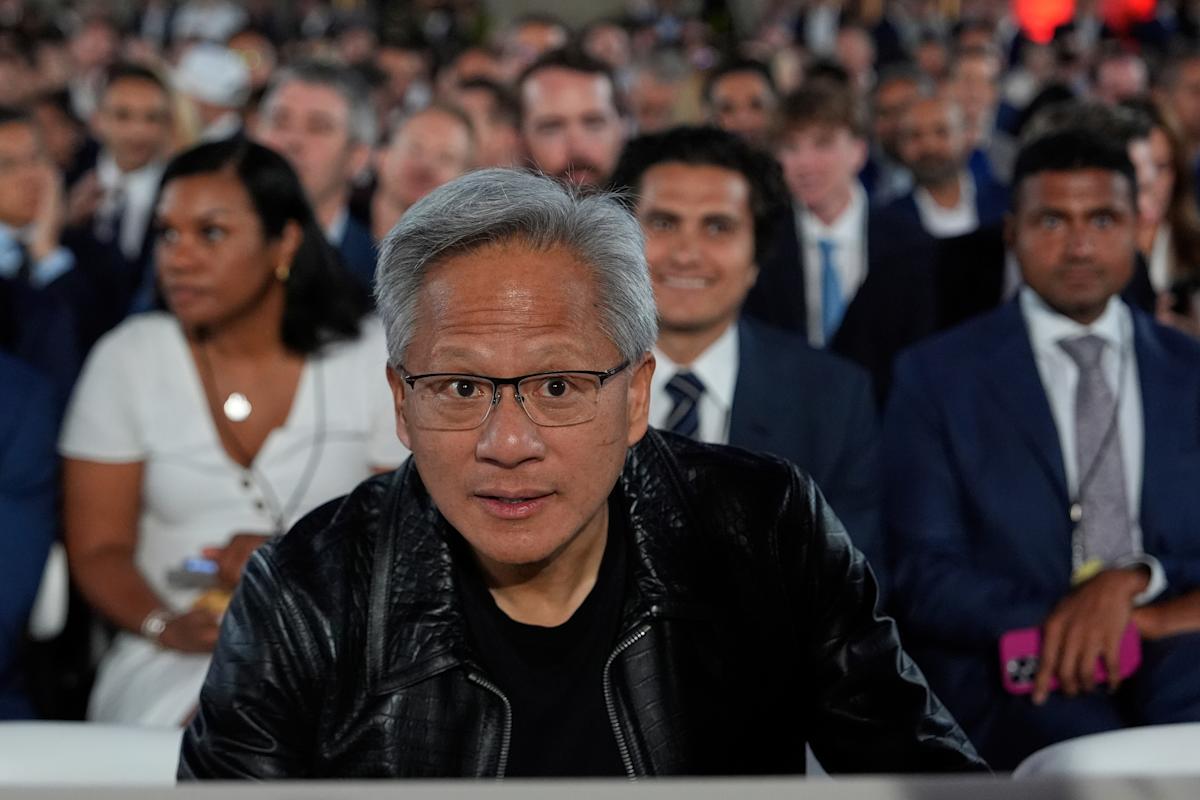

A new Trump proposal to levy a special tax on Nvidia, AMD, and other AI chipmakers has ignited a storm among legal scholars and investors, with constitutional experts calling the plan “clearly unconstitutional.” The idea, framed as an “AI windfall tax,” would target extraordinary profits from companies central to the current AI boom, reallocating proceeds to fund domestic manufacturing and infrastructure.

Key points:

– The proposal reportedly singles out leading AI chipmakers—most notably Nvidia and AMD—whose market valuations and margins have surged on unprecedented AI demand. Advocates argue these firms benefit from quasi-monopoly positions and government-supported ecosystems, justifying a one-off or recurring excess-profits levy.

– Constitutional lawyers counter that a tax tailored to a narrow set of companies or industries risks violating equal protection and due process principles if it is arbitrary or punitive in effect. They also warn that a measure aimed at specific firms could be attacked as a bill of attainder in disguise, particularly if the statute appears retaliatory or names companies explicitly.

– Business groups caution that an unpredictable, retroactive, or firm-specific tax would raise the cost of capital, chill semiconductor capex, and undermine U.S. leadership in AI. They note that Washington has simultaneously pushed to onshore chips via CHIPS Act incentives—making a targeted clawback appear contradictory.

– Policy analysts add that if the true objective is competition or broader tax reform, Congress already has tools: antitrust enforcement, modernization of international tax rules, stronger minimum taxes, or neutral excess-profits frameworks applied across sectors with clear thresholds and sunset clauses.

– Markets are sensitive to headline risk. A credible path for a targeted tax—especially one perceived as retroactive—could compress multiples for AI leaders, widen risk premia, and shift flows toward beneficiaries in non-targeted segments (AI software, memory, networking), while accelerating geopolitical diversification of fabs.

What to watch:

– Legislative text: whether the bill names firms, sets industry-neutral criteria, or imposes retroactivity.

– Legal posture: immediate challenges on equal protection, due process, and potential bill-of-attainder claims.

– Policy tradeoffs: interaction with CHIPS Act incentives and broader 2025 tax reform.

– Market signaling: guidance from Nvidia/AMD on pricing, supply allocation, and capex if a windfall framework advances.

Bottom line: A narrowly targeted “AI windfall tax” faces steep constitutional and political hurdles. If anything moves, expect any viable version to be industry-neutral, time-limited, and crafted to survive court scrutiny—yet even that could alter capex calculus and AI market leadership dynamics.