|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Soars Past $3,570 Amid Historic Rally Driven by Central Bank Demand, Inflation Fears, and Weakening Dollar

2025-09-04 @ 05:00

Gold has embarked on a historic rally, surging to fresh all-time highs beyond $3,570 per ounce in early September 2025. This remarkable upswing underscores gold’s enduring appeal as a safe-haven asset, especially as global economic and political uncertainties continue to mount. Investors of all stripes—individuals, institutions, and central banks—are repositioning their portfolios to take advantage of gold’s perceived stability and hedge against rising inflation.

Several interrelated factors have combined to create a potent environment for gold’s ascent. Central banks, particularly in countries such as China, India, Turkey, and Poland, are actively bolstering their gold reserves. Their accelerated buying is part of a broader trend to diversify away from U.S. dollar holdings—a process often referred to as “de-dollarization.” The year 2024 even saw gold overtake the euro as the world’s second-largest reserve asset after the U.S. dollar. This structural shift in central bank behavior continues to provide strong underlying demand and helps explain gold’s sharp move higher.

At the same time, global investors are pouring into gold-backed exchange-traded funds (ETFs). The SPDR Gold Trust, the largest of its kind, recently reported holdings at their highest since 2022, and pension funds in key emerging markets like India are seeking regulatory approval to add more gold exposure to their portfolios. Even at record prices, institutional appetite for gold remains robust, reflecting continued confidence in gold as a portfolio hedge.

Monetary policy developments are playing an equally significant role. Market participants are increasingly convinced that the U.S. Federal Reserve is on the brink of its first interest rate cut in nine months, with a 90% probability of a 25-basis-point move at the next meeting. This prospect was reinforced by recent U.S. economic data and by growing political pressure on central bank independence. Concerns that the Fed might succumb to political influence, especially after a federal appeals court ruling striking down global tariffs, have created further jitters in the financial markets.

A weakening U.S. dollar is amplifying gold’s rally. The dollar’s persistent slide—down over 2% over the past month—has made gold more affordable for investors holding other currencies. This has been a boon for demand, both from foreign institutions and retail buyers. With traditional markets displaying increasing fragility and volatility, gold’s reputation as a store of value is back in the spotlight.

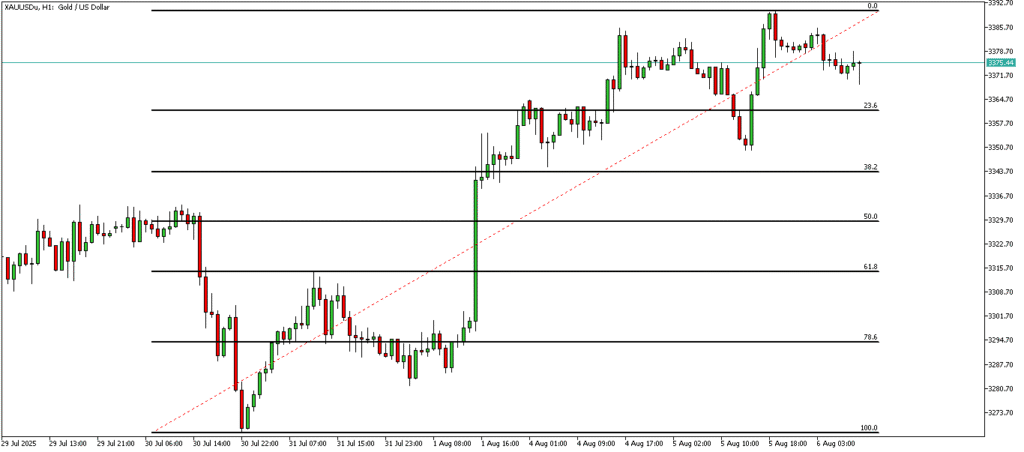

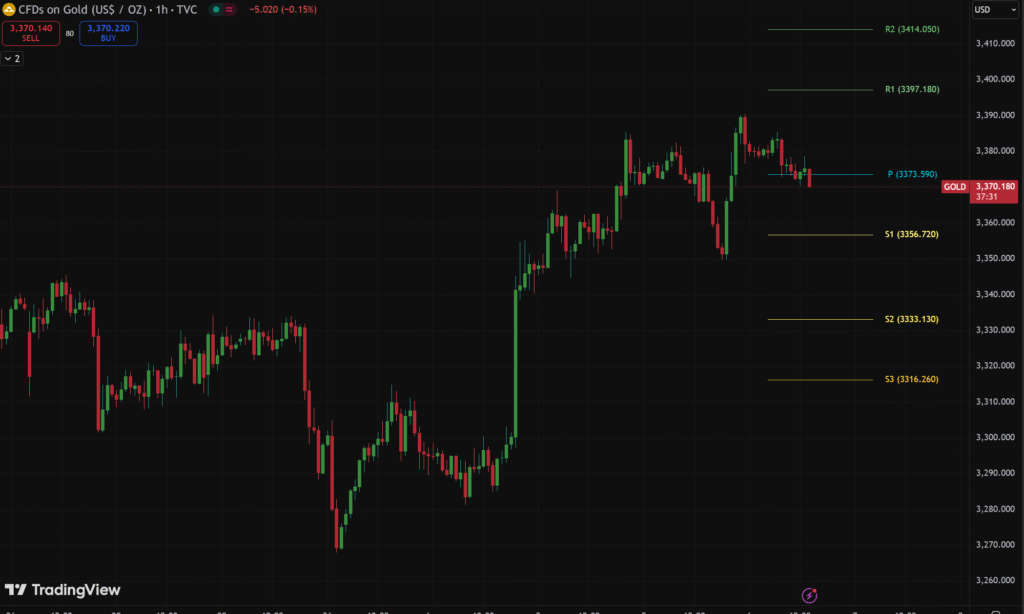

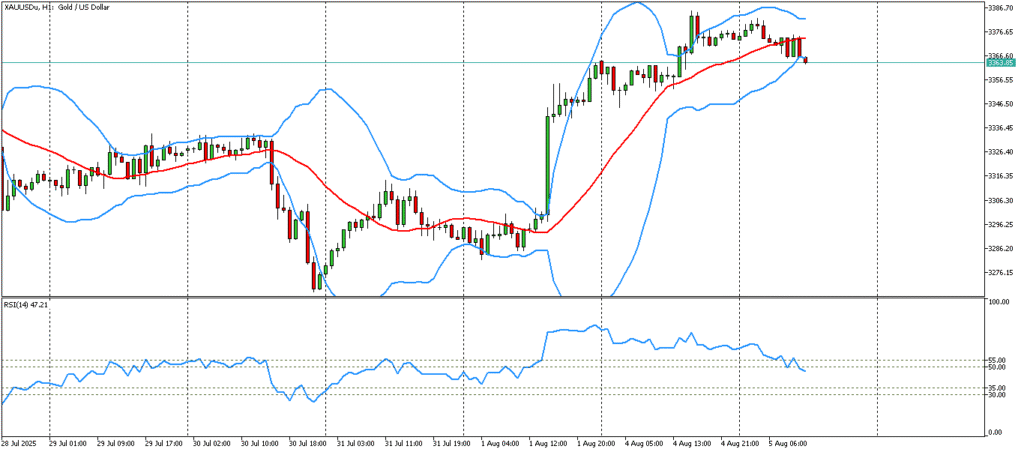

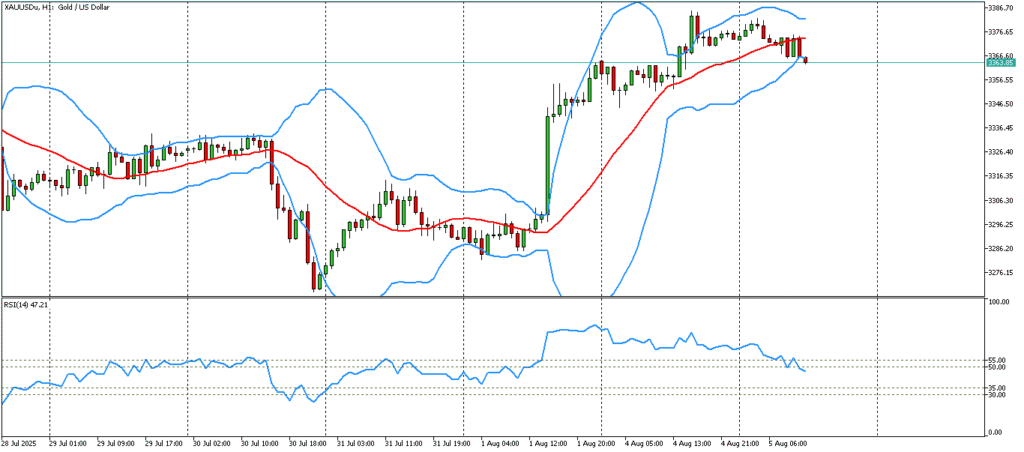

Technical indicators also support the bullish case. Gold’s price charts reveal a strong uptrend, highlighted by the “bull cross” of key moving averages. With the metal breaking above recent psychological resistance levels such as $3,500 and $3,550, analysts now point to next targets in the $3,620–$3,700 per ounce range. In fact, some market watchers believe that if current conditions persist, challenges to $4,000 per ounce in 2026 are within reach.

Short-term market action offers additional nuance. Some analysts note that as traders price in Fed rate cuts, gold could experience some consolidation, particularly ahead of key U.S. labor market data releases. Nevertheless, the broader momentum remains upward, sustained by the combined force of policy shifts, geopolitical risks, and robust physical and speculative demand.

Looking further out, forecasters are split on just how high gold might climb. While some expect continued upward momentum as global uncertainties linger, others caution that the pace of gains could slow if monetary policy begins to normalize or geopolitical pressures ease. However, the consensus is clear: gold has reasserted itself as a premier hedge in a world marked by economic transition and growing skepticism toward fiat currencies.

For investors, the message is twofold. Short-term volatility should be expected, especially as market expectations adjust to fresh economic data and central bank communications. However, the structural tailwinds—central bank buying, the rush to diversify reserves, ongoing inflation fears, and global instability—point to a durable era of strength for the yellow metal.

The ongoing rally is a testament to gold’s adaptability amid shifting global dynamics. Whether viewed as a tactical trade or a long-term store of value, gold’s role in today’s financial landscape is as prominent as ever. As the world faces an unpredictable economic outlook, gold’s newfound highs may well prove to be just the beginning of a new chapter for this age-old asset.