|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Price Drops Below $4,000 in 2025: Key Levels and What Investors Should Watch Next

2025-10-28 @ 02:01

Gold Price Drops Below Critical $4,000: What’s Next for the Precious Metal?

Gold is capturing headlines once again as it breaks below a significant psychological and technical barrier—the $4,000 price level. This decline is more than a round-number breach; it signals a notable change in sentiment and raises questions for traders and long-term investors alike. Let’s examine what’s driving this move, the key technical levels to watch, and what may come next for the gold market.

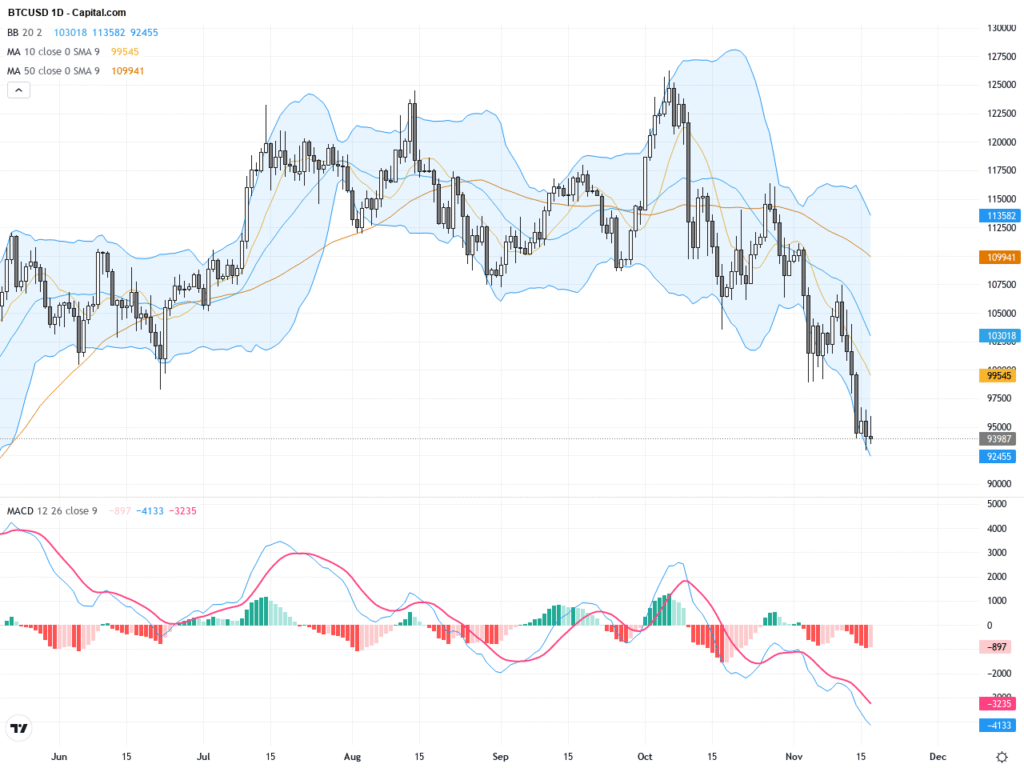

Persistent Downward Pressure and Technical Weakness

Gold has been under consistent negative pressure in recent trading sessions. The momentum shifted decisively toward the bears as the price fell below the $4,000 support zone, a level that historically acted as a strong floor for buyers. This has intensified bearish sentiment and reduced the likelihood of a near-term recovery.

One major factor contributing to this pressure is gold’s continued trading below its 50-period Exponential Moving Average (EMA50) on key timeframes. The EMA50 often acts as a dynamic support or resistance, and a sustained move below this line tends to reinforce existing downtrends. Until gold manages to reclaim this moving average, rallies may remain limited and short-lived.

Additionally, technical indicators are echoing the bearish tone. Relative strength indices (RSIs) have registered negative crossovers after working off previous oversold conditions, which suggests that sellers remain in control. This pattern is often seen before further declines, as it reflects an environment where even previous buyers are reluctant to offer support at current levels.

Why Did Gold Fall?

A combination of technical and fundamental drivers is at play:

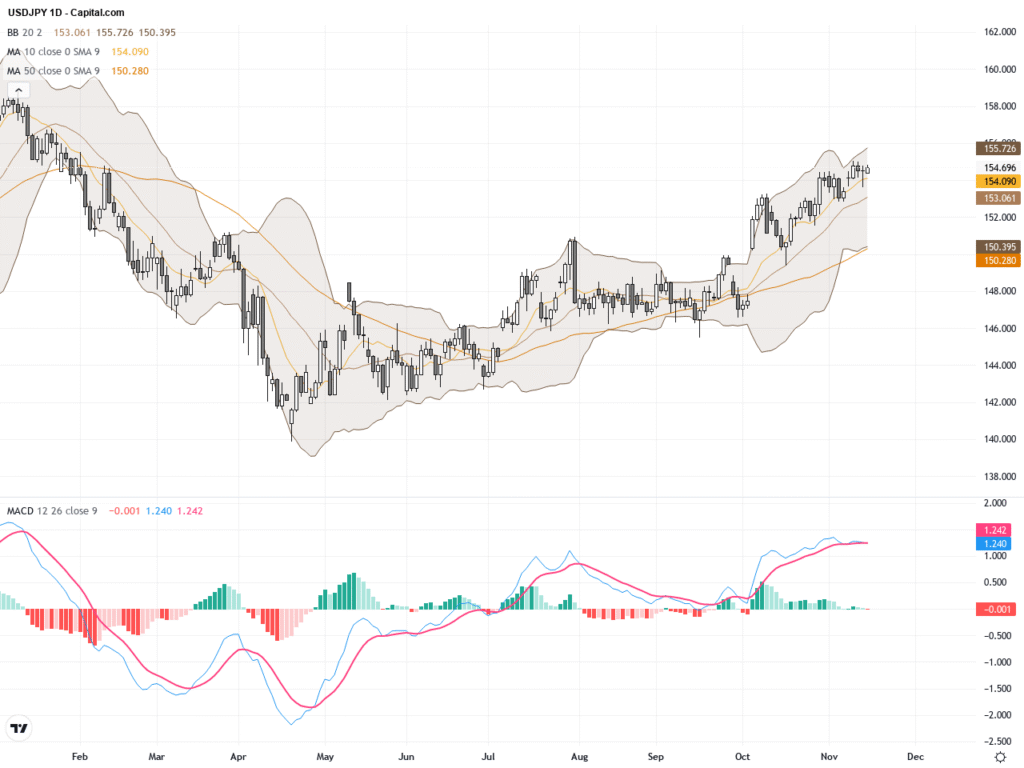

- Strength in the US Dollar: Gold often moves inversely to the dollar. Recent US dollar stability or strength tends to weigh on commodities priced in USD, adding downward impetus to gold.

- Interest Rate Expectations: Higher or persistent interest rates make holding non-yielding assets like gold less attractive. Shifts in policy signals from major central banks have also contributed to the current environment, limiting gold’s appeal as an inflation hedge.

-

Market Sentiment Shift: The breach of a major round number like $4,000 carries psychological weight. When such significant support levels give way, it can accelerate selling as technical traders and algorithms trigger additional sell orders.

Key Levels to Watch

While the breakdown below $4,000 is critical, traders are now monitoring new support and resistance areas:

- Immediate Resistance: The $4,000 level, which recently turned from support into resistance. Sustained trading below this figure may confirm the bearish trend and prompt further unwinding of long positions.

-

Next Support Zones: The market’s focus is shifting to the next major support areas, such as $3,950 and $3,900. The behavior of gold around these levels will be vital for near-term direction. If gold fails to find stability above $3,950, deeper declines toward $3,900 or lower could be on the cards.

-

Technical Indicators: Watch for signs of bullish divergence on momentum oscillators like RSI and MACD, which can sometimes foreshadow a reversal after rapid declines. However, until these indicators flash clear buy signals, caution is warranted.

Market Sentiment and Strategies

Market sentiment following this drop is understandably cautious. Many traders remain on the sidelines, awaiting clearer signals of a bottoming process or stabilization. For active traders, the focus is on identifying short-term entry levels and keeping stops tight in a volatile environment.

Long-term investors may see a potential opportunity emerging if gold continues to drop into oversold territory, especially if wider macroeconomic risks—such as geopolitical tensions or unexpected financial shocks—reemerge to support demand for defensive assets.

Short-Term Versus Long-Term Outlook

In the immediate term, the dominance of bearish corrective waves and technical weakness is likely to limit any meaningful rallies. Gold could face further selling pressure if it remains below the EMA50 and fails to quickly recover lost ground. That said, the market’s longer-term narrative—centered on gold’s inflation protection role, central bank buying, and diversification—remains unchanged. A sharp and sustained drop may eventually attract bargain hunters and strategic buyers, particularly if broader economic uncertainty resumes.

Final Thoughts

Gold’s move below the $4,000 mark represents a significant shift in the technical and psychological landscape for the yellow metal. While further declines are likely in the short term, the next few trading sessions will be critical in determining whether this is just a corrective phase or the beginning of a deeper bearish trend.

For traders and investors, maintaining discipline and closely monitoring key technical levels can provide both risk management and new opportunity amid the turmoil. As always, market conditions can shift rapidly—so stay alert, stay informed, and adjust strategies as new information emerges.