|

| Gold V.1.3.1 signal Telegram Channel (English) |

Trump’s Proposed Tariffs on UK’s ARM and AMD: Legal Risks and Market Implications for Semiconductor Investors

2025-08-12 @ 14:04

Trump Floats Tariffs on UK’s ARM and AMD: What It Could Mean

Former U.S. President Donald Trump has reportedly suggested imposing tariffs on tech giants ARM (UK-based) and AMD, drawing swift legal criticism that such a move would be difficult to justify and likely unlawful under existing trade rules. Here’s what matters for investors.

What’s being proposed

– Targeted tariffs on specific foreign and U.S.-listed tech firms—most notably ARM and AMD—framed as a response to perceived unfair competition or national interests.

– Unlike broad, country-wide tariffs, this would single out companies, raising questions under U.S. trade law and World Trade Organization (WTO) principles.

Why lawyers say it’s problematic

– U.S. trade tools (e.g., Section 301, 232, IEEPA) are designed for actions against countries, sectors, or classes of products—not individual companies absent clear national security findings.

– Singling out firms like ARM and AMD could be viewed as arbitrary discrimination, conflicting with WTO rules on most-favored-nation and national treatment.

– Any executive action would face immediate court challenges on statutory authority, due process, and administrative procedure grounds.

– If framed as a national security measure, the government would still need a defensible record. Courts have become more skeptical of expansive executive trade actions without strong evidence.

Potential market impacts

– Semiconductors are systemically important. Even tariff headlines can trigger factor-wide volatility across:

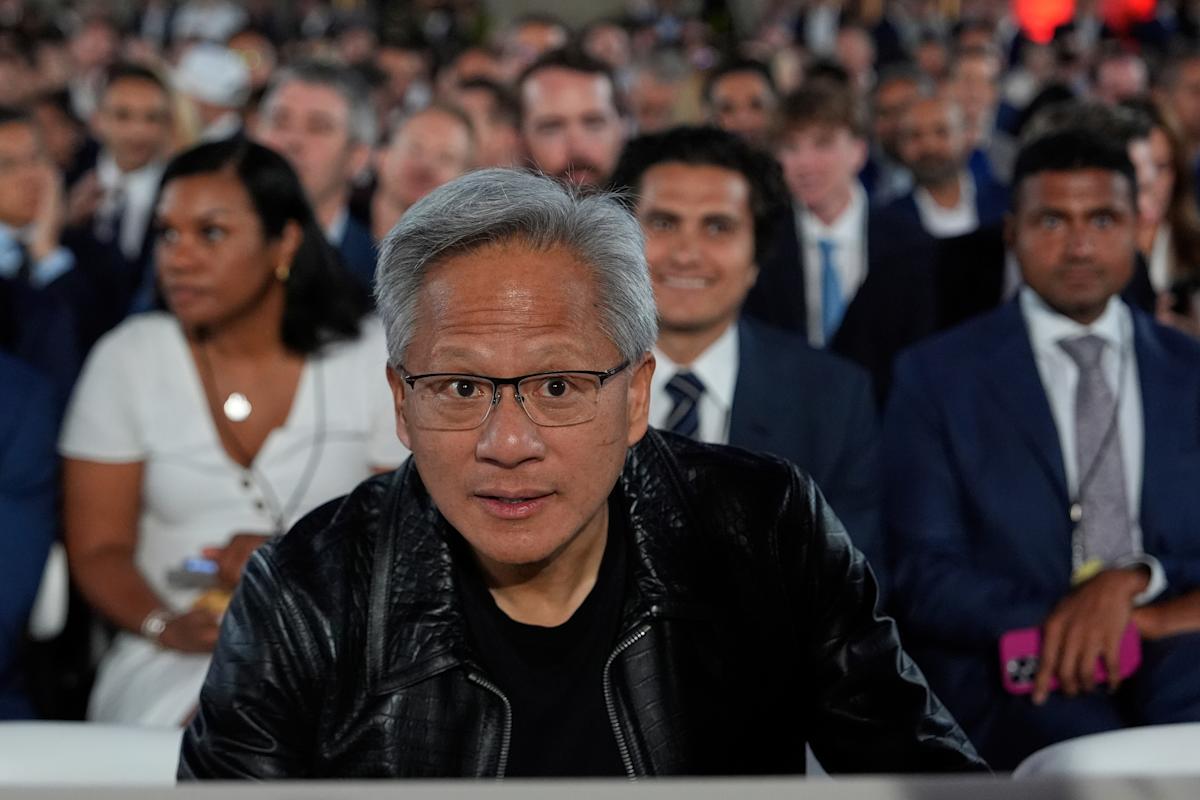

– Chip designers (AMD, NVIDIA, ARM licensees)

– Foundries (TSMC, GlobalFoundries)

– Equipment suppliers (ASML, Applied Materials)

– Downstream OEMs (PCs, servers, AI infrastructure)

– ARM’s business model—licensing CPU architectures globally—means tariffs could create cross-border compliance frictions for licensees and customers, complicating supply chains.

– AMD’s products are largely fabbed via overseas foundries; tariffs could effectively tax U.S. imports of AMD-designed chips, lifting relative costs and potentially benefiting competitors with alternative supply or domestic production.

Geopolitical and policy context

– The U.S. has increasingly used export controls and investment screening (e.g., CHIPS Act incentives, outbound investment proposals) to shape semiconductor supply chains.

– Tariffs on specific firms would mark an escalation from systemic tools to targeted penalties, heightening retaliation risk from allies and partners—especially the UK in ARM’s case.

– The UK government would likely defend ARM, a national tech champion, potentially complicating U.S.-UK trade and tech cooperation.

What to watch next

– Formal policy documents or notices invoking specific legal authorities (Section 232 for national security, Section 301 for unfair practices, or IEEPA).

– Reactions from:

– UK officials and regulators (given ARM’s UK base and London listing)

– U.S. semiconductor industry groups (SEMI, SIA)

– Major hyperscalers and OEMs that depend on AMD and ARM ecosystems

– Market signaling:

– Widening valuation spreads between U.S.-centric and globally sourced chip names

– Options skew and implied volatility in ARM and AMD

– Supply-chain repositioning disclosures (multi-sourcing, domestic packaging/assembly)

Investor takeaways

– Policy feasibility is low without a national security hook and robust evidentiary record; litigation risk is high.

– Headline risk is non-trivial: expect intermittent volatility, with potential spillovers to AI, data center, and edge computing plays.

– Relative winners could include firms with:

– More domestic U.S. manufacturing footprint

– Diversified geographies and licensing models less exposed to U.S. border taxes

– Substitution potential in CPUs, GPUs, or accelerators if pricing gaps widen

– Consider stress-testing portfolios for tariff scenarios on import-dependent semis and monitoring policy catalysts before making directional bets.

Bottom line: Targeted tariffs on ARM and AMD would be legally vulnerable and economically disruptive. Until there’s a concrete legal basis and rulemaking, this looks more like a market-moving headline risk than an imminent structural shift—but one worth hedging for in semiconductor exposure.