|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Price Forecast 2025: Will Gold Hit the $3,700 Milestone Amid Fed Decisions and Market Uncertainty?

2025-09-16 @ 05:00

Gold Price Forecast 2025: Is $3,700 the Next Big Milestone?

As we move deeper into September 2025, gold continues to command attention in global financial markets. After breaching all-time highs this month and trading near $3,600 per ounce, investors and analysts alike are zeroed in on its next potential target: the psychological $3,700 mark. Let’s examine the current drivers behind gold’s rally, how the Federal Reserve’s monetary policy influences its trajectory, and what leading institutions predict for the precious metal in the months ahead.

Current Market Momentum

Gold’s rise above $3,600 per ounce in September reflects a powerful, ongoing bull market. Several factors contribute to this momentum:

– Persistent uncertainty around global economic growth and geopolitical risks has kept gold attractive as a safe haven.

– Continued inflationary pressures mean that investors are seeking alternatives to cash and bonds whose real yields may be eroded.

– Expectations around U.S. interest rates have tightened focus on gold’s short-term movement, especially as the market awaits the next Federal Reserve decision.

In short, gold’s price is riding high not just on technical breakouts but also on enduring macroeconomic themes.

Eye on the Fed: Rate Decisions and Gold

The upcoming Federal Reserve monetary policy announcement looms large over the gold market. Investors widely expect the Fed to keep rates unchanged, but remain acutely sensitive to signals of future policy direction. Should the Fed indicate a more dovish stance or hint at potential future cuts, gold could receive an added boost as lower rates typically decrease the opportunity cost of holding non-yielding assets like gold.

On the flip side, any surprise hawkishness—such as an unexpected rate hike—could trigger quick profit-taking and a pullback in gold prices, even if only temporarily. The interplay between Fed language and gold is thus more pronounced than ever, making central bank commentary a key catalyst for near-term volatility.

Institutional Outlooks: 2025 Gold Price Predictions

Top financial institutions are already recalibrating their gold forecasts upward in response to this year’s robust gains and changing economic landscape. Here’s a summary of the latest projections for year-end 2025:

– Goldman Sachs: Raised its forecast to $3,700 per ounce.

– J.P. Morgan: Targets $3,675, reflecting confidence in ongoing price strength.

– Bank of America and UBS: Both expect gold to reach around $3,500, noticeably higher than previous estimates.

– ANZ: Sees gold at $3,600 by the end of 2025, a substantial revision upwards.

– OCBC Bank: Is even more bullish, setting a target at $3,900.

Such forecasts reflect broad institutional belief that the upward pressure on gold is far from over. Underpinning these upgrades are expectations of continued central bank demand, inflationary persistence, and financial market volatility.

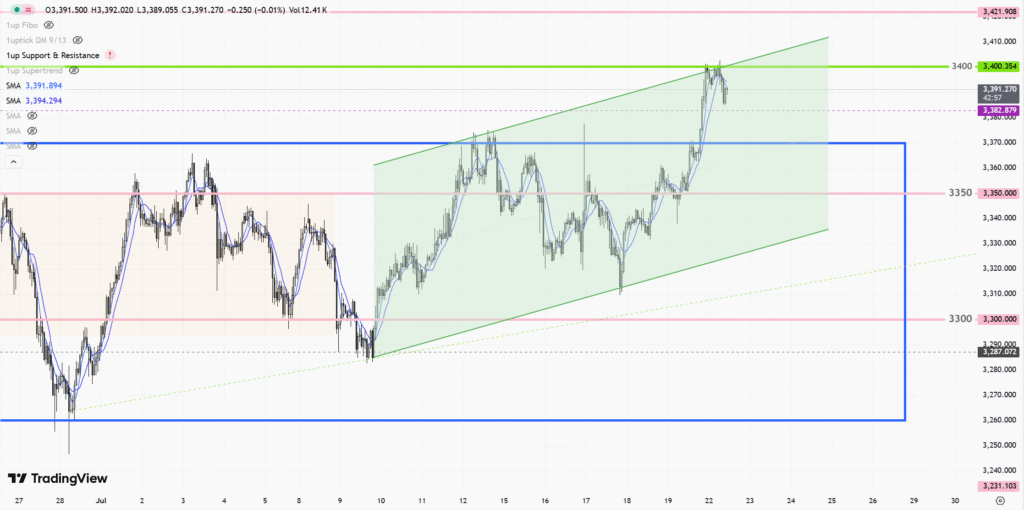

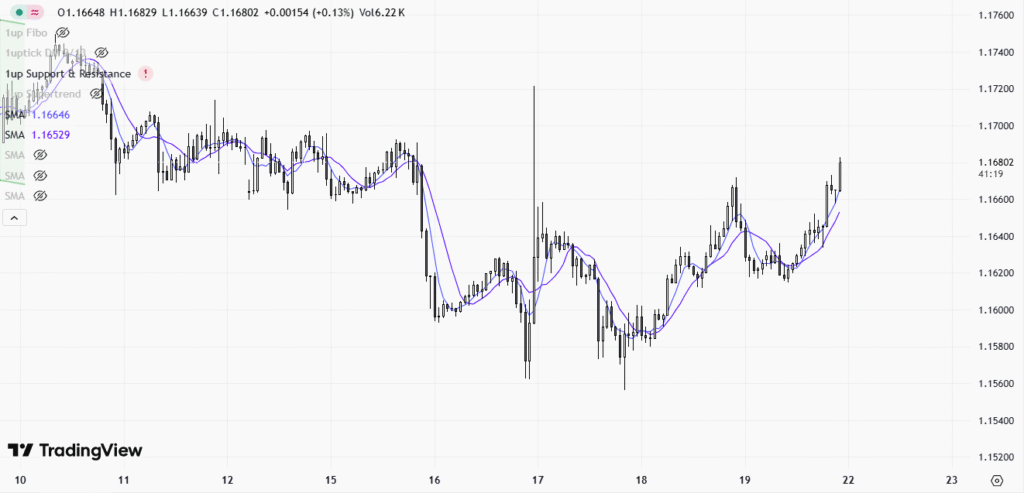

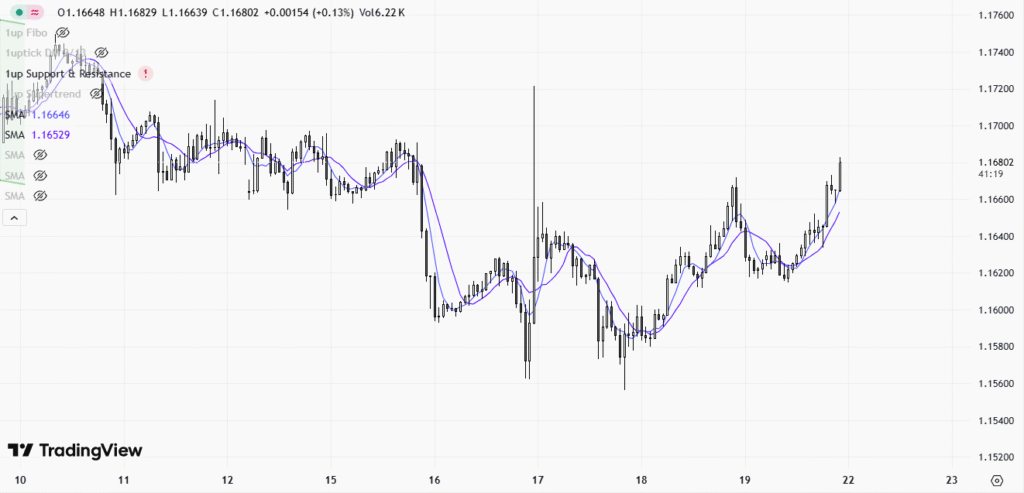

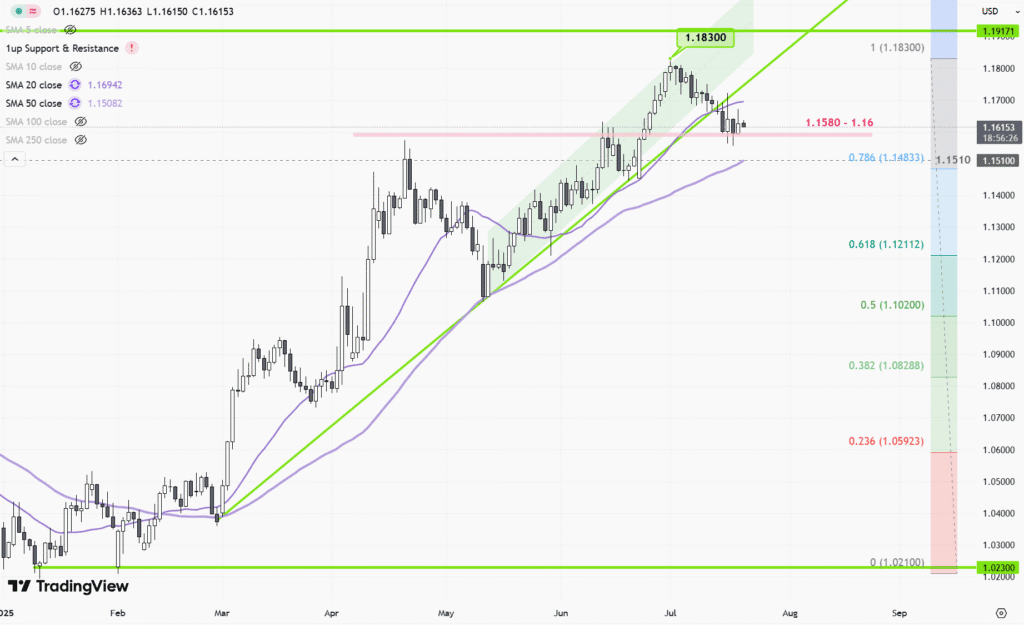

Technical Picture: Sustained Bullishness

Recent price action shows gold maintaining its surge above key moving averages, confirming a bullish trend across short and long timeframes. Technical indicators such as Relative Strength Index (RSI) remain elevated, signaling strong buying interest but also warranting caution against potential corrections after overbought conditions.

For traders, price targets of $3,700 and $3,800 now represent both natural resistance points and potential breakout levels. Sustained closes above these levels could open the path towards even higher institutional forecasts seen for 2026 and beyond.

Investment Considerations: Risk and Opportunity

For those learning toward gold as a store of value or tactical trade, the current environment offers both opportunity and risk:

– Pros: Persistent macro uncertainty, potential for further Fed dovishness, and robust long-term price targets.

– Cons: Possibility of short corrections if rate hikes return or if macro risks subside faster than expected.

For long-term investors, gold remains a relevant portfolio diversifier and inflation hedge. For short-term traders, vigilance around Fed events and technical signals is essential.

Conclusion: What’s Next for Gold?

As September unfolds, gold’s push towards $3,700 looks more plausible by the week, underpinned by global economic uncertainty, resilient demand, and shifting central bank narratives. With new all-time highs already established this year, the gold market remains one of the most closely watched arenas for opportunities and risk.

Whether you’re a seasoned investor or a curious observer, keep an eye on policy decisions, institutional forecasts, and of course, those technical milestones. The road to $3,700—and possibly beyond—may be volatile, but it’s also primed with potential for those watching closely.