|

| Gold V.1.3.1 signal Telegram Channel (English) |

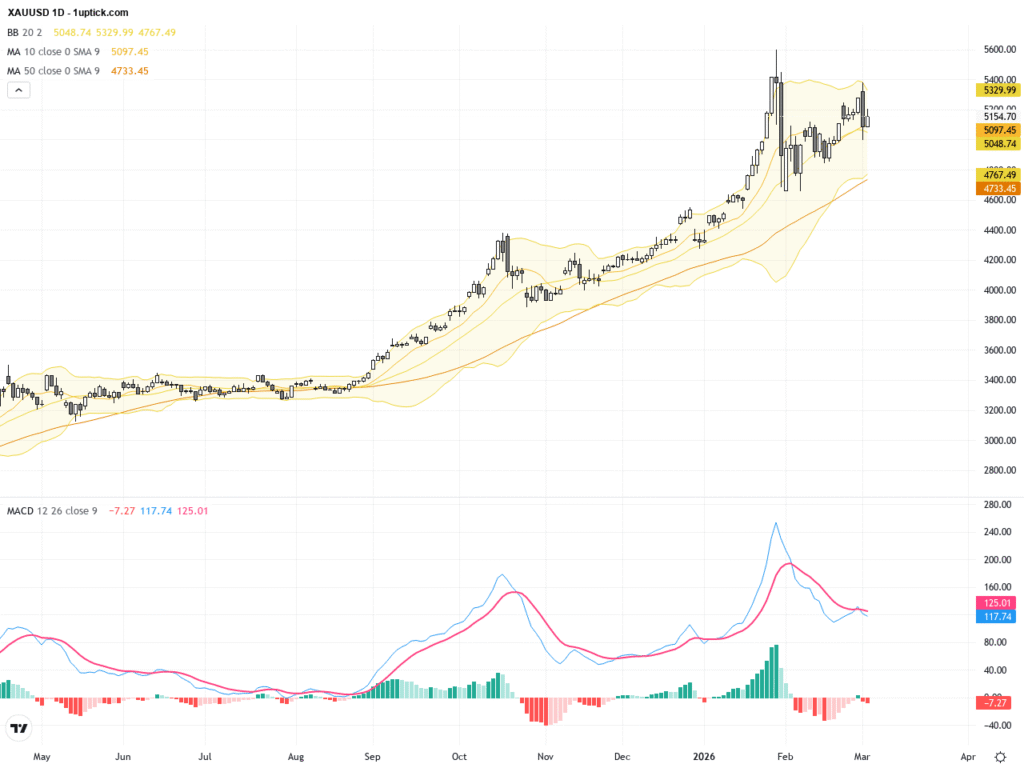

Gold Rally Surges in 2025: XAU/USD Targets New Highs on Rate Cut Hopes and U.S. Fiscal Uncertainty

2025-09-29 @ 20:01

Gold Rally Accelerates: XAU/USD Eyes New Highs Amid Rate Cut Hopes and U.S. Fiscal Uncertainty

Gold prices surged in recent trading sessions, reigniting bullish sentiment as investors look to the precious metal for refuge amid mounting concerns over U.S. fiscal instability and growing expectations of global rate cuts. The XAU/USD is rapidly approaching critical resistance points, emboldened by a wave of risk aversion and supportive macroeconomic backdrops.

Gold’s Upward Momentum and Macro Drivers

In late September 2025, gold climbed above $3,800 per ounce, marking a substantial monthly advance and bringing year-to-date gains to over 40%. This impressive performance has been underpinned by macroeconomic uncertainty, particularly fears of a looming U.S. government shutdown and persistent debate over the path of U.S. interest rates.

Expectations for imminent rate cuts by major central banks have fueled demand for non-yielding assets like gold. As central banks worldwide signal a shift toward more accommodative monetary policies, investors have increased their exposure to gold as a hedge against both currency debasement and geopolitical turbulence.

Technical Outlook: Resistance, Correction Risks, and Upside Potential

Technically, gold remains in a pronounced uptrend, trading within a bullish channel and consistently breaking above previous resistance levels. Despite the strong rally, analysts caution that the market may see short-term corrections, with a potential pullback towards key support zones. A retreat to the $3,635 level could offer a healthy reset for bulls, but the prevailing momentum suggests that buying pressure will remain dominant.

If gold were to close above $3,855 and sustain momentum, the next clear target sits above $4,075. A breakout of this magnitude would likely confirm another major bullish extension, potentially attracting additional capital flows from institutional and retail investors alike. However, should prices fall below the critical support of $3,445, this would indicate a breakdown from the bullish channel and could spark a deeper corrective phase, with bearish targets below $3,100.

Investor Sentiment and Institutional Forecasts

Bullish sentiment is also reflected in forecasts from leading financial institutions. Most major banks and analysts remain positive on the 2025 outlook for gold, citing persistent inflation, currency volatility, and robust fundamentals. Forecasts for 2025 range from $3,500 to over $4,000 per ounce, with some outliers projecting even higher levels in the coming years.

Key drivers cited by institutions include:

– Ongoing uncertainty about U.S. fiscal health and political stability

– Shifts in central bank policies towards lower rates

– Heightened demand for safe-haven assets, especially in periods of financial market volatility

– Structural tailwinds from persistently high inflation and currency debasement narratives

Near-Term Risks and Key Levels

While the prevailing trend favors the bulls, risks have not dissipated. A failure to sustain levels above $3,800–$3,850 could lead to profit-taking and a test of support. The $3,635 area has emerged as a significant support zone, with a deeper decline below $3,445 raising the possibility of a trend reversal.

On the upside, a close above resistance and a sustained rally toward $4,075 would keep gold in a firmly bullish trajectory. Should institutional buying accelerate, gold could overshoot even the most optimistic short-term targets, especially in the event of a severe economic or geopolitical shock.

Why Gold Remains a Core Portfolio Asset

The case for gold remains compelling, especially for investors seeking diversification and protection against systemic risks. As central banks weigh the risks of prolonged tightening against growing economic fragility, gold offers a non-correlated hedge with a track record of retaining value during crises.

With global debt levels at record highs, political risks mounting, and confidence in fiat currencies wavering, gold’s appeal as a tangible, scarcity-backed asset stands stronger than ever. Whether you are an active trader or a long-term investor, the current environment favors maintaining or increasing gold allocations as a core strategy to navigate market uncertainty.

Final Thoughts

As we navigate the last quarter of 2025, all eyes remain on the interplay between monetary policy shifts, political gridlock, and market sentiment. Gold’s rally above $3,800 reflects not just short-term trading dynamics, but deeper structural anxieties that are unlikely to dissipate soon. Investors should closely monitor key support and resistance levels, watch for signals from central banks, and remain alert to both correction risks and further breakout opportunities as the gold market charts its next moves.