|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold and Silver Rally in 2025: Key Drivers Behind Historic Highs and Future Market Outlook

2025-09-30 @ 20:01

Gold and Silver Surge in 2025: What’s Behind the Rally and Where Do We Go Next?

The precious metals market is making headlines in 2025, with both gold and silver achieving historic highs and drawing renewed interest from investors and institutions. As we move through September, these trends remain at the forefront of financial discussions. Let’s break down the key factors propelling these metals, explore the latest price action, and consider what could be next for gold and silver.

Gold’s Unstoppable Rise

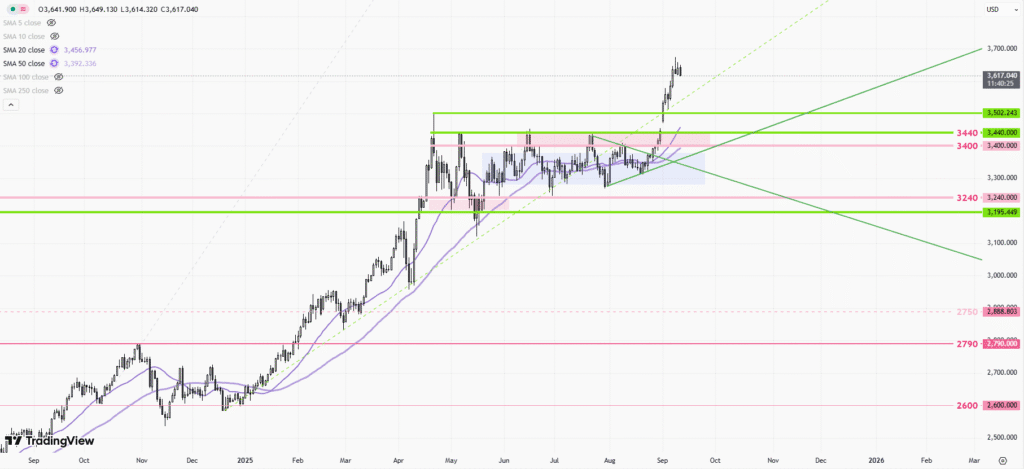

Gold is trading near $3,650 per ounce in early September, marking an impressive year-to-date gain of approximately 42%. This surge is not just a short-term reaction but a part of a sustained uptrend that has continued for over seven months. Since the Federal Reserve signaled its intention to ease monetary policy, gold has drawn strong inflows from both institutional and retail buyers.

The rally has not only pushed gold to new records—recently eclipsing its previous multi-year high of $3,500 set in June—but also showcased escalated monthly volatility, now averaging over 4%. Historically, gold often enjoys seasonal buying in September, but the scale of demand in 2025 highlights a broader structural shift toward safe-haven assets in response to macroeconomic changes.

Silver’s Multi-Year Breakout

Silver is experiencing an even stronger surge, breaking through the $40 per ounce level for the first time since 2011 and recently hitting $41.50 with a year-to-date gain near 44%. This sharp performance is drawing significant attention from both long-term investors and short-term traders, as well as from industries relying on silver for green technologies.

The silver market’s momentum is supported by persistent supply deficits, robust industrial demand (especially from the renewable energy and electronics sectors), and, importantly, the same financial forces propping up gold. As spot prices set new record highs, silver coins and bullion products are witnessing a spike in demand from collectors and investors aiming to capitalize on the rally.

Key Market Drivers: What’s Fueling the Gold and Silver Boom?

Several interconnected factors are shaping the precious metals landscape in 2025:

- Federal Reserve Rate Cuts: Anticipated and actual interest rate reductions by the Fed have lowered real yields on traditional safe assets like U.S. Treasuries. This shift increases the attractiveness of zero-yielding assets such as gold and silver, which benefit when cash and bonds look less appealing by comparison.

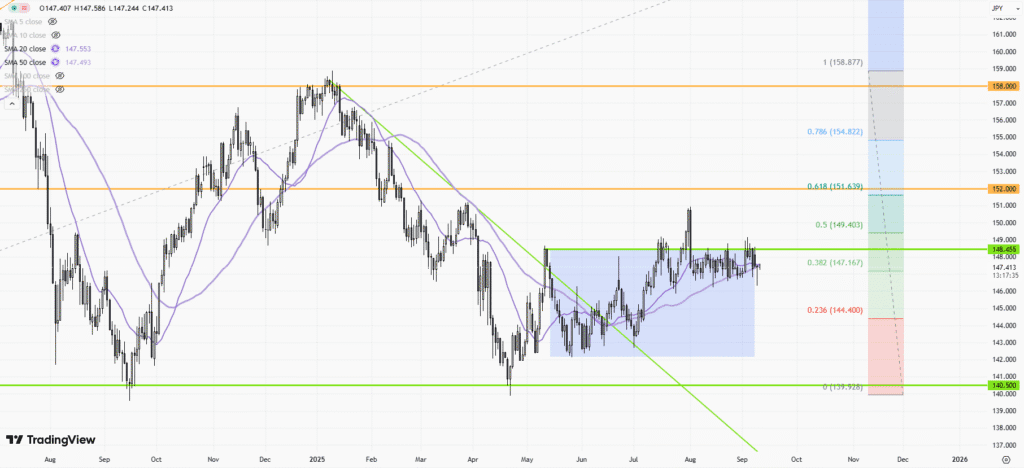

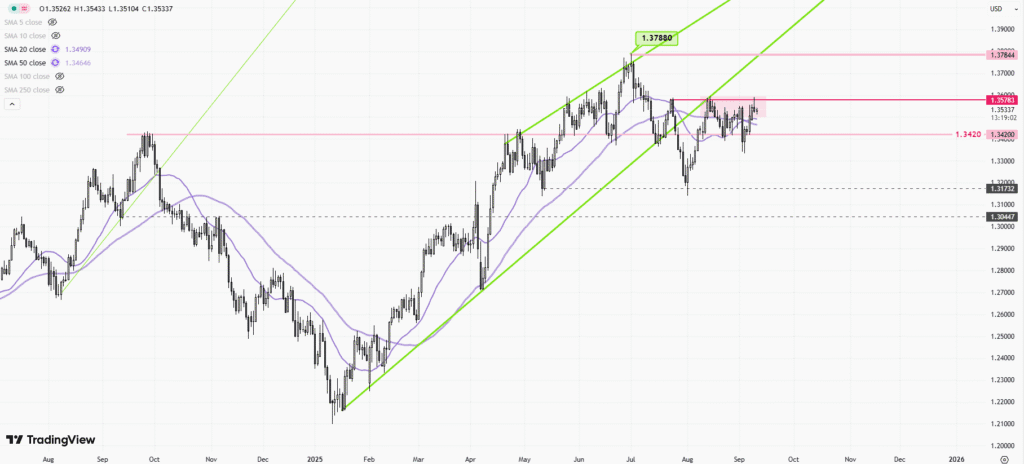

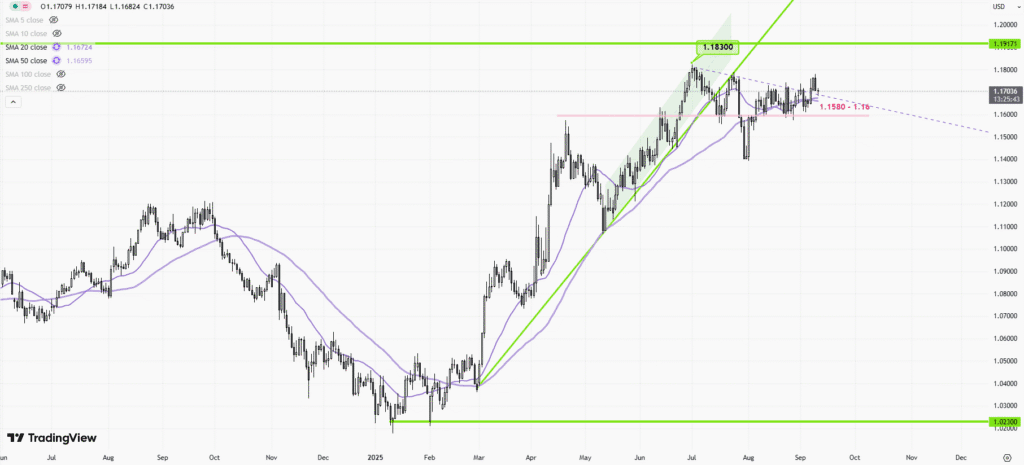

- US Dollar Weakness: The U.S. Dollar Index (DXY) is down roughly 9% for the year, making dollar-denominated metals cheaper for international buyers. This has driven global demand for both gold and silver, expanding their appeal well beyond the U.S. market.

- Geopolitical and Economic Uncertainty: Rising geopolitical tensions—whether related to trade disputes or regional conflicts—have triggered significant flows into safe-haven assets. Institutions and fund managers are rebalancing portfolios towards gold and silver to hedge against these diverse risks.

Technical Outlook and Investor Sentiment

Looking ahead, the technical picture for both metals suggests that volatility will remain a central theme. For silver, key support is seen around $42.80, with resistance at $45.20. Should silver push above resistance, a test of $47 or even $48 is plausible in the near term; however, a pullback to the $41.50–$42 region cannot be ruled out given recent gains and elevated volatility.

Gold, meanwhile, appears set to consolidate its gains as long as expectations for dovish Fed policy persist and risk aversion remains high. Many market analysts project gold could climb towards $4,000 by year’s end if current trends hold, and some even see $4,300 as attainable if the global economic backdrop deteriorates further.

Investment Implications

For investors and traders, the key takeaway is that the backdrop for precious metals remains compelling. Potential for further upside persists, especially if monetary policy continues to loosen, the dollar weakens further, or geopolitical risks escalate. However, rapidly rising prices also mean greater volatility—risk management remains critical.

Both gold and silver have reasserted themselves not merely as hedges but as must-watch assets in a world grappling with uncertainty. As we enter the final months of 2025, market participants should remain nimble, monitor macroeconomic signals, and stay prepared for dynamic swings in these pivotal markets.

Whether you’re reallocating your portfolio, considering your next bullion purchase, or simply following the markets, gold and silver’s rally this year is a testament to the enduring roles of these metals as both financial and real-world assets.