|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold and Silver Price Outlook October 2025: Key Support, Resistance, and Market Drivers Explained

2025-10-01 @ 20:00

Gold and Silver Outlook: Key Levels as Metals Consolidate in October 2025

Gold and silver markets are consolidating after an impressive rally in 2025, captivating traders and investors as both metals approach critical price levels. With macroeconomic uncertainty and shifting investment flows propelling price action, understanding what comes next requires close monitoring of technical boundaries and fundamental undercurrents.

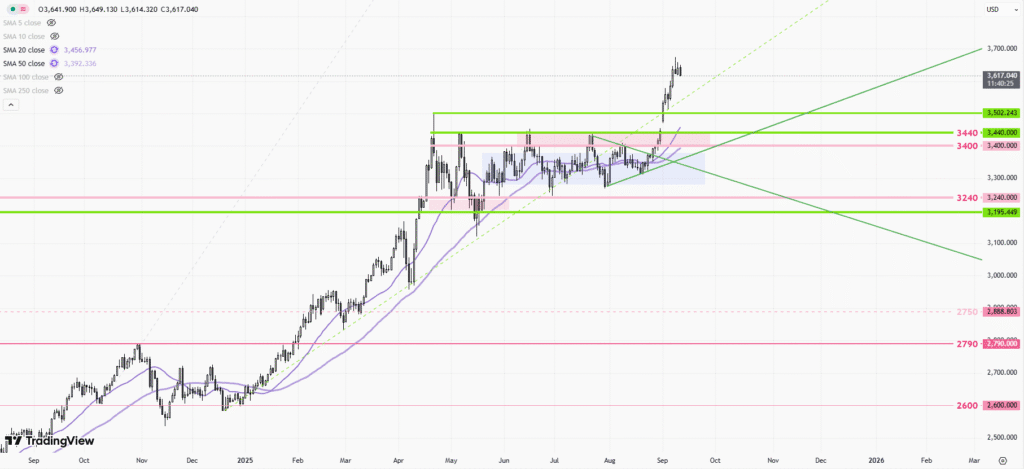

Gold Consolidates Near $3,864: Support and Resistance to Watch

Gold has surged this year, now trading around $3,864 per troy ounce. The short-term trend remains bullish, supported by upward pressure from asset buyers and positive signals from major moving averages. However, recent sessions show that gold is consolidating, hovering between clear levels of support and resistance that will likely define its next major move.

The immediate support zone to watch is near $3,845. Price action near this area is critical—should gold dip to or just below $3,845 and rebound, it may attract more buyers and resume its upward trajectory with a target above $3,955. Conversely, a decisive breakdown below the $3,805 mark would invalidate the bullish scenario, opening a path to further declines and a potential test of the $3,735 region.

On the upside, traders are eyeing the $3,885 resistance zone. A close above this level could accelerate bullish momentum, potentially paving the way for fresh highs in the coming sessions. Technical indicators, such as the relative strength index (RSI) and the structure of the current bullish channel, suggest that continued strength remains possible if support holds.

Silver Rally Shows Strength But Faces Key Tests

Silver has been one of 2025’s standout performers. Prices have advanced sharply, now trading around $46 per troy ounce at the end of September and notching year-to-date gains of approximately 40-50%. The rally has been fueled by a combination of factors: falling real yields, strong flows into silver ETFs, and robust industrial demand, especially from the solar and electronics sectors.

Investor flows into major ETFs, like SLV, have dramatically amplified silver’s momentum. These inflows represent a direct source of demand, often triggering additional upside when sentiment turns positive. Physical supply, meanwhile, remains tight—a factor that could sustain elevated price levels if demand persists.

Technical momentum remains strong for silver, but price action is approaching important resistance and consolidation zones. Should silver maintain its current tone and break through the $47.36 level, analysts anticipate the possibility of an extended move above $50 in the near term, driven by ongoing retail interest and ETF purchases.

However, silver’s longer-term path depends on how industrial demand growth stacks up against mine output and whether investment inflows remain robust. Any signs of supply easing or a shift in risk sentiment may spark corrections.

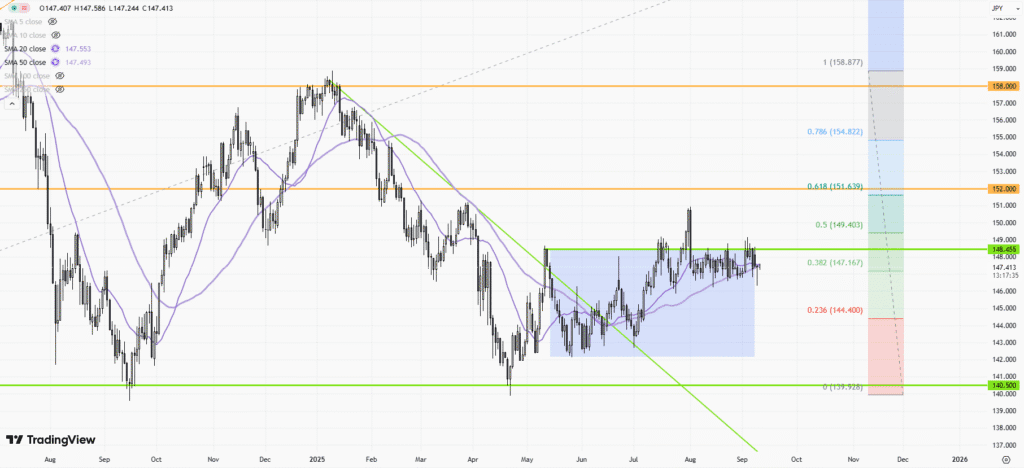

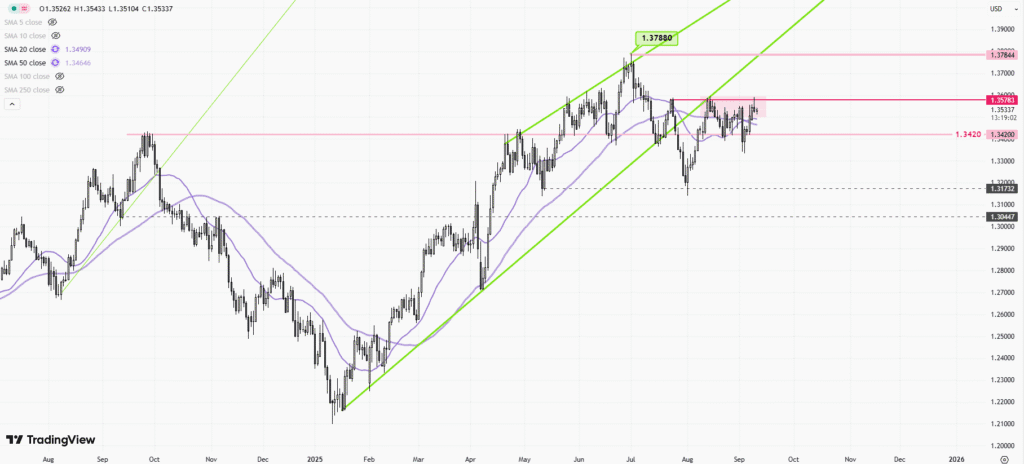

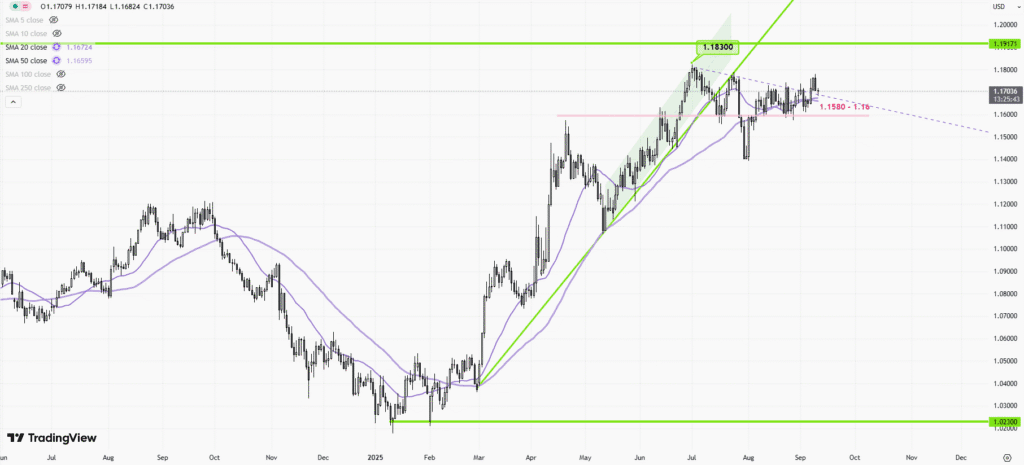

Market Themes Driving Precious Metals

Several macroeconomic dynamics are shaping the precious metals landscape as we enter the final quarter of 2025:

- Interest Rates and Real Yields: Lower real yields continue to benefit gold and silver, pushing investors towards hard assets as a hedge against inflation and financial volatility.

- ETF and Retail Demand: Surge in investment products tied to precious metals amplifies price moves, signaling robust interest across both institutional and retail segments.

- Industrial Use: In silver’s case, expanding demand in green technologies and electronics is a powerful tailwind, supporting prices above historical averages even as supply challenges persist.

- Technical Levels: Key price boundaries—like $3,805 and $3,885 for gold, and $47.36 for silver—will guide near-term trading and sentiment.

What Traders Should Watch

For those active in the precious metals market, several tactical considerations stand out as we move through October:

- Monitor gold’s behavior near $3,845. A bounce could trigger new highs, while a failure may signal a broader correction.

- Watch for silver’s ability to hold above $46. Sustained momentum above this level and a breakthrough of $47.36 could unleash further gains.

- Pay attention to ETF flows and industrial demand trends, as both are critical drivers of underlying market strength.

- Stay attuned to broader macro shifts, especially in global interest rates and inflation data, as policymaker actions could influence both gold and silver valuations.

Conclusion

Gold and silver have delivered exceptional returns in 2025. As prices consolidate near pivotal technical and fundamental levels, the next few weeks will provide crucial signals about where the metals are headed. Traders and investors should remain vigilant, watching support and resistance lines as well as flows and fundamentals. By understanding these dynamics, market participants can better navigate the volatility and capitalize on opportunities in the evolving precious metals landscape.