|

| Gold V.1.3.1 signal Telegram Channel (English) |

Largest U.S. Job Growth Revision in History Reveals Weaker Labor Market and Economic Concerns

2025-09-10 @ 00:00

The U.S. labor market has faced a significant reassessment following news that job growth was much weaker over the past year than initially reported. According to newly released data, government estimates of job creation from April 2024 to March 2025 were overstated by a striking 911,000 jobs. This adjustment, derived from the Bureau of Labor Statistics (BLS) annual benchmarking process, reflects just how much preliminary monthly jobs reports can diverge from reality before fuller data is processed.

Every year, the BLS revises its payroll employment figures to incorporate state unemployment insurance records as well as business births and deaths, which provide a more complete picture of the workforce. The revision aims to correct survey errors that accumulate in the monthly releases and to align estimates with more comprehensive data sources. This year’s downward revision is the largest on record, exceeding both economists’ forecasts and any recent adjustments. The annual benchmarking process, while routine, can have major implications for our understanding of the economy, policy discussions, and political discourse.

What caused such a dramatic shortfall in reported job growth? The gap reflects discrepancies between initial survey-based estimates and administrative data collected after the fact. Monthly jobs reports rely on two types of surveys—one of businesses (the establishment survey) and one of households—which are then revised as more granular, administrative data becomes available. This benchmarking process captures factors such as employer reporting errors, late-reporting firms, and newly recognized businesses.

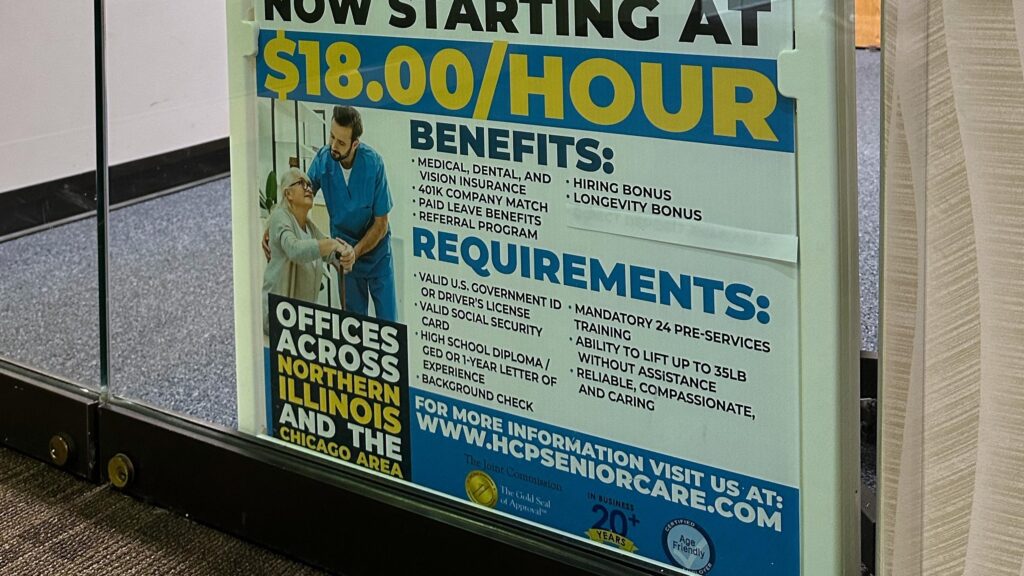

Over this most recent revision period, several sectors saw substantial downward adjustments. Industries within trade, transportation, and utilities were particularly impacted, with retail trade alone accounting for over 126,000 fewer jobs than previously reported, and transportation and warehousing shedding over 110,000 jobs from the initial count. Such reductions point toward broader weakness or caution in consumer spending and logistics—key sectors that can serve as economic bellwethers.

Beyond the technical details, the revision has important economic and political ramifications. For one, it means the labor market was significantly softer than first believed. Employment growth was already slowing in mid-2025, with August’s jobs report showing meager gains of just 22,000 jobs (a far cry from the robust monthly increases seen at the height of the post-pandemic recovery). These findings suggest the economy has lost some of its hiring momentum, raising concerns about overall growth, consumer demand, and how resilient businesses are to economic uncertainties.

The timing and scale of the revision have also fueled political scrutiny. Government labor statistics, while rigorously produced, are an ongoing point of debate. In this highly charged environment, the BLS has come under attack—most notably with the recent firing of its commissioner following a disappointing monthly jobs report. Critics allege, without concrete evidence, that jobs data revisions are susceptible to political influence. Economists, however, generally view benchmark revisions as a necessary process that improves the accuracy of labor statistics over time.

Why do these revisions matter so much? Investors, policymakers, and businesses rely on official job numbers to make decisions about spending, investment, and hiring. When estimates are significantly revised—especially downward—it can prompt reconsideration of economic health and appropriate policy responses. For households and workers, slower job growth may signal a tougher market, wage stagnation, and a drag on consumer confidence.

Looking ahead, the preliminary figure of 911,000 fewer jobs is not yet the final word. The BLS will publish a finalized benchmark revision early next year, further refining the numbers as more data arrives. Still, the magnitude of this correction offers a sobering reminder: Early reports are snapshots, not verdicts, and should always be viewed with an understanding that reality is often more complex, especially in a vast economy like the United States.

For financial observers and everyday workers alike, the lesson is that labor market trends can shift upon careful review, often revealing vulnerabilities that the fast-moving headlines miss. As the next few months unfold, watch for how these revised figures shape expectations, influence policy debates, and impact the real economy—especially as the nation weighs its economic direction in the coming year.