|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Price Forecast September 2025: Will the Historic Rally Continue or Face a Pullback?

2025-09-25 @ 20:00

Gold Price Forecast: Will the Rally Persist or Stall in September 2025?

Gold has been on a remarkable run in 2025, with prices reaching all-time highs above $3,500 per ounce. This surge has captured the attention of investors worldwide, driven by economic uncertainty, shifting US monetary policy, and aggressive buying from central banks. As we head into September, the pressing question is whether gold will maintain its upward momentum or face resistance—and possibly a downturn.

Recent Performance and Technical Landscape

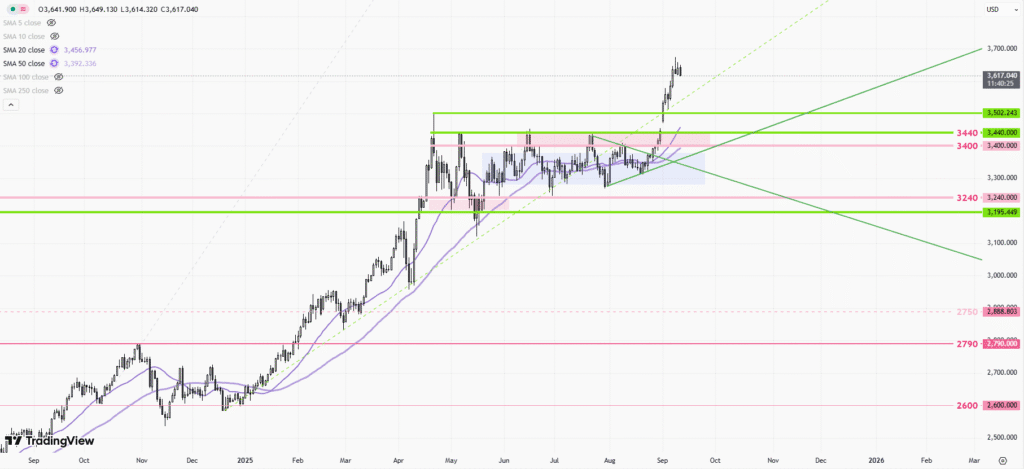

Throughout 2025, gold prices have moved rapidly, touching new records and consolidating above key support levels. The current range in international markets is between $3,300 and $3,534 per ounce, while Indian markets have seen prices fluctuate from ₹92,000 to over ₹1,02,000 per 10 grams. Analysts predict that prices could retest their highs if conditions align, especially if the US Federal Reserve moves to cut interest rates in response to cooling inflation and weaker job numbers.

Looking at technical indicators:

– The 50-day and 200-day moving averages continue to point upwards, reflecting a strong medium- and long-term trend.

– The Relative Strength Index (RSI) hovers above 65, signaling bullish sentiment but suggesting potential caution as overbought conditions arise.

– Volatility remains elevated, so rapid price swings are possible.

Key Drivers Influencing Gold in September

Several factors are coming together to shape the outlook for gold:

- Central Bank Buying: Many central banks, especially in Asia, have consistently increased their gold reserves, providing a stable backbone for demand.

- Federal Reserve Policy: The likelihood of a September rate cut stands high. Lower interest rates typically make non-yielding assets like gold more attractive, reducing the opportunity cost for investors.

- Geopolitical Risks: Persistent trade tensions, global conflicts, and upcoming elections keep the demand for safe-haven assets like gold alive. Any sudden spikes in geopolitical risk could trigger further rallies.

- Inflation Concerns: Although inflation has softened somewhat, ongoing uncertainty keeps investors looking to gold as a hedge.

Expert Projections

Major institutions remain broadly bullish:

– Goldman Sachs has set a year-end target of $3,700 per ounce, expecting upside if the Federal Reserve adopts a dovish stance.

– J.P. Morgan points to “strong tailwinds” as stagflation and policy risks continue.

– The World Gold Council notes resilient institutional and retail demand, particularly in India and China.

HSBC recently revised its 2025 forecast, predicting an average gold price of $3,215 per ounce and a trading range from $3,100 to $3,600, citing persistent inflation pressures and robust central bank demand.

Short-Term and Long-Term Outlooks

For September, projections suggest consolidation above key support levels. Most analysts anticipate gold will test new highs if macroeconomic signals—such as rate cuts or unexpected economic shocks—trigger increased demand. Indian markets could see amplified gains if the rupee continues to weaken, making global price moves even more pronounced locally.

Looking further ahead, estimates for year-end and beyond remain positive, with some models forecasting gold could approach or exceed $4,000 per ounce within the next year if current trends persist. Over the next five years, increased volatility is expected, but the general direction remains upward due to ongoing supply constraints and global demand growth.

Investor Strategies: Buy, Hold, or Wait?

Given the positive outlook and underlying drivers, many experts recommend a cautiously bullish stance. For those already holding gold, the current environment suggests room for additional gains, but monitoring global developments and technical signals is essential.

Prospective investors should consider timing their entry during potential market pullbacks or consolidations, as overbought conditions could temporarily ease prices before the next leg higher. Portfolio diversification with gold continues to make sense in an environment characterized by uncertainty, volatility, and policy shifts.

Risks to Watch

Despite the bullish consensus, investors should remain vigilant. Sharp corrections can occur if the Federal Reserve delays rate cuts, inflation cools faster than expected, or geopolitical tensions abruptly ease. Additionally, profit-taking at elevated price levels could introduce short-term downside risk.

Conclusion

Gold enters September 2025 at a pivotal moment, with strong fundamental and technical support but key risks on the horizon. Both short-term traders and long-term investors should watch central bank moves, US economic data, and global events closely. The precious metal’s safe-haven allure is firmly intact, and while consolidation is possible, any major shock could ignite another rally.

Whether you choose to buy, hold, or wait, gold’s role as a store of value remains as relevant as ever in today’s complex financial landscape.