|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold’s Historic Rally Nears $3,800: Key Drivers and What Investors Need to Know in 2025

2025-09-24 @ 05:00

Gold’s record-breaking rally shows no sign of slowing down. With the metal now trading around historic highs, investors and analysts alike are setting their sights on the next major psychological milestone: $3,800 per ounce. The prevailing bullish sentiment is backed by robust fundamental factors, resilient technical setups, and a wave of upward revisions from major financial institutions. Let’s dive into the forces driving gold’s ascent and the outlook for the months ahead.

Gold’s March Higher: Technical and Fundamental Backdrop

The gold market has unequivocally entered a new era. Over the past year, XAU/USD has shattered previous resistance levels, pushing into uncharted territory above $3,750 per ounce. This relentless advance is being propelled by several intertwined factors:

- Inflation Expectations: As global inflation remains elevated, gold’s appeal as a hedge against purchasing power erosion has strengthened considerably.

- Currency Depreciation: Persistent weakness across major fiat currencies, particularly the US dollar, has amplified gold’s attractiveness as a store of value.

- Geopolitical Tensions: Ongoing conflicts and economic disputes have heightened investor risk aversion, further boosting demand for safe-haven assets.

- Central Bank Purchases: Aggressive buying by central banks—especially in emerging markets—has added significant support to gold prices.

Institutional Upgrades Signal Confidence

The renewed optimism is reflected in the latest price forecasts from leading financial institutions. Most major banks now anticipate gold reaching or even surpassing $3,800 by the end of 2025, with several institutions revising their targets upwards:

- Goldman Sachs: $3,700 per ounce.

- J.P. Morgan: $3,675 per ounce.

- Bank of America: $3,500 per ounce.

- ANZ: $3,600 per ounce.

- OCBC Bank: $3,900 per ounce.

- UBS: $3,500 per ounce.

This consensus reflects deep-seated confidence in gold’s ability to withstand market volatility and serve as a reliable vehicle for wealth preservation. Notably, the upward revisions have mirrored developments in global policy uncertainty, interest rate dynamics, and the growing role of gold in diversified investment portfolios.

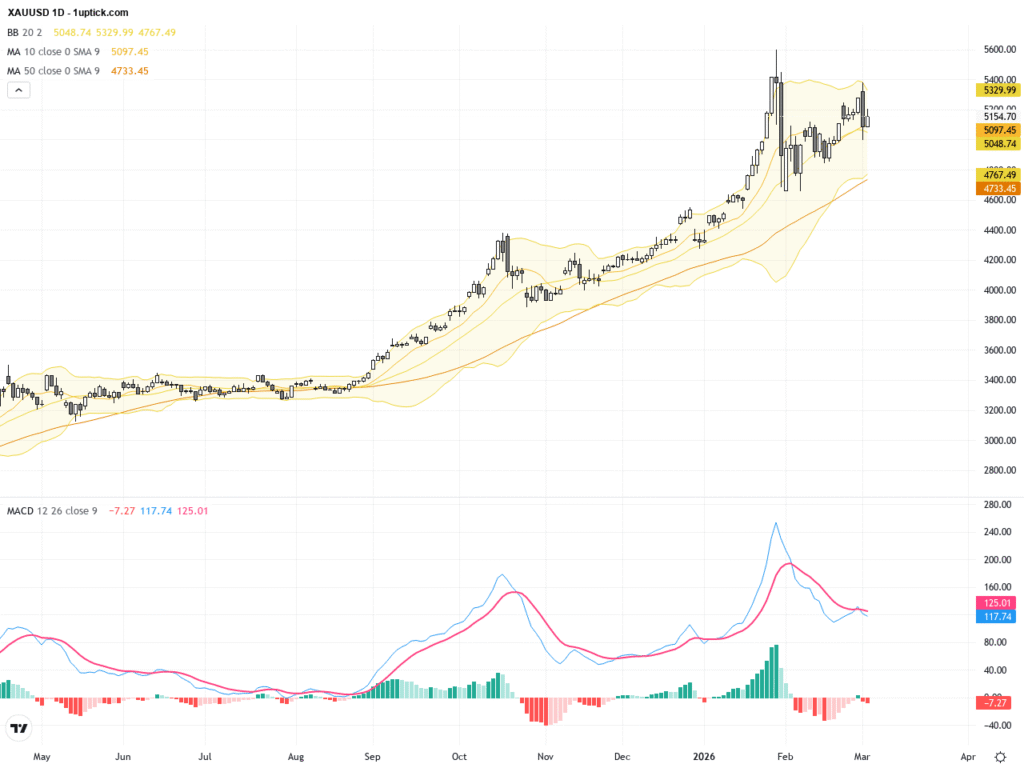

Technical Picture: Momentum and Possible Consolidation

From a technical standpoint, gold’s rally has unfolded in a classic “breakout and retest” pattern. The metal shattered long-term resistance near $3,200 earlier this year, driven by surging futures volumes and rapidly rising open interest. The subsequent run above $3,700 has been characterized by steady, buying-driven momentum with limited instances of profit-taking.

Despite the robust uptrend, short-term pullbacks and consolidations remain likely. Such pauses can provide the base for further advances by shaking out speculative excess and allowing new buying interest to emerge. Analysts expect gold’s next consolidation phase to occur around the $3,800-$3,900 area, where previous psychological barriers may prompt increased market volatility.

Macro Forces and the Road Ahead

Looking beyond technical charts and institutional notes, several macroeconomic factors continue to exert upward pressure on gold:

- Looming global recession fears are curbing risk appetite and encouraging more defensive asset allocations.

- Uncertainty about central bank policy—especially the timing and magnitude of future rate cuts—has sustained flows into gold and other alternative assets.

- Rising government deficits and ballooning national debts are stoking concerns about future fiat stability, enhancing gold’s safe-haven credentials.

Long-term projections are equally robust. Some forecasts now predict that gold could approach $5,000 per ounce by the end of this decade if inflation remains sticky and geopolitical risks do not abate. Although episodic corrections are to be expected, the broader investment thesis for gold remains intact: it is one of the few assets offering true diversification and downside protection against monetary and economic turbulence.

What Should Investors Watch Next?

With gold approaching a new threshold, investors should closely monitor a handful of high-impact variables:

- Changes in inflation data and central bank forward guidance.

- Shifts in currency markets, especially renewed volatility in the US dollar and euro.

- Official sector gold purchases, as large institutional flows can quickly reshape market trends.

- Geopolitical news flow, which can spark sudden safe-haven buying.

Allocators looking to ride the next leg of gold’s bull market may consider a phased approach to entry, using short-term dips and consolidations as buying opportunities. As always, prudent risk management and portfolio diversification remain essential amid rapidly shifting global conditions.

In Summary

Gold’s record-setting surge is being underpinned by powerful macro and micro forces. With institutional forecasts turning increasingly bullish and technical patterns signaling further momentum, $3,800 per ounce is now a realistic near-term target. For investors, gold continues to represent a vital hedge and strategic allocation in the face of relentless uncertainty—a testament to its enduring appeal as the ultimate safe haven.