|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold and Silver Price Forecast 2025: Signs of a Near-Term Pullback Amid Strong Long-Term Growth

2025-09-23 @ 20:00

Gold and Silver Price Outlook: Are We Near a Short-Term Pullback?

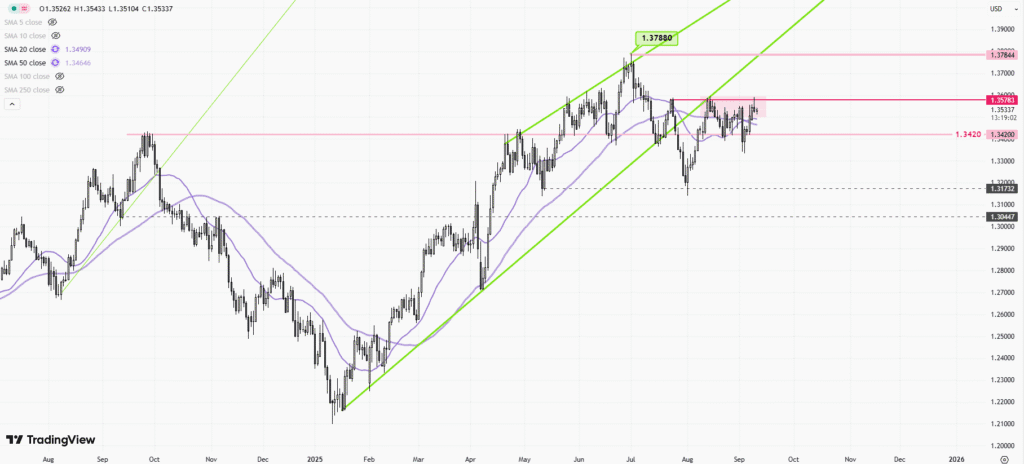

Gold and silver have been riding a wave of bullish sentiment in recent months, fueled by global economic uncertainty, persistent inflation, and ongoing geopolitical tension. Many investors have flocked to these precious metals as a hedge against volatility and currency debasement. However, mounting technical signals now suggest we may be approaching a period of short-term correction.

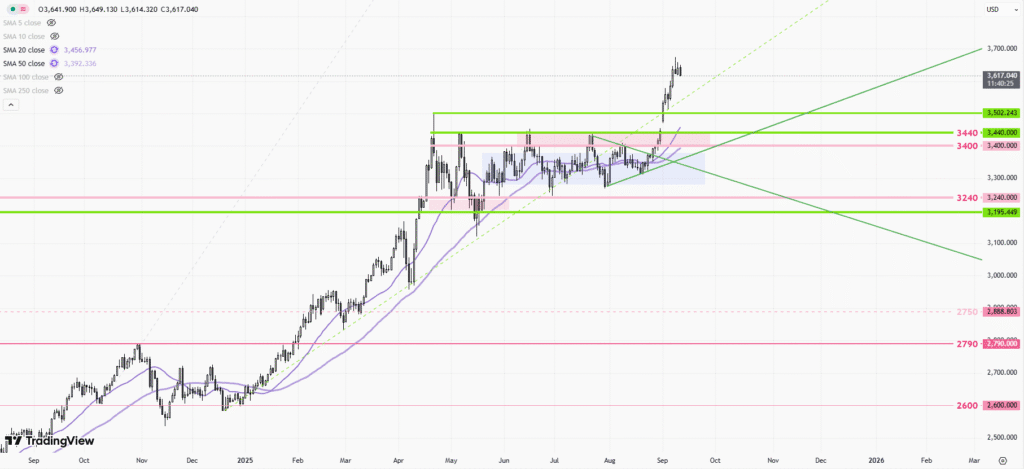

Gold: Cautiously Bullish but Overbought

Gold’s price trajectory throughout 2025 has largely reflected a blend of inflation concerns, central bank policies, and rising global risk aversion. The precious metal reached multi-year highs as investors sought safe haven assets. Leading banks and analysts currently project end-of-year gold prices ranging anywhere from $2,700 to $3,800 per ounce, with consensus clustering in the $3,000-$3,500 range. Some bullish forecasts even extend toward $3,800 and above if current inflation and monetary trends persist.

Several factors underpin gold’s long-term strength:

– Inflation-resistant asset: Gold has historically preserved purchasing power during periods of high inflation.

– Central bank accumulation: Continued diversification away from the US dollar into gold by sovereign funds and central banks.

– Global uncertainty: Heightened fear around geopolitics and economic slowdown supports demand.

Despite these robust fundamentals, technical analysis indicates that gold’s recent rally may have pushed prices into overbought territory. Relative Strength Index (RSI) readings and momentum oscillators point to exhaustion, hinting that the metal’s next move could be a healthy correction rather than further rapid price acceleration. Pullbacks in strong bull markets are common and can offer new opportunities for patient buyers.

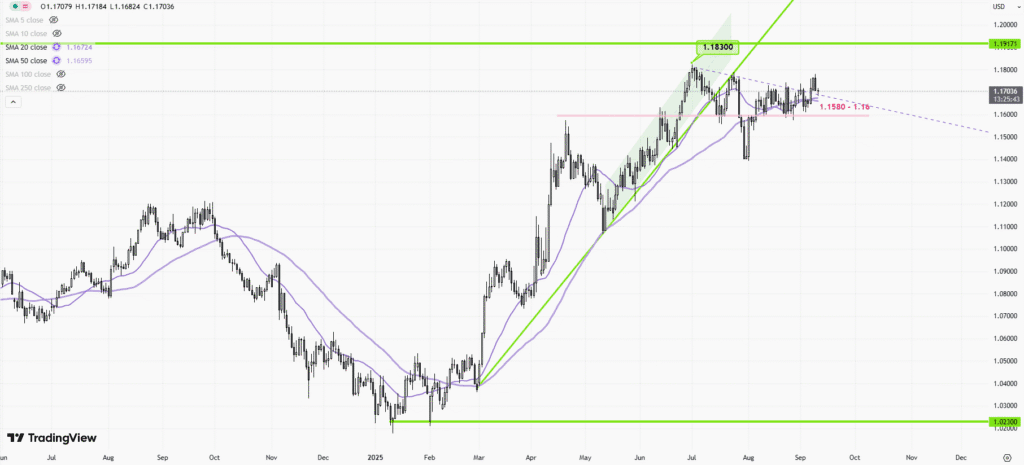

Silver: Industrial Demand Meets Investor Hype

Silver’s story in 2025 is dual-faceted: it is prized for its role as a financial safe haven, yet also driven by explosive industrial demand from the clean energy and electronics sectors. Silver’s use in solar panels, electric vehicles, and high-tech devices has expanded rapidly, creating a significant supply-demand imbalance. Analysts expect this gap, estimated at as much as 15% by year’s end, to provide structural support for prices.

Forecasts for silver vary widely, with consensus expectations for Q4 2025 ranging sharply, typically between $30 and $50 per ounce depending on economic scenarios. On the technical side, however, silver too shows signs of being overextended. Indicators like RSI and MACD suggest the current momentum may be unsustainable in the very near term, and a corrective phase is likely.

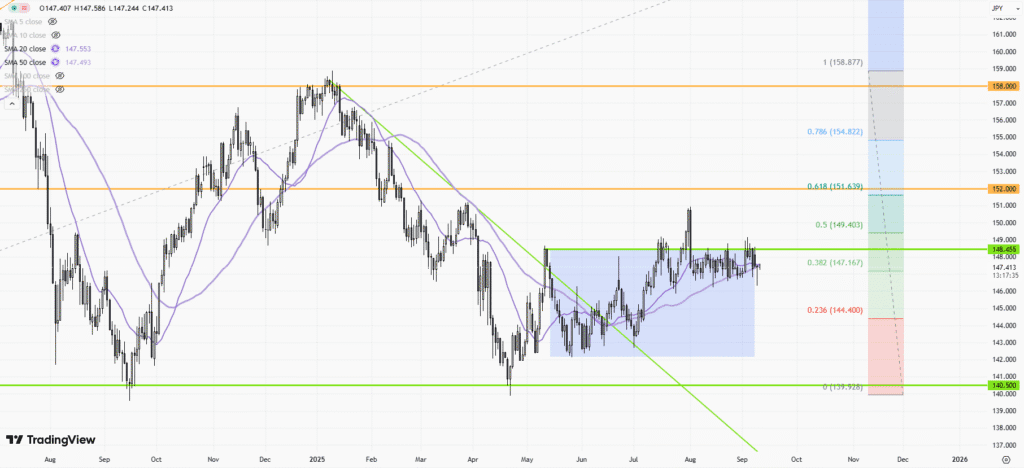

Key Triggers for a Pullback

Several interconnected factors could prompt a short-term decline in gold and silver prices:

– Technical Exhaustion: Overbought signals often precede profit-taking and short-term drops in price.

– Dollar Strengthening: Any rebound in the US dollar, possibly triggered by unexpected monetary tightening or economic data, could weigh on precious metals.

– Interest Rate Hikes: Rising real yields make non-yielding assets like gold and silver less attractive in the short term.

– Shift in Sentiment: If inflation fears subside or geopolitical risk diminishes, investors may rotate out of metals into riskier assets.

Nonetheless, it’s important to distinguish short-term corrections from the long-term strategic case for gold and silver. Both metals remain well-supported by fundamental global trends such as ongoing inflation, industrial use cases for silver, and persistent economic uncertainty.

What Should Investors Do?

For those considering entry or expansion of positions in gold or silver, patience may prove rewarding. Rather than chase prices at technical extremes, waiting for pullbacks could offer better entry points. Investors with longer investment horizons should focus on fundamental drivers and not be unnerved by temporary dips.

Diversification is also key. Silver, with its unique blend of industrial and investment demand, can complement gold within a portfolio. Monitoring chart signals alongside macro trends helps balance risk and opportunity.

The Road Ahead: Volatility and Opportunity

While the gold and silver markets are not immune to volatility, the overarching macroeconomic environment remains conducive to further gains over the medium and long term. A likely scenario is a short-term retreat, washing out excessive optimism and resetting momentum for the next leg higher. Paying close attention to overbought signals and fundamental catalysts can help guide prudent positioning in a dynamic market.

Gold and silver continue to serve as valuable anchors for portfolios in uncertain times, but discipline and timing are essential to capitalizing on their long-term uptrend. As always, alignment with personal financial goals and risk tolerance should underpin any investment strategy in the precious metals space.