|

| Gold V.1.3.1 signal Telegram Channel (English) |

U.S. Stock Market Plunges After Weak Jobs Report and Trump’s Renewed Tariff Threats: What Investors Need to Know

U.S. Stock Market Plunges After Weak Jobs Report and Trump’s Renewed Tariff Threats: What Investors Need to Know

2025-08-03 @ 18:00

U.S. stocks ended sharply lower as the Dow, S&P 500, and Nasdaq all posted significant losses following a weaker-than-expected jobs report and renewed tariff threats by former President Trump. The S&P 500, which had recently hit all-time highs, dropped 1.6% on August 1, closing at 6,238 points after a wave of selling across major indexes. Despite this recent pullback, the index remains up approximately 16.7% over the past year, reflecting substantial gains earlier in 2025.

Market sentiment took a hit after the latest employment data showed a slowdown in job growth, raising fresh concerns about the robustness of the economic recovery. The weak jobs report has intensified worries about consumer strength and the outlook for corporate earnings in the coming quarters.

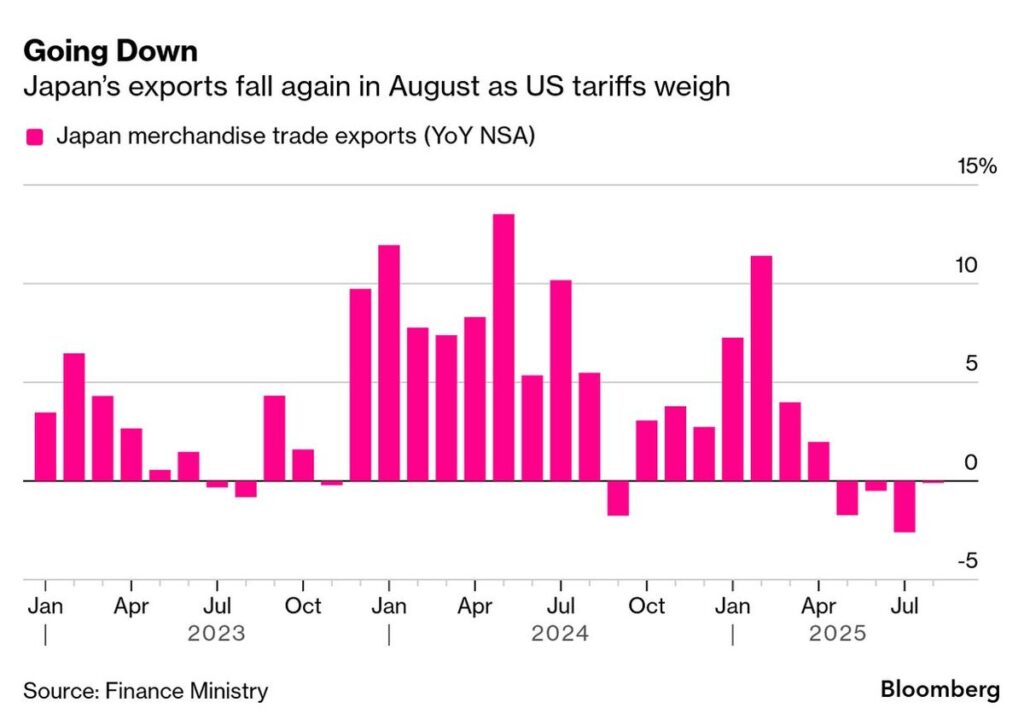

Compounding the negative mood, Donald Trump reiterated his calls for sweeping tariffs on foreign goods, bringing trade tensions back into focus. Investors are increasingly wary that the prospect of renewed tariffs could stoke inflation and disrupt global supply chains, putting additional pressure on both the Federal Reserve and the broader economy. Some analysts noted that the Fed, already cautious about rate cuts due to inflationary risks, may remain on hold for longer if tariff policies are reinstated.

Despite recent turbulence, the market’s year-to-date total return remains deeply positive, though volatility may persist as policymakers and investors weigh the impact of shifting trade policies and mixed economic signals. With global headwinds and domestic uncertainties back in play, investors are advised to stay alert to rapid market developments and consider a diversified approach to weather potential volatility in the months ahead.