|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold and Silver 2025 Forecast: What’s Driving Record Prices and Future Market Trends

2025-09-12 @ 20:01

Gold and Silver 2025 Outlook: Momentum, Drivers, and Key Market Insights

2025 has turned out to be a remarkable year for precious metals, with both gold and silver reaching new heights. Silver in particular has experienced an explosive rally, surging past $40 per ounce—a level not seen since 2011—while gold has pushed to fresh all-time highs above $3,500 per ounce. As these metals capture investors’ attention, it’s crucial to understand what’s fueling this momentum, how the fundamentals stack up, and what might lie ahead for gold and silver in the coming months.

Silver’s Historic Climb

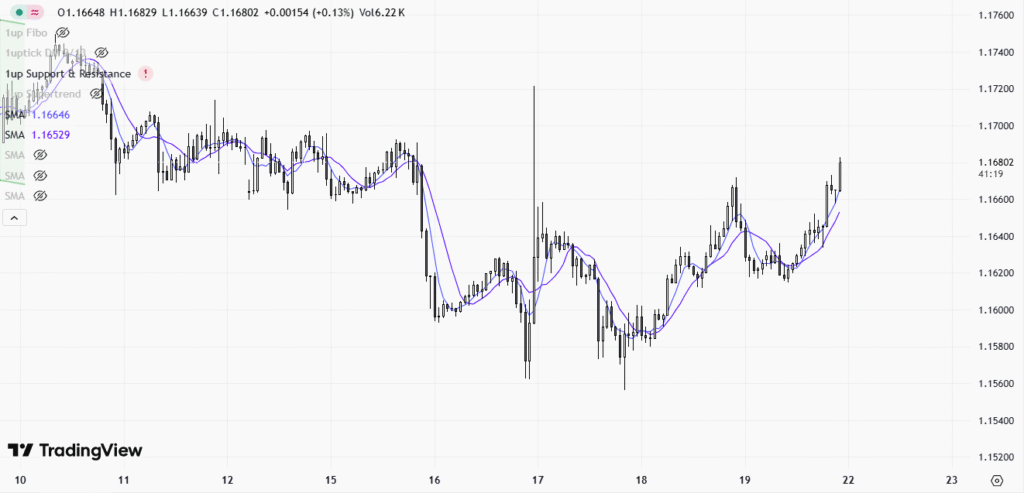

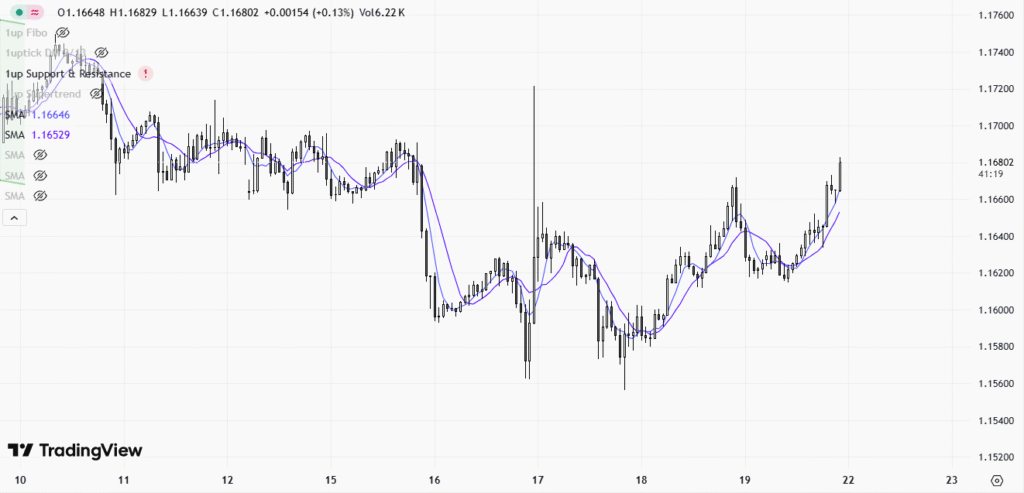

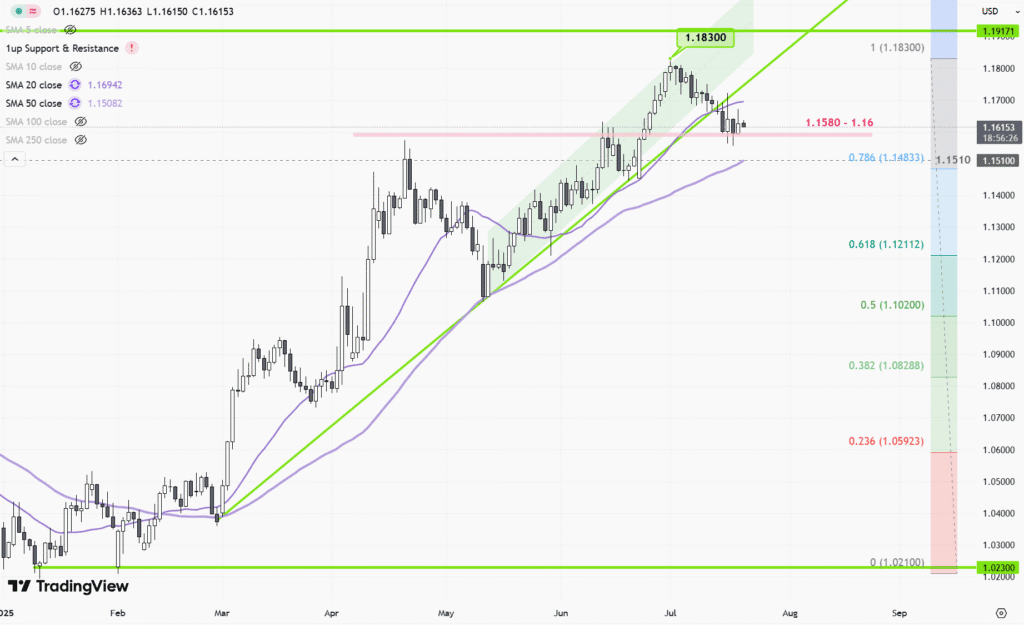

Silver’s price action in 2025 has astonished even the most bullish analysts. Starting the year below $29 per ounce, silver rallied nearly 45% year-to-date as of September, recently trading above $41. This surge broke through the psychological and technical resistance of $40, a barrier that had stalled previous rallies for more than a decade.

Unlike prior bull runs that were largely speculative, the current silver rally is anchored in robust fundamentals. Industrial demand has surged, especially from the solar energy and electric vehicle (EV) sectors, accounting for roughly half of annual silver consumption. This structural demand, combined with tightening supply and renewed safe-haven interest driven by economic uncertainty, has created a “perfect storm” for higher prices.

Market analysts see further upside, with many forecasting year-end targets in the $45 range and some even projecting potential tests of the all-time high near $50 if bullish drivers persist. However, caution is warranted: technical analysts warn that the $50 level has proven to be a formidable ceiling in the past, and the road higher is likely to be marked by phases of consolidation rather than uninterrupted gains.

Seasonal Trends and Investment Flows

Several seasonal and historical patterns could also add fuel to silver’s rally. Precious metals markets often strengthen from September into November, reflecting increased jewelry demand for the holiday season and year-end portfolio rebalancing by institutions. Historical analysis shows that these autumn months have delivered positive returns for silver about two-thirds of the time over the past two decades, with average outperformance relative to summer.

The current rally is also benefiting investors in the physical market. Uncommonly, premiums on physical silver remain low despite historic price gains, offering buyers attractive entry points even as the market surges.

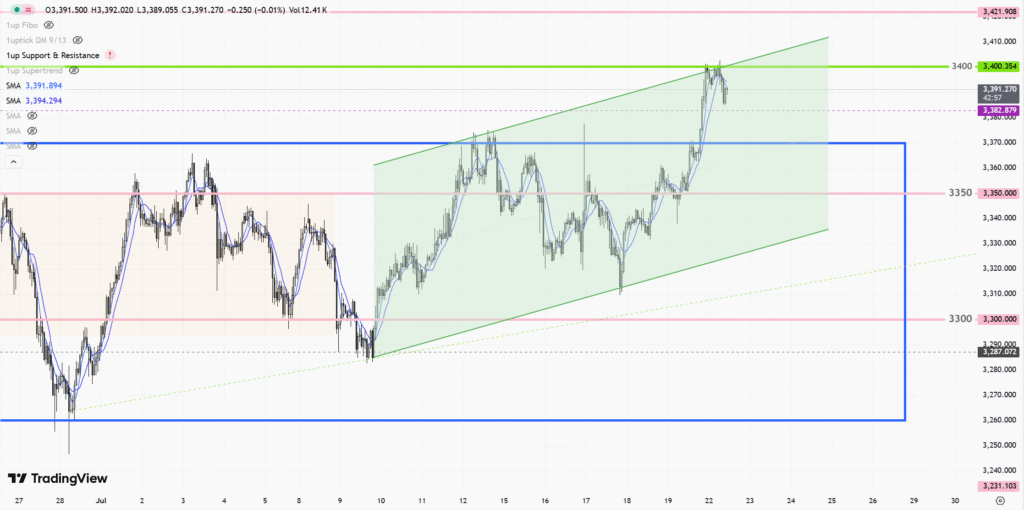

Gold’s Record-Breaking Surge

While silver’s percentage move has taken center stage, gold’s performance is equally impressive. Gold futures have notched all-time highs this year, topping $3,500 per ounce, with a year-to-date gain of nearly 34%. The traditional safe-haven metal is benefitting from a combination of persistent inflation concerns, rising geopolitical risks, and expectations for looser central bank policy as economic data becomes more mixed globally.

Gold’s outperformance is less dramatic than silver’s but highlights its unique role as a portfolio stabilizer. Compared to silver, gold’s price is driven primarily by investment and monetary factors, rather than industrial consumption.

Examining the Silver-to-Gold Ratio

One striking trend of 2025 is the sharp compression in the silver-to-gold ratio. This metric, which measures how many ounces of silver are needed to buy one ounce of gold, has narrowed from over 80:1 to below 70:1. The falling ratio signals silver’s significant outperformance relative to gold, and if history is a guide, there could be further room for silver to shine if the bull market continues. For context, during previous precious metals booms, the ratio tightened to as low as 30:1, though a move of that magnitude would require even more aggressive silver buying.

Factors Setting This Rally Apart

What makes the current precious metals market different from previous cycles is the combination of resilient industrial demand, ongoing macroeconomic uncertainty, and low physical premiums. For silver, its wide range of industrial applications ensures that even outside of monetary demand, there are strong underpinnings for price appreciation amid global technological transformation. Gold, meanwhile, is benefiting from its traditional role as a hedge against inflation and monetary instability.

Short-Term Outlook and Investment Strategy

Despite the strong upward momentum, both gold and silver markets are expected to experience periods of volatility and consolidation, especially after such rapid advances. Traders are watching for potential pullbacks and profit-taking, particularly if macroeconomic data surprises or central banks shift tone. Commercial hedgers are increasing short positions to lock in profits, while speculative traders remain largely bullish.

Looking ahead, the fundamental case for both metals remains robust. For those considering investment, silver offers higher potential upside—and risk—due to its industrial links and greater sensitivity to economic cycles. Gold offers a steadier, more defensively oriented play on ongoing global uncertainty.

In summary, 2025 is shaping up to be a transformational year for precious metals. Silver has broken out of a decade-long trading range while gold pushes into uncharted territory. Both industrial and monetary dynamics are at play, creating a landscape of opportunity for investors who navigate the volatility with a clear understanding of the drivers behind these historic moves.