|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold and Silver Prices Soar in Late 2025: Historic Highs, Supply Constraints, and What Investors Should Watch Next

2025-09-09 @ 20:01

Gold and silver have surged to new milestones as 2025 enters its final quarter, with both metals defying traditional market patterns and setting the stage for what could be a longer-term transformation in the precious metals landscape. Investor sentiment, macroeconomic shifts, and persistent supply constraints are shaping a market in which bullish momentum may continue to dominate.

Gold: Testing Historic Highs with Upward Momentum

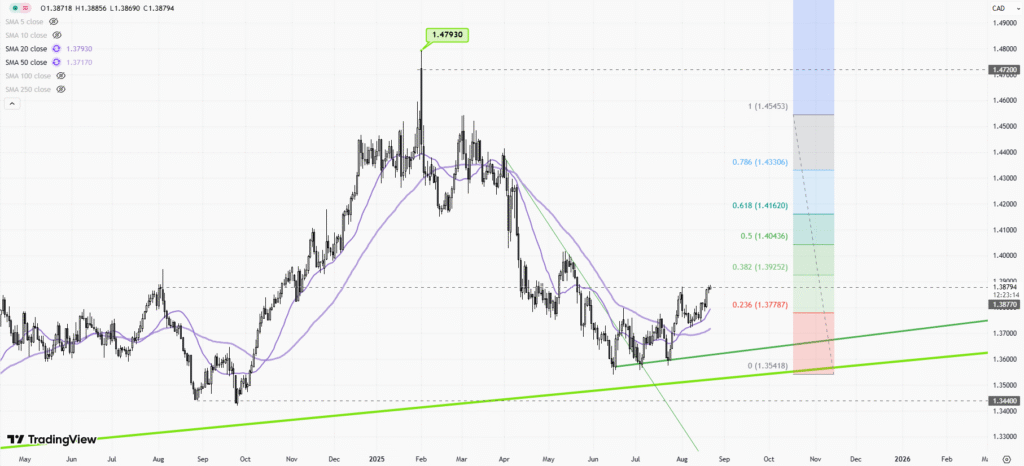

Gold entered September trading near historic highs, hovering just below the $3,700 mark. Major banks and institutions have revised their forecasts upward throughout the year, with current 2025 projections clustering between $3,500 and $3,700 per ounce. J.P. Morgan predicts $3,675, Goldman Sachs sees $3,700, and Bank of America suggests $3,500 is attainable before year-end. Retail trading platforms and investor surveys echo similar sentiment, with end-of-year consensus gravitating toward the $3,650-$3,700 range.

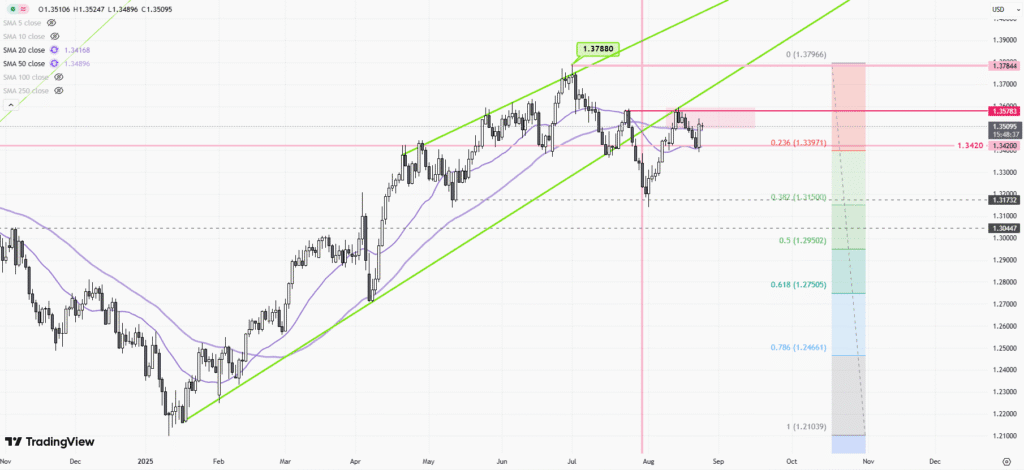

The key technical resistance for gold now sits at $3,674 per ounce—a critical level that, if surpassed, could open the way for further upside. Elevated inflation expectations, central bank buying, and declining confidence in fiat currencies are reinforcing investor demand for gold. This trend is further underscored by sovereign wealth funds and central banks reallocating reserves away from U.S. Treasuries and toward physical gold holdings.

Institutional appetite for physical gold is pronounced; paper-based instruments no longer dominate flows as investors increasingly seek the security of allocated metal. This shift is putting sustained pressure on physical supply, contributing to the metal’s resiliency even as other asset classes face headwinds from high interest rates and global liquidity concerns.

Silver: Outperforming Expectations Amid Supply Tightness

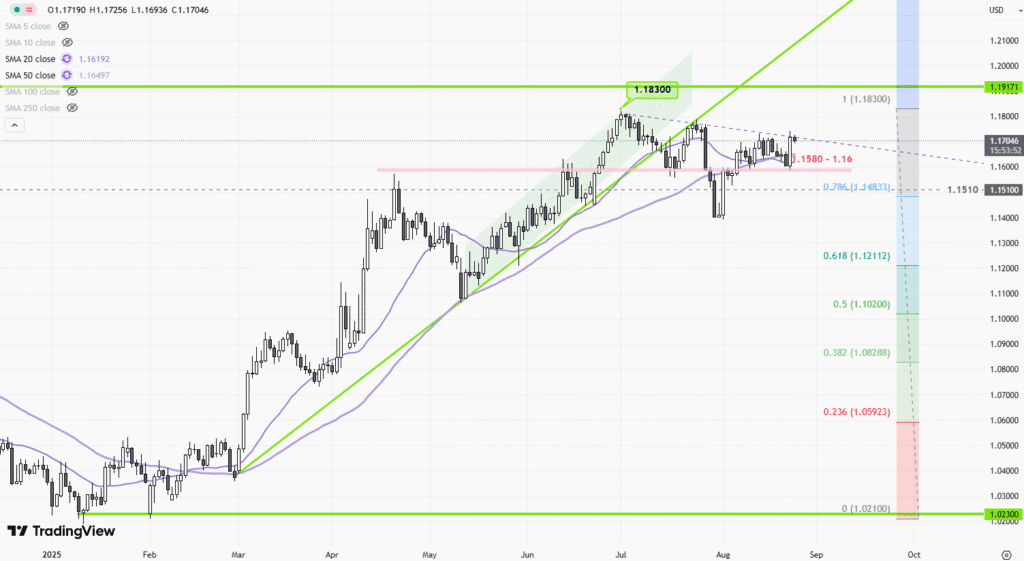

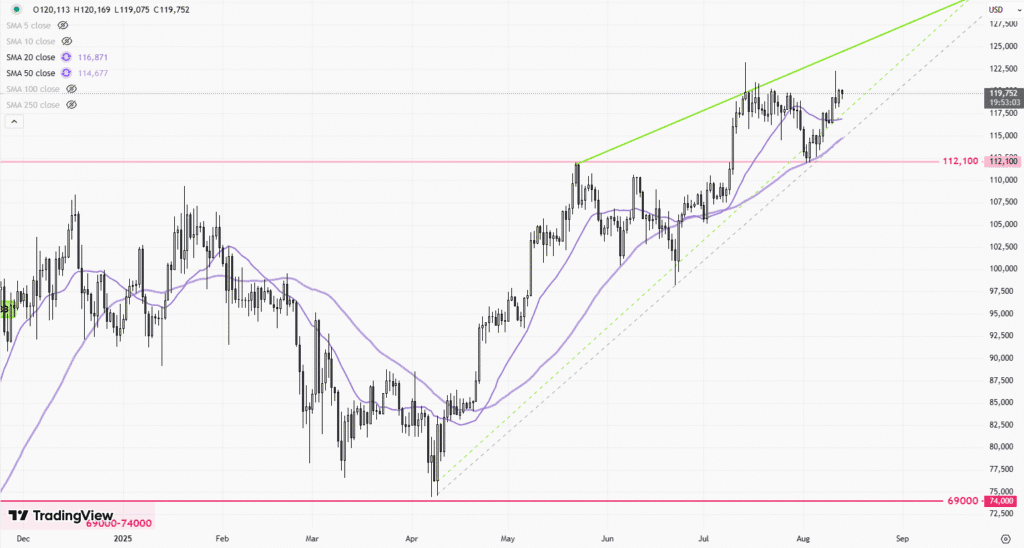

Silver’s 2025 journey has been marked by both substantial gains and extreme volatility. Prices began the year around $29 and, by early September, had climbed past $41 per ounce, with daily moves breaching $42 on multiple occasions. This jump represents nearly a 45% rise year-to-date, fueled by ongoing supply deficits and rising industrial demand, especially from solar energy and electronics manufacturing.

Importantly, silver is not just tracking gold; it is outperforming on a relative basis. Several forecasts point toward silver challenging the psychologically important $50 threshold—levels not seen since the early 2010s. Many analysts now predict that silver’s rally could not only sustain but potentially accelerate as the current supply shortfall continues—a projected fifth straight year of market deficit.

Physical silver inventories are drawing down, and exchange-traded funds (ETFs) have seen robust inflows since late spring. This reflects a broader recognition among institutional allocators that industrial and investment demand is now consistently outstripping mine supply. In the past, paper contracts offered easy liquidity, but the rising preference for physical delivery is exposing vulnerabilities in the metals’ fractional reserve system and underpinning spot prices.

Macro Backdrop: A Changing Financial Landscape

Several key macroeconomic factors are supporting the renewed strength in gold and silver:

– Rising global debt levels and expanding fiscal deficits have undermined confidence in major currencies, prompting a shift to tangible stores of value.

– Central banks, especially in emerging economies, are diversifying their reserves into gold and—where permitted—silver.

– Long-term real interest rates, though higher than in recent years, remain below inflation in many jurisdictions, strengthening the case for holding non-yielding assets.

Market participants have also noted the stark contrast between precious metals and traditional asset classes. Equities face valuations stretched by shrinking corporate earnings, while bond markets remain pressured by persistent inflation and tightening monetary policy. In this environment, both gold and silver are benefiting not just from safe-haven flows but from strategic asset rotation by large market players.

What to Watch in the Months Ahead

For gold, four critical levels deserve monitoring: the recent resistance at $3,674, with upside potential toward $3,750–$3,800 if momentum persists; and support near $3,570, where buyers have consistently stepped in.

Silver’s immediate resistance now stands at $42 per ounce. A successful breakout above this level could spark a rapid move toward the $45–$50 band. On the downside, key support is seen near $39—a level that, if breached, could trigger a swift retracement.

As both metals increasingly attract the attention of institutional and sovereign investors, volatility is likely to remain high. However, the strategic case for gold and silver as core portfolio allocations has rarely looked stronger.

For investors and traders, the remainder of 2025 may present rare opportunities in the precious metals sector—whether for tactical momentum plays or as part of a longer-term wealth preservation strategy. As gold and silver push ever higher, close attention to key technical levels and the evolving macro narrative will remain essential.