|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Prices Soar to Historic Highs in 2025: Key Factors Driving the Surge and What Investors Should Know

2025-09-18 @ 05:00

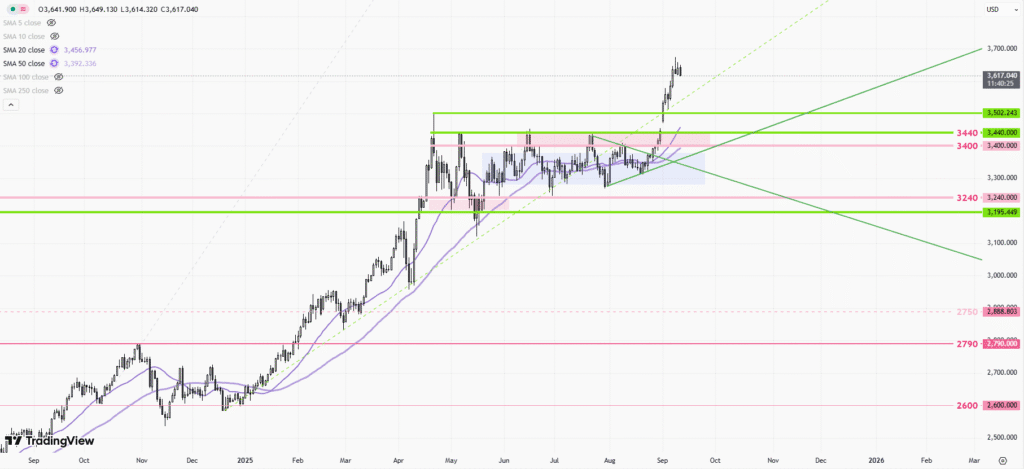

Gold prices have surged to historic levels in 2025, captivating investors and analysts worldwide. In September, gold briefly touched an all-time high of around $3,704 per ounce, primarily in response to the Federal Reserve’s decision to lower its benchmark interest rate by a quarter point. The Fed’s move reflects mounting concerns over slowing job growth and persistent inflation, highlighting the ongoing challenges facing policymakers as they balance economic growth with price stability.

After reaching this new peak, gold has experienced minor fluctuations, most recently trading around $3,665 per ounce. Despite these short-term shifts, the broader trend remains remarkably strong. Over the past month alone, gold has climbed nearly 10%, and its year-to-date gain approaches an astonishing 41%. Compared to this time last year, gold’s price is up almost 43%. Such gains underscore the commodity’s enduring appeal, especially during periods of uncertainty.

Several factors have converged to drive gold’s impressive rally in 2025:

- Central Bank Buying: Major central banks have increased their reserves of gold, seeking a safeguard against currency risk and economic volatility. This sustained demand from institutions has provided powerful support to prices.

- Flight to Safety: Investors have turned to gold as a safe haven amid geopolitical tensions, concerns about slowing growth, and instability in financial markets. Gold’s reputation as a store of value during uncertain times has been a driving force behind its rise.

-

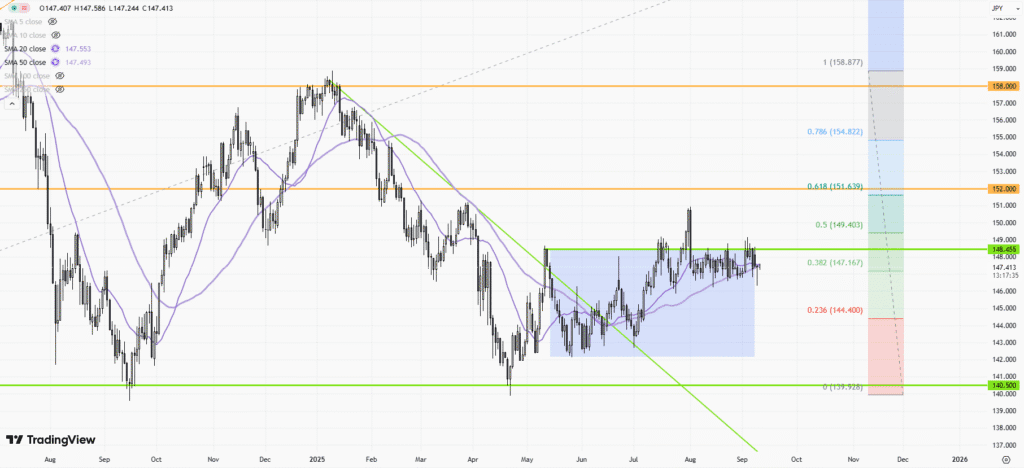

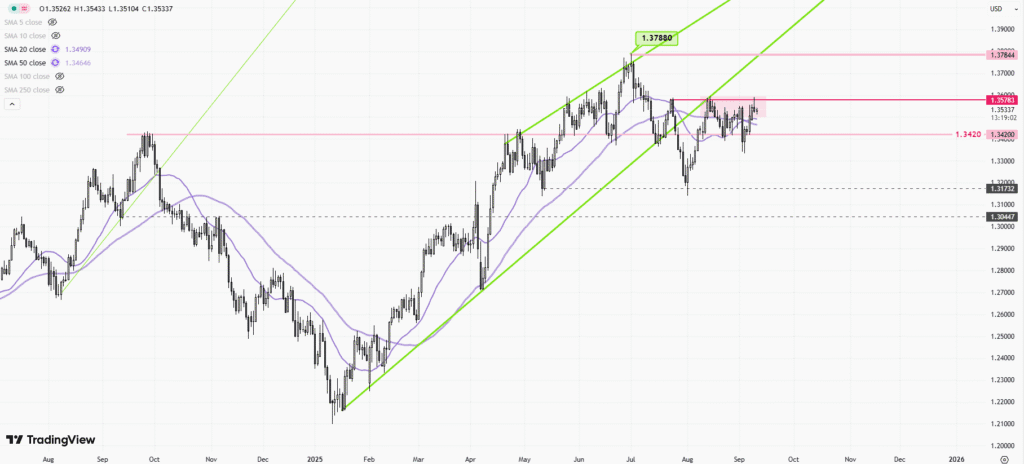

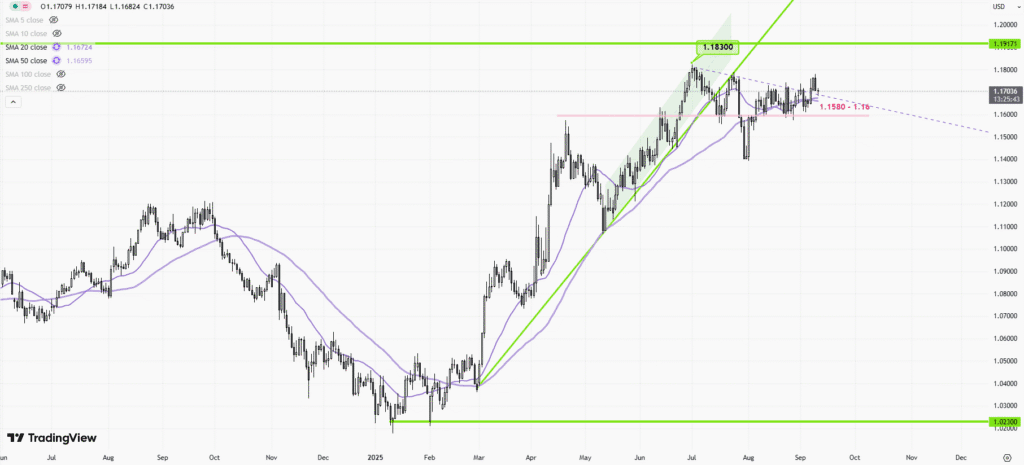

Weakening U.S. Dollar: The Federal Reserve’s rate cut and a general softening in the U.S. dollar have made gold attractive not only to domestic investors but also to those abroad. Typically, when the dollar weakens, gold costs less in other currencies, boosting global demand.

-

Inflation Risks: With inflation remaining above central bank targets, gold has benefited from its historical role as an inflation hedge. Investors looking to preserve purchasing power have flocked to the precious metal, further stoking demand.

Looking ahead, analysts expect gold to maintain its strong performance. Projections suggest gold could trade around $3,694 per ounce by the end of the current quarter, with some forecasts placing it above $3,850 within the next year. While these estimates are subject to changes in monetary policy or shifts in macroeconomic trends, the fundamental drivers of gold demand remain robust.

For individual investors, the current environment presents both opportunities and challenges. On one hand, gold’s surge reinforces its reputation as a portfolio diversifier and a hedge against risk. On the other, buying at record highs requires a thoughtful approach and a clear understanding of the factors influencing its price.

Some key points for investors considering gold today:

- Long-Term Value: Gold has demonstrated consistent long-term appreciation, overcoming short-term volatility and corrections.

- Diversification: Including gold in a diversified portfolio may help reduce overall risk, especially in periods of market stress or high inflation.

- Economic and Policy Impacts: Gold’s price is sensitive to central bank decisions, global growth prospects, and currency movements. Monitoring these factors can help investors make informed decisions.

- Market Timing: While timing market peaks is notoriously difficult, setting a disciplined investment strategy—such as dollar-cost averaging or allocating a set percentage to gold—can help mitigate the risks associated with buying during rallies.

Despite nearing record highs and ongoing volatility, many experts continue to affirm gold’s relevance as an investment. Some view short-term dips as potential buying opportunities, provided the broader economic trends supporting gold remain intact.

In summary, gold’s remarkable advance in 2025 reflects a convergence of policy decisions, market uncertainty, and shifting investor behavior. Whether you are a seasoned investor or new to the commodity market, staying informed about economic developments and maintaining a balanced approach to portfolio management can help you navigate the evolving landscape shaped by gold’s performance. As the year unfolds, watching central bank actions, inflation data, and global market signals will remain critical for anyone invested in or considering gold.