|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold, Silver, and Platinum Surge to Record Highs: What’s Driving the Bullion Market Rally in 2025?

2025-09-09 @ 05:02

Bullion markets have caught fire in recent months, with gold, silver, and platinum all surging to multi-year highs as investors ramp up bets on imminent U.S. Federal Reserve rate cuts. This renewed enthusiasm for precious metals has sent prices into record territory and rekindled bullish sentiment across the sector.

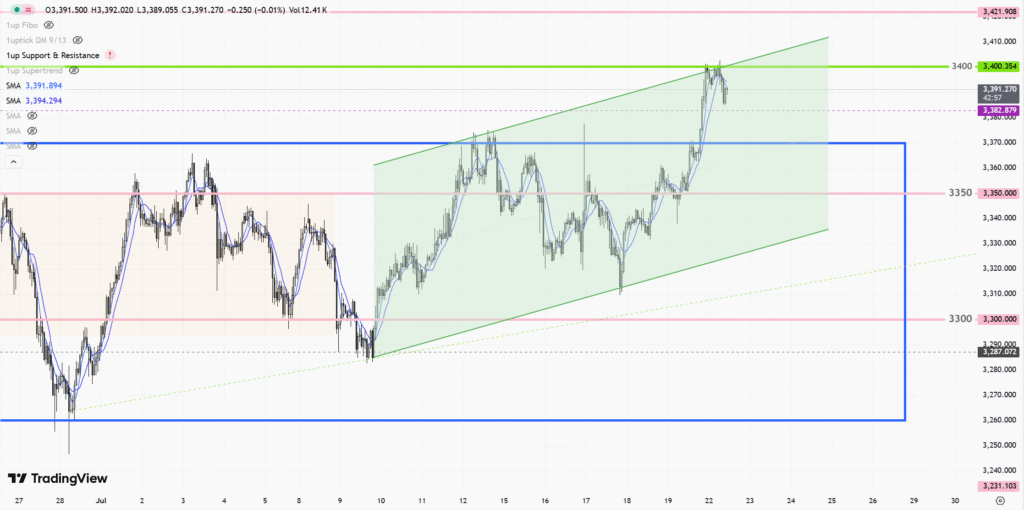

Gold Leads the Charge to Record Highs

Gold has been the standout performer, recently breaking past $3,600 per ounce — a historic level that marks new territory for the yellow metal. Even as prices slipped slightly from intraday highs, gold remains up sharply for the year, climbing more than $600 since the start of 2025. This remarkable rally reflects shifting dynamics in global financial markets, as investors seek safety amid persistent inflation and expectations that the U.S. central bank will begin reducing interest rates before year-end.

Much of the momentum in gold has been driven by two key factors. First, signs of cooling inflation and a slowing U.S. economy have increased conviction that the Fed’s hiking cycle is over, with rate cuts now a matter of when, not if. Lower rates typically weaken the U.S. dollar and reduce the opportunity cost of holding non-yielding assets like gold, making bullion more attractive. Second, geopolitical tensions and continued demand from central banks — especially in emerging markets — have provided strong tailwinds for gold prices.

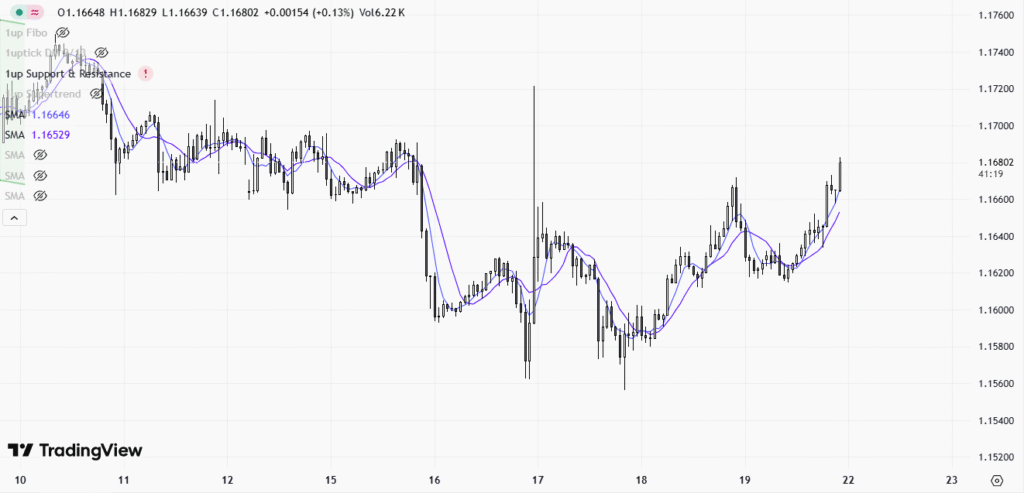

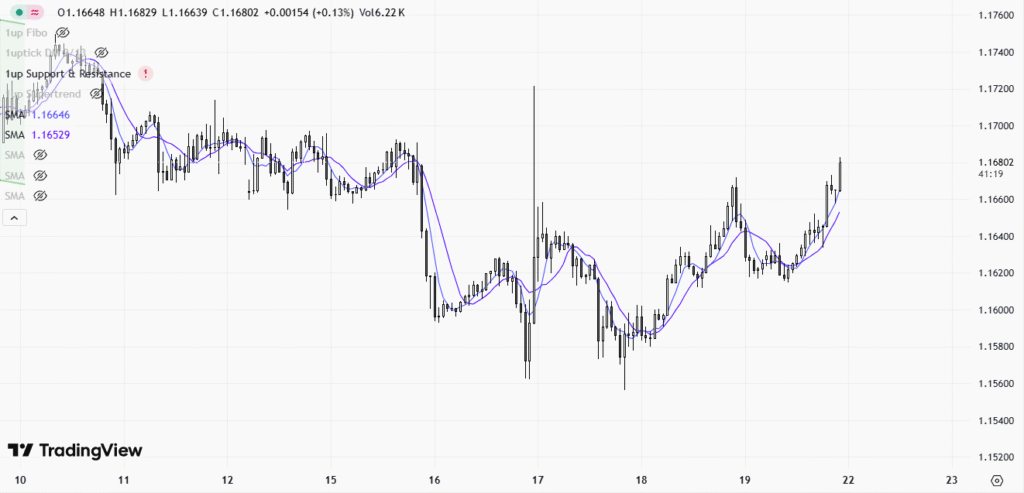

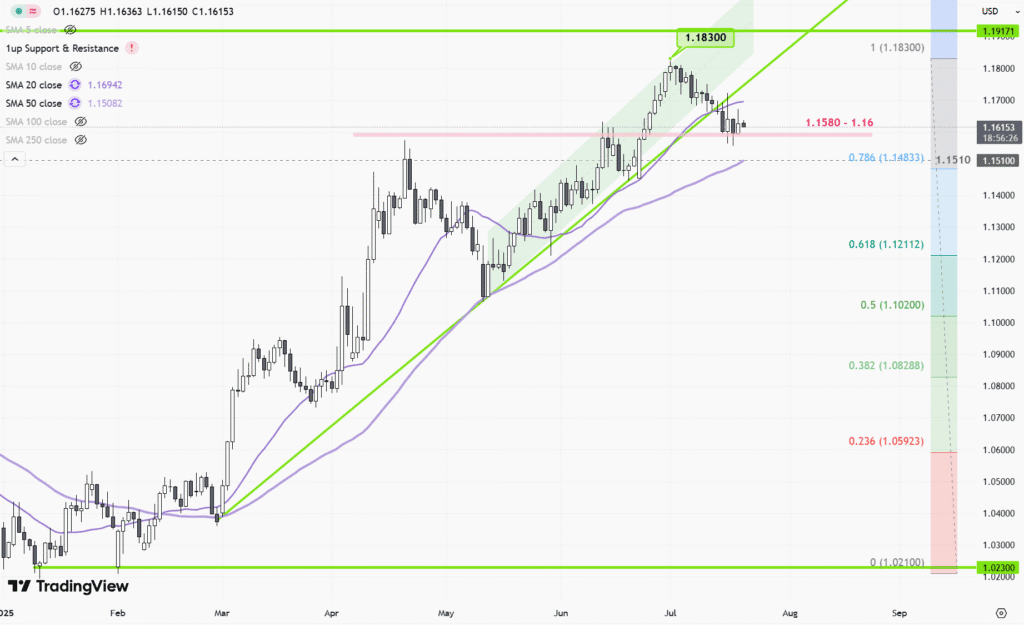

Silver Outpaces Expectations

Silver has outperformed many forecasts, surging to over $41 per ounce for the first time in more than a decade. This marks a more than 44% gain over the past year, outstripping gold’s percentage rise during the same period. Silver is not only benefiting from safe-haven demand but also from its vital role in industrial applications — especially in the green energy and technology sectors.

The strong rally in silver underscores its dual function as both a precious and an industrial metal. As global economies invest heavily in renewable energy infrastructure and advanced electronics, silver’s unique conductive properties have made it a critical component, further fueling investor interest. Tightening physical supplies and increasing coin and bar purchases have amplified upward price pressure, with silver now trading at levels not seen since the post-financial crisis boom.

Platinum Joins the Rally

Platinum, though often overshadowed by gold and silver, has also posted impressive gains, with prices recently topping $1,390 per ounce. That’s a rise of nearly 48% from just a year ago, as platinum’s supply-demand picture improves. The auto industry’s transition toward cleaner technologies is a major driver, as platinum remains essential in both conventional and some hydrogen fuel cell vehicles.

Investment interest in platinum has grown as investors look for alternatives to already expensive gold and silver. Additionally, tighter mine output, particularly from major suppliers in South Africa, has reduced available supply, providing another boost to prices.

Why Are Precious Metals So Strong Right Now?

Several macroeconomic factors have combined to create a near-perfect environment for precious metals:

- Expectations that the Federal Reserve will start cutting rates in late 2025 have increased investor demand for non-yielding assets.

- Ongoing geopolitical turbulence and concerns over global conflict and trade tensions have drawn safety-oriented buyers into bullion.

- Strong central bank demand, especially from developing economies diversifying away from the U.S. dollar, continues to support prices.

- Robust industrial demand, particularly for silver and platinum, is underpinning tight physical markets as global energy transitions accelerate.

Market Outlook: Room for Further Upside?

While prices for gold, silver, and platinum are already at multi-year or record highs, forecasts suggest there may still be further upside if current trends persist. Analysts point to the likelihood of further dollar weakness, continued low or falling interest rates, and possible supply shortages as reasons why the rally could continue.

- Gold is widely expected to remain well-bid, especially if central banks continue to buy at record paces and investor sentiment remains cautious.

- Silver’s price action is likely to remain volatile but skewed to the upside given ongoing demand from both investors and industry.

- Platinum could keep gaining, particularly if supply constraints persist and the transition to cleaner, alternative vehicles accelerates.

Key Risks to Watch

Despite the bullish backdrop, risks remain. A surprise rebound in inflation could force the Fed to delay or reverse planned rate cuts, potentially dampening precious metal demand. Similarly, stronger-than-expected economic growth could lift the dollar and U.S. yields, weighing on bullion prices. Investors should also monitor developments in industrial demand, as shifts in technology or supply chains could alter the outlook for silver and platinum, in particular.

In summary, the current rally in gold, silver, and platinum reflects a convergence of economic, geopolitical, and technological trends. As rate-cut speculation intensifies and global uncertainty persists, precious metals seem set to remain in the spotlight for the foreseeable future.