|

| Gold V.1.3.1 signal Telegram Channel (English) |

Is Private Credit the Next Financial Casino? Risks, Growth, and the Future of Private Lending

2025-09-20 @ 22:01

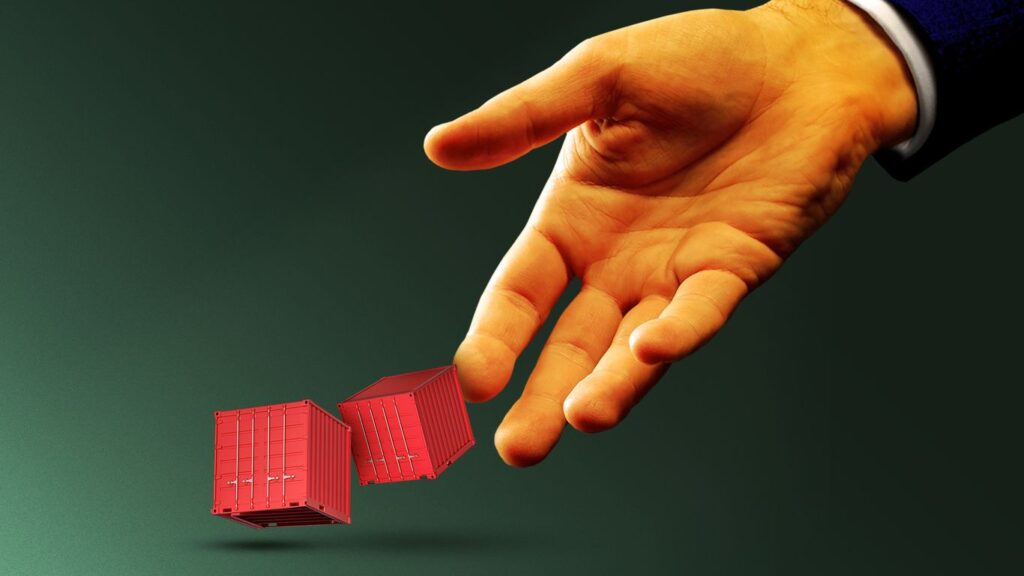

Are Private Credit Markets Becoming the New Financial “Casino”?

In recent months, the rapid expansion of private credit markets has sparked heated debate among leading European finance chiefs, raising questions about whether this booming sector is starting to resemble a casino more than a disciplined investment platform. As traditional avenues of funding become more restrictive and companies search for flexible alternatives, private credit has moved into the spotlight, prompting both excitement and concern about its long-term impact on financial stability.

The Meteoric Rise of Private Credit

Private credit—direct lending by non-bank institutions such as private equity firms, pension funds, and asset managers—has emerged as a vital source of financing, especially as regulatory constraints have made banks more cautious lenders. In the last decade, the volume of private credit transactions has soared, with global assets in private debt funds now exceeding the $2 trillion mark. Europe has become a particularly fertile ground for this growth, with borrowers drawn by the speed, tailored terms, and confidentiality that private lenders can offer.

This boom has been fueled by investors searching for higher yields in a low-interest-rate environment, as well as by companies eager to avoid the complexities of public debt markets. For many, private credit represents a more flexible, relationship-driven alternative to traditional bank loans or public bonds.

Voices of Caution: Gambling with Risk?

Despite the benefits, top financial executives are voicing growing concern over what they call “casino behavior” in private credit. The worry is that as more capital floods into this market, lenders are being tempted to loosen standards, take on greater risk, and chase returns at the expense of prudent risk management.

Several key risks have come to the forefront:

- Opaque Risk Profiles: Private loans are typically less transparent than publicly traded assets. The details of deals are seldom disclosed, making it harder for regulators and investors to assess aggregate risks or spot trouble early.

- Looser Lending Terms: With intense competition among private credit lenders, some are relaxing covenants and extending credit to weaker borrowers. This trend is reminiscent of the pre-2008 credit exuberance, which ultimately led to financial instability.

-

Potential for Default Clusters: If economic conditions deteriorate—such as through a jump in interest rates or a slowdown in growth—companies with stretched finances may struggle to service these loans. This could trigger a cascade of defaults concentrated among private credit borrowers.

-

Limited Regulatory Oversight: Unlike banks, private credit lenders operate with less regulatory scrutiny, increasing the risk of unchecked lending practices that might go unnoticed until problems become systemic.

Why Are Borrowers and Investors Still Hooked?

Despite these concerns, both borrowers and institutional investors continue to flock to private credit. For companies, particularly mid-sized firms unable to easily tap public markets, private lenders offer a lifeline with minimal bureaucracy and customized deal structures. For investors, private credit’s high yields remain attractive, especially compared to traditional fixed income investments, which continue to be hampered by low or even negative real returns.

A resilient macroeconomic backdrop in Europe, marked by moderate growth and lower interest rates, has so far supported solid performance in private credit portfolios. Many investors are betting that the relative insulation from public market volatility will continue to make private debt an appealing asset class.

A Critical Juncture Ahead

The crucial question is whether the current pace of private credit expansion is sustainable or if excess is creeping in. Some financial chiefs warn that the very innovations and flexibility that fueled the market’s growth could become its undoing if discipline is not maintained. There are calls for more robust risk assessment procedures, greater transparency, and possibly tighter regulatory oversight to avoid a situation where too much risk is concentrated in too few hands.

Key recommendations from industry watchers include:

- Stress-testing portfolios for downside scenarios and liquidity shocks.

- Improving transparency through voluntary reporting and disclosures.

- Avoiding “covenant-lite” loans that give lenders less protection in case of default.

- Encouraging regulators to monitor aggregate exposures, even if the sector lacks a single institutional regulator.

Conclusion

As private credit cements itself as a critical pillar of modern finance, striking a balance between innovation and caution will be essential. The lessons from previous waves of easy credit—most notably the financial crisis of 2008—should serve as a stark reminder. If unchecked exuberance overtakes prudent underwriting, the private credit market risks becoming less a sober source of capital and more a roll of the dice.

For market participants, the challenge is clear: harness the benefits of this dynamic sector, but don’t lose sight of the discipline that underpins lasting financial health. The coming year could reveal whether private credit will mature into a stabilizing force within the global economy, or if, as some fear, the casino is indeed open for business.