|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Price Outlook 2025: Key Drivers, US NFP Impact, and Forecasts for Future Growth

2025-09-06 @ 01:00

Gold Price Outlook: Consolidation, Drivers, and Future Prospects Ahead of US NFP Data

Gold has been consolidating around the $3,550 mark, a development that has captured market attention in early September 2025. This phase of price stability comes as investors brace for impactful US economic data, particularly the Nonfarm Payrolls (NFP) report. The movements in gold are not occurring in isolation; they reflect a confluence of macroeconomic, geopolitical, and monetary policy drivers that continue to shape the precious metal’s trajectory.

Recent Performance and Market Sentiment

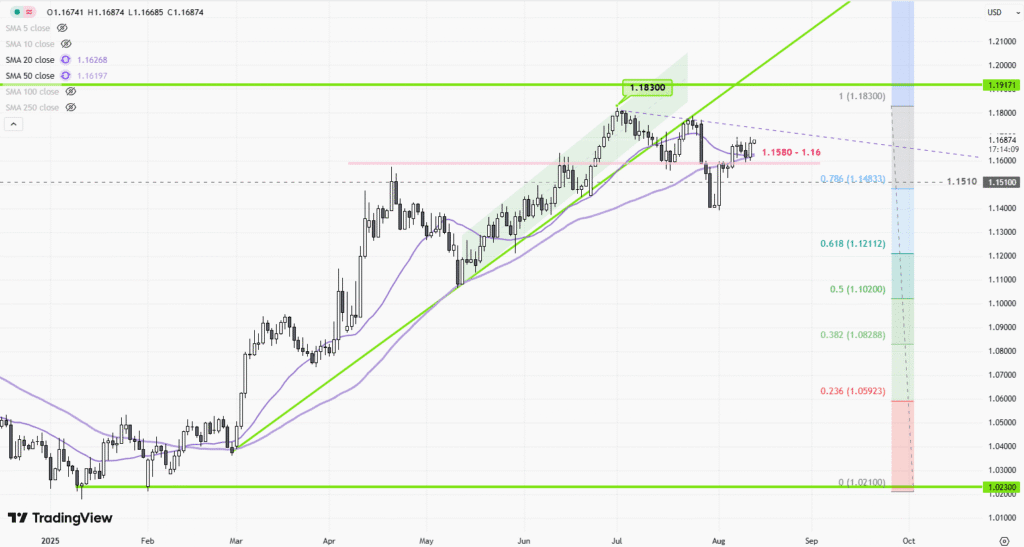

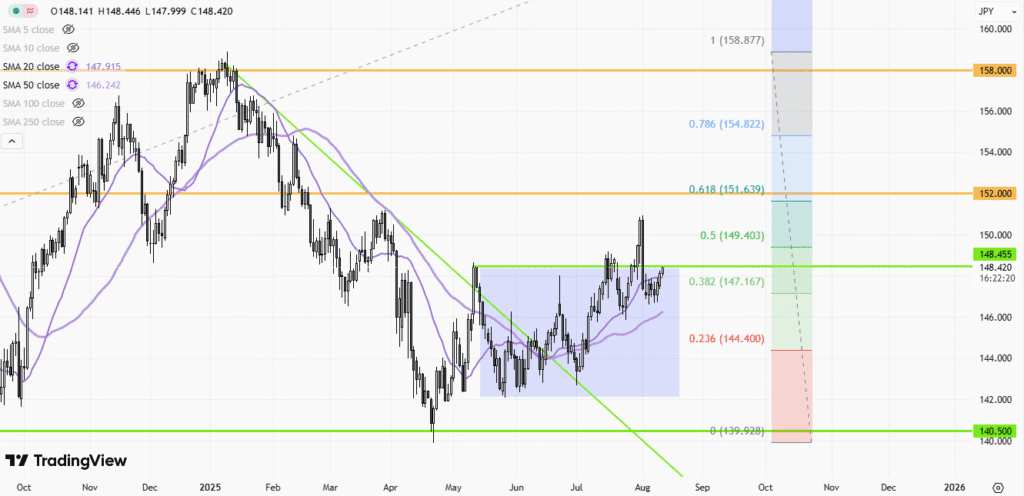

Recently, gold surged to a new record high of $3,545 per ounce, representing a substantial 30% gain year-to-date. The primary catalyst behind this dramatic rally has been the weakening US dollar. When the dollar depreciates, gold becomes comparatively less expensive for holders of other currencies, spurring additional demand and upward pressure on prices.

Another critical factor is the increasing inclination of both central banks and large institutional investors to accumulate gold. With persistent global uncertainties—from geopolitical tensions to evolving inflation risks—gold has proven itself as a reliable store of value and a favored safe-haven asset. As traditional financial markets face volatility, more participants are turning to gold as a hedge against inflation and as a tool for wealth preservation.

Upcoming US Data and Its Influence

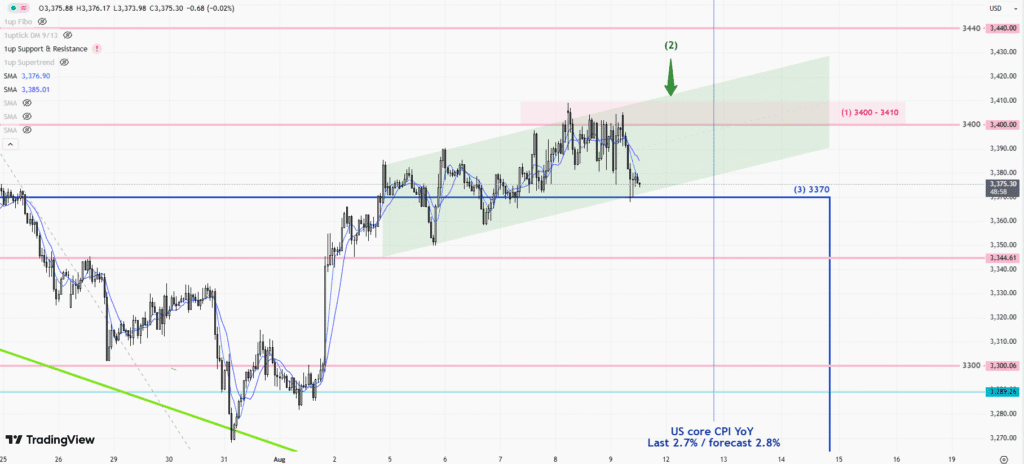

The market’s consolidation in gold prices reflects caution ahead of the release of several key US economic indicators. Of particular significance is the NFP report, which underpins expectations about the health of the US labor market and clues about the future direction of Federal Reserve policy.

Recent comments by Federal Reserve officials, coupled with growing expectations of rate cuts, have added to gold’s attractiveness. Any sign of softness in the labor market or dovish commentary from the Fed could serve as a further boost to gold’s price, especially if investors perceive rising risks to the independence and future policy trajectory of the central bank.

While short-term trading strategies favor “buying the dips,” the broader sentiment remains constructive for gold prices as long as inflation concerns and central bank purchases persist.

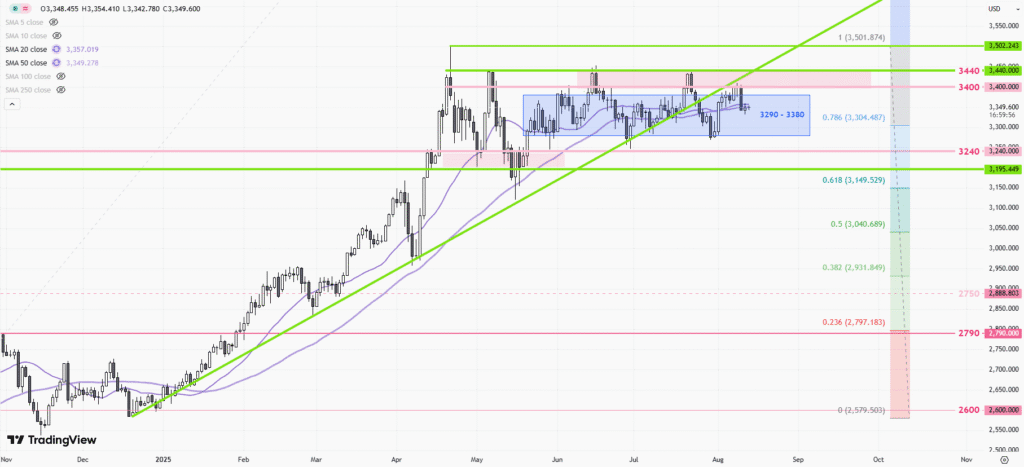

Technical Picture and Volatility

From a technical perspective, gold’s price range in early September has hovered between $3,595 and $3,654 per ounce. This consolidation phase, while relatively tight, reflects uncertainty around upcoming data releases and monetary policy shifts. Some projections suggest that gold may climb to $3,700 in the near term if current trends hold, particularly if global risk factors intensify or the dollar continues its downward trajectory.

Looking forward, forecasts for gold prices indicate notable volatility. The consensus among analysts points toward bullishness, with high-end projections for 2025 suggesting gold could reach well above $3,700 per ounce. Algorithmic models and institutional surveys have produced a variety of price targets, some of which extend into the $4,000 territory should demand remain robust and macro conditions supportive.

Key Drivers Shaping Gold’s Path

Several major factors continue to underpin gold’s strength:

- Weaker US Dollar: Currency depreciation increases gold’s appeal to international investors.

- Central Bank Purchases: Official sector buying adds solidity and demand to the market.

- Geopolitical Uncertainties: Tensions, whether across borders or within fiscal and monetary institutions, enhance gold’s safe-haven role.

- Expectations of Lower Rates: Anticipation of Federal Reserve rate cuts makes non-yielding assets like gold more attractive compared to interest-bearing securities.

- Inflation Risks: As persistent inflation erodes paper wealth, investors seek protection in hard assets.

Long-Term Projections and Strategic Considerations

Historical patterns suggest that gold is likely to remain an essential component in diversified portfolios, especially as the world navigates complex financial and political landscapes. While short-term volatility can be pronounced—driven by data releases and sentiment shifts—the medium- to long-term fundamental outlook for gold remains positive, supported by the factors outlined above.

For investors and traders, the current environment favors active monitoring and adaptive strategies. Those looking to capitalize on gold’s momentum may consider tactical entries on pullbacks, while investors focused on long-term stability and inflation protection may find gold’s current consolidation phase a reasonable opportunity for gradual accumulation.

Conclusion

With gold consolidating at historic highs and the global macro backdrop evolving rapidly, the outlook for the precious metal remains robust. Key US employment data, Federal Reserve policy expectations, and persistent geopolitical uncertainties are set to shape the direction of gold prices in the weeks and months ahead. Whether you are a short-term trader or a long-term investor, closely tracking these core drivers will be essential for navigating the gold market’s next phase.