|

| Gold V.1.3.1 signal Telegram Channel (English) |

France’s Political Crisis and Budget Challenges: Key Insights for Investors Navigating Uncertainty

2025-09-10 @ 22:00

France’s Political Crisis and Its Budget Dilemma: What Investors Should Know

France finds itself at a crossroads after the recent collapse of its government, triggered by political infighting and mounting economic pressures. Prime Minister François Bayrou’s administration was ousted following a failed confidence vote in the National Assembly—culminating in a nationwide conversation about the country’s fiscal priorities, pension spending, and the sustainability of current deficit levels. For investors and market-watchers, this episode reveals key risks and signals for the future trajectory of the French economy, European financial markets, and the eurozone at large.

The Roots of the Drama: A Battle Over the Budget

At the heart of France’s political turmoil is the contentious budget plan proposed by Bayrou. His blueprint aimed to save forty billion euros, primarily to realign public finances and bring France’s annual deficit under 3% of GDP by 2029. This threshold isn’t arbitrary: it’s the critical point where—assuming moderate growth and inflation—France’s debt-to-GDP ratio would stabilize rather than rise year after year. The planned spending cuts included controversial measures such as eliminating two public holidays without wage compensation, a move fiercely opposed by both public sector unions and retirees.

Bayrou’s determination to attack the deficit is arguably commendable from a fiscal discipline standpoint. Yet, his approach was widely criticized for failing to forge consensus, especially with opposition parties in a fractious National Assembly. Governing with a minority has become the new normal in France, and Bayrou’s approach—marked by a lack of broad-based negotiations—proved unsustainable.

Why Pension Costs Are at the Center of France’s Dilemma

France’s “social model”—celebrated for its robust welfare state and generous public pensions—now faces acute fiscal challenges. Demographic trends mean that retired voters, who reliably support centrist candidates like Bayrou, wield disproportionate influence. Consequently, resources have increasingly flowed to pension systems, often at the expense of vital services like education, security, and healthcare. These trade-offs are coming under scrutiny, especially as France confronts uneven growth prospects and rising interest costs.

For market participants, the tension here is crucial. Persistent pension liabilities and resistance to reform remain a drag on France’s public finances. Any meaningful change is likely to be politically costly but essential to restore balance and investor confidence.

What’s Next? Possible Scenarios for France’s Government

With the government out, President Emmanuel Macron faces significant decisions. He can attempt to install a new prime minister—risking another round of political deadlock with the current parliamentary makeup—or call for new elections, which could produce an even more unpredictable assembly. Until a new government is formed, ministers may continue in office temporarily to ensure public services remain operational.

Market Impact: Uncertainty and Risks

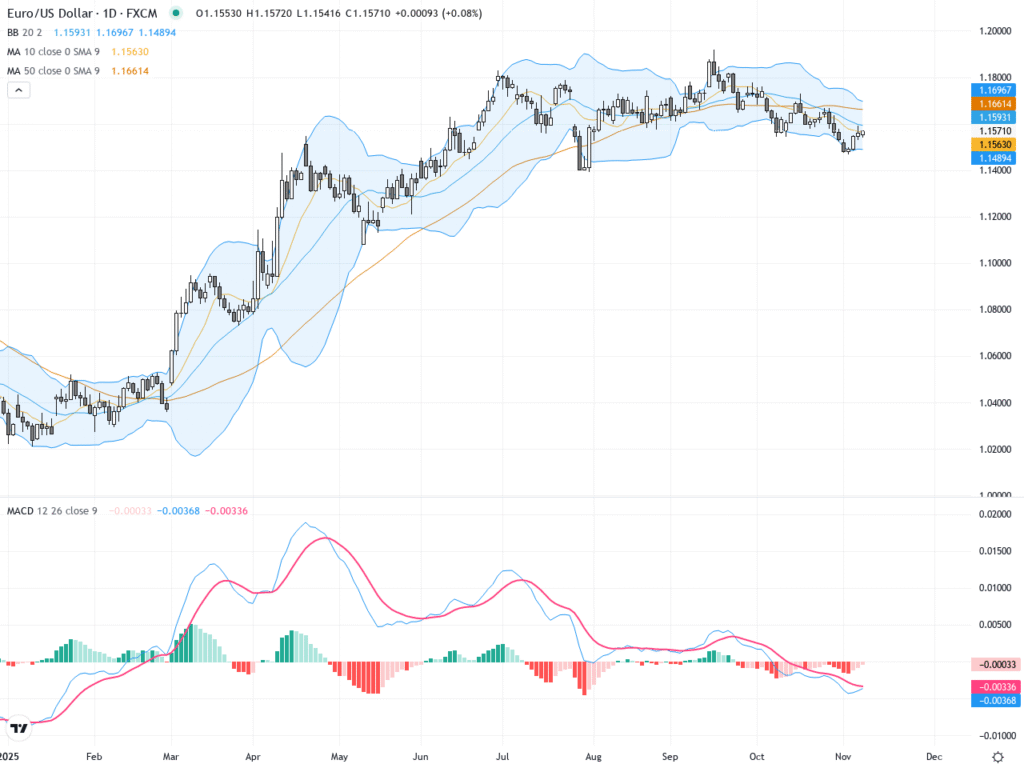

Political and institutional uncertainty in a major eurozone economy like France can spark volatility across European financial markets. Unresolved budget issues or fears of deeper political gridlock may depress investor sentiment toward French government bonds—or even the euro itself—if fiscal discipline appears unattainable. On the other hand, decisive steps toward reform, consensus-building, and deficit reduction could help reassure both domestic and international investors.

A Lesson for Investors: Balancing Political and Fiscal Risk

France’s latest crisis is a reminder that economics and politics are tightly interwoven. Policies with clear-cut economic benefits may run into insurmountable political obstacles when influential interest groups—such as retirees—feel threatened. For investors targeting European assets, monitoring the evolution of France’s government and its fiscal strategy is paramount, as these will shape the investment environment in both the medium and long term.

Key Insights for Financial Bloggers

- France’s public debt challenge is structural, rooted in demographics and a traditionally generous welfare state.

- Political decision-making is at a premium, as governing coalitions are weaker and consensus harder to build.

- Short-term uncertainty could lead to market volatility in French and European assets depending on signals from Paris.

- Longer-term, the need for sustainable deficit reduction and pension reform is likely to define the investment narrative.

Understanding the intersection of politics and economics is crucial for financial professionals and investors alike. As France navigates this latest turning point, ongoing analysis and careful risk assessment will be vital to safely capitalizing on opportunities and mitigating exposure to an increasingly complex landscape.