|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Prices Hold Strong Above $3,500 in 2025 Amid Global Uncertainty and Dollar Weakness

2025-09-05 @ 01:01

Gold prices have recently demonstrated remarkable resilience, holding close to critical support levels even as global economic uncertainties persist. As of early September 2025, gold has maintained its position above the $3,500 mark per ounce, reflecting both its traditional role as a safe-haven asset and a response to a confluence of market drivers.

Recent Performance and Current Trends

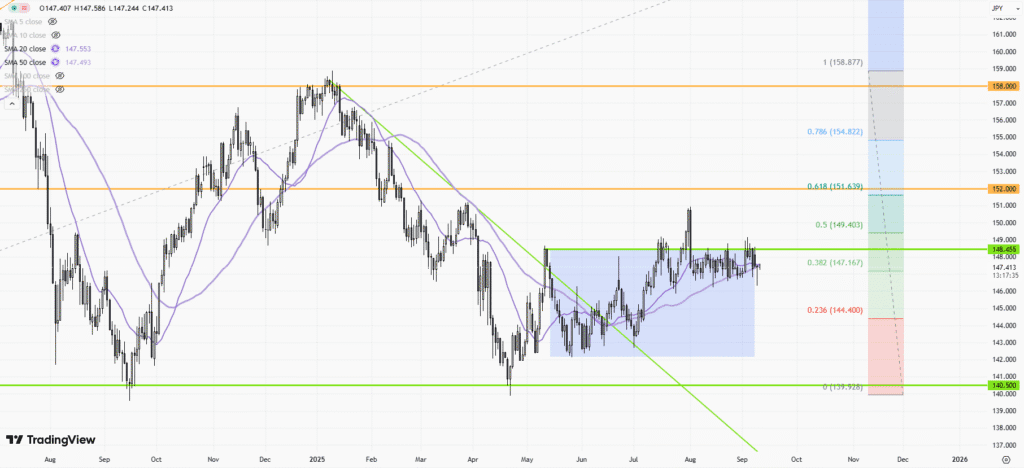

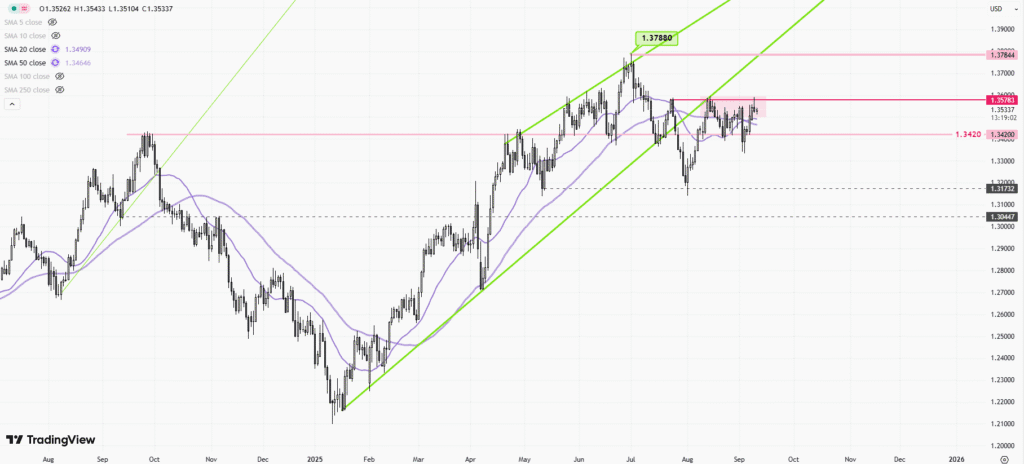

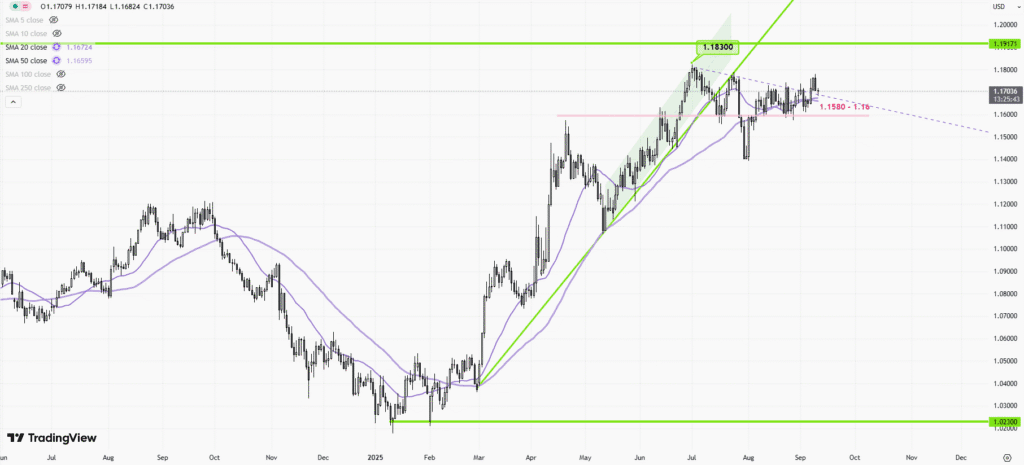

Gold has experienced an extraordinary rally in 2025. Starting the year with strong momentum, the metal reached new record highs, fueled by a combination of factors. In particular, as of September 1, gold traded at roughly $3,545 per ounce, marking a dramatic 30% gain year-to-date. This upward movement has been closely linked to shifts in the foreign exchange market, with the U.S. dollar sliding over 2% in recent weeks. A weaker dollar typically makes gold more attractive to investors using other currencies, thereby increasing demand.

Besides currency movements, gold’s performance has benefited from global uncertainty and geopolitical tensions. With financial markets facing heightened volatility and inflation remaining elevated in several major economies, both institutional and individual investors have sought stability in precious metals. Central banks, too, have been notable buyers of gold in 2025, further supporting its price floor near $3,500.

Key Support and Resistance Levels

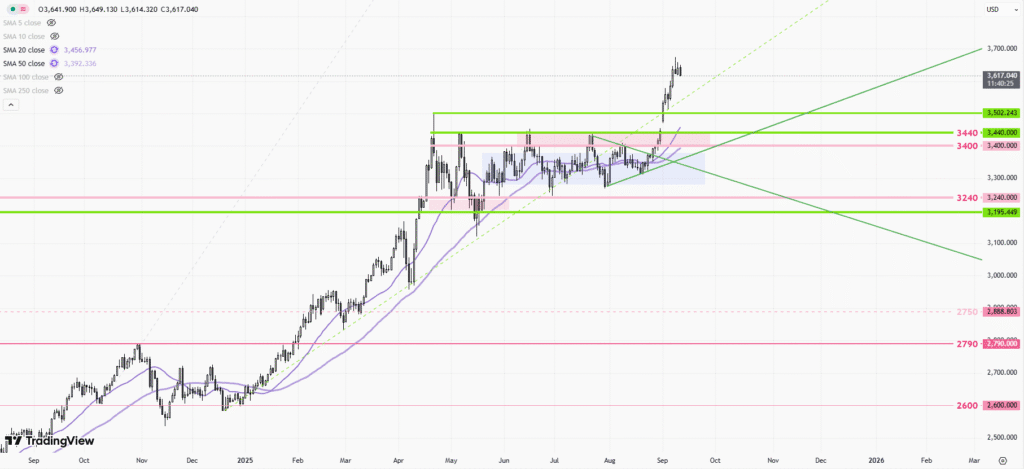

The $3,500 per ounce level has emerged as a pivotal support area for gold. Price action over recent weeks shows bulls defending this threshold, with any intraday dips below this zone met by renewed buying interest. Technical analysts note that sustaining prices above this support is crucial for maintaining the bullish outlook in the medium term.

On the upside, analysts and industry experts now eye the $3,700 resistance zone as the next logical target. Breaks above this level could open the door for a continued rally, especially if economic or political uncertainties intensify or the dollar weakens further.

Factors Driving the Gold Market

Several intertwined factors are underpinning gold’s 2025 rally:

- Inflation and Monetary Policy: Persistent inflation concerns have kept real yields in check, enhancing gold’s appeal as a store of value. While central banks, particularly the U.S. Federal Reserve, have sent mixed signals regarding future rate policies, anticipation of a pause or more dovish stance has buoyed precious metal prices.

- Central Bank Purchases: Sovereign accumulation of gold has accelerated this year, with many nations increasing their reserves to diversify away from the dollar and hedge against global risks.

-

Geopolitical Risk: Ongoing geopolitical flashpoints and trade tensions continue to drive safe-haven flows into gold, especially during episodes when traditional risk assets falter.

-

Currency Market Volatility: The weakening dollar not only makes gold cheaper for non-U.S. investors but also prompts portfolio managers to reallocate toward hard assets like precious metals.

Market Outlook and Future Forecasts

While some short-term profit-taking is always possible after such a steep rally, most projections for the remainder of 2025 and beyond remain constructive toward gold. Industry consensus points to prices remaining well supported above $3,500, with potential to challenge $3,700 or even higher if current trends persist.

Forecasting agencies and analysts provide a wide range of end-of-year price targets. Moderately optimistic models envisage gold trading in the $3,600 to $3,700 range into the final quarter, with some projecting further upside should inflation surprise to the upside or if additional geopolitical shocks occur.

For investors, gold’s strong defense of the $3,500 mark confirms its role as a robust hedge amid uncertainty. The metal’s unique qualities—scarcity, historical credibility, and independence from fiat currency systems—continue to attract capital flows in turbulent times.

In summary, gold’s technical strength, supportive macro backdrop, and ongoing demand from both investors and central banks point to a solid foundation for the metal in the months ahead. While short-term volatility is always possible, the broader trends suggest that gold will remain a vital component of diversified portfolios as global uncertainties persist through the end of 2025 and into the future.