|

| Gold V.1.3.1 signal Telegram Channel (English) |

What Investors Must Watch as U.S. Stock Market Slips Before Powell’s Crucial Speech

2025-08-22 @ 05:00

U.S. Stock Market Slips Ahead of Powell’s Key Speech: What Investors Should Watch

The U.S. stock market faced renewed volatility as investors eyed Federal Reserve Chair Jerome Powell’s much-anticipated remarks, with major indices ending the day in the red. Persistent uncertainty over the timing of interest rate cuts and broader economic signals cast a shadow on Wall Street’s recent optimism, reminding investors that the path forward remains rife with challenges.

On Thursday, the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all recorded declines, erasing some of the gains built up amid previous rallies. High-profile technology stocks—previously the market’s main drivers—lost ground. The day’s cautious mood was set by a combination of soft labor market data and the looming prospect of updated guidance from Powell on the future of monetary policy.

Investor anxiety revolved around whether the Fed will cut rates as soon as anticipated. Hopes for an economic soft landing and a swift return to lower interest rates have buoyed equities for much of the year, but recent economic data has muddied that outlook. Jobless claims ticked higher than expected, adding to concerns that the labor market may be losing steam after an extended period of robust growth.

Market participants have been betting on rate cuts in the near term, especially as inflation has shown signs of cooling since its peak levels driven by the pandemic and global disruptions. However, policymakers remain wary of declaring victory over inflation too soon. The Federal Reserve has reiterated that further progress on inflation is needed before it considers bringing rates down. Even as mortgage rates and broader borrowing costs remain elevated, Fed officials stress a patient approach—balancing the risks of moving too soon with the danger of choking off economic growth if they wait too long.

As Powell’s speech approached, market analysts debated whether the Fed would signal a more accommodative stance or continue urging restraint. Investors are watching for any hints that officials could accelerate their timeline for easing, though consensus still suggests the central bank wants to see more definitive progress in both inflation data and the health of the labor market before acting. A premature cut could risk reigniting inflation, undoing months of progress.

Adding to market jitters, global trends have also entered the calculus. Several major central banks outside the U.S. have already begun lowering interest rates in response to their own economic slowdowns. This has fueled calls from some quarters for the Fed to follow suit, but U.S. policymakers face unique challenges given the size and structure of the American economy.

In this climate, sectors most sensitive to interest rates—such as real estate, consumer discretionary, and smaller-cap stocks—have come under particular pressure. Conversely, large technology companies with strong balance sheets have outperformed for much of the year, though even these giants are not immune to the broader uncertainty now taking hold.

For investors, the outlook remains highly dependent on forthcoming signals from the Fed. Powell’s comments are expected to touch on both the progress made against inflation and the potential risks to the employment picture. Investors will be parsing every word, searching for any indication of changing policy preferences.

Bond markets have also reflected this uncertainty, with yields stabilizing after their recent run-up and suggesting that many are bracing for a more cautious Fed. Market-based measures of inflation expectations have inched higher on ongoing concerns about trade policy and the possibility of more persistent price pressures.

In the near term, volatility may persist as Wall Street digests the Fed’s latest signals along with upcoming economic data. Eyes will be on reports covering inflation, consumer spending, and job growth, as each will shape expectations on the timing and size of any future rate cuts.

Ultimately, the direction of the stock market will hinge on the Federal Reserve’s evolving assessment of inflation, economic growth, and employment conditions. Until a clearer picture emerges, investors can expect headlines and Fed commentary to continue driving sentiment—and market swings. Staying informed, maintaining balance, and being prepared for more fluctuations will be essential as we navigate this uncertain landscape.

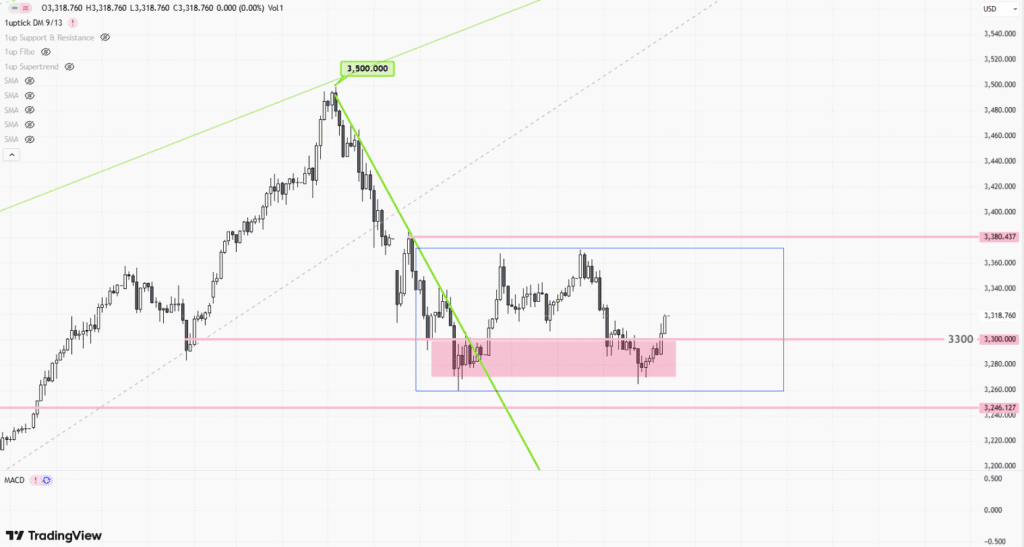

![[Gold price weekly] – Volatile Consolidation Driven by Multiple Factors](https://int.1uptick.com/wp-content/uploads/2025/04/2025-04-28T055444.196Z-file-1024x551.png)