|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Price Rally 2025: Bullish Breakout Targets and Key Drivers for New All-Time Highs

2025-10-07 @ 20:01

Gold Analysis: Bulls Position for Historic Breakouts as Precious Metal Eyes New Records

Gold continues its impressive rally as we enter October 2025, with the precious metal trading at remarkable levels around $3,963.84. The yellow metal has demonstrated exceptional strength, gaining significant momentum over recent trading sessions and positioning itself for what could be historic breakout territory.

Current Market Dynamics

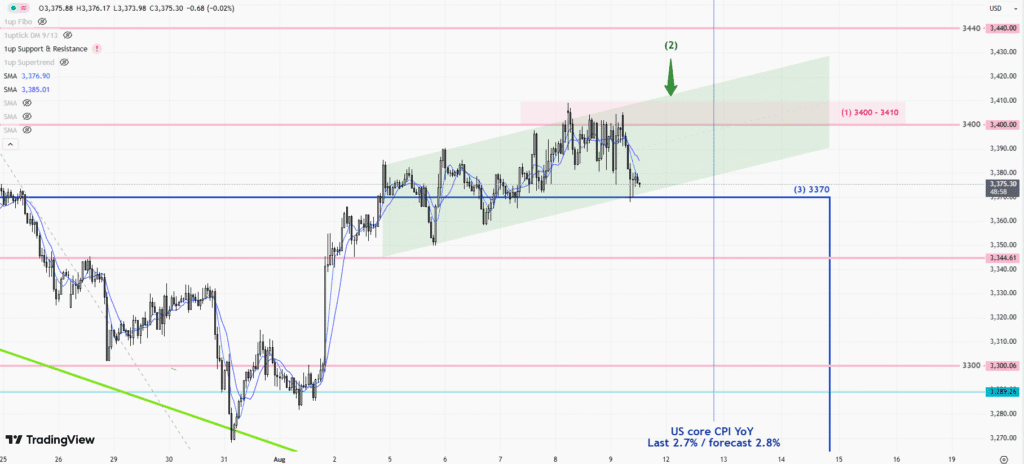

The gold market has experienced another exceptionally positive week, with bullish momentum showing no signs of abating. Technical indicators suggest that gold is maintaining its robust short-term uptrend, having successfully reached critical target zones between $3,970 and $3,986. This achievement marks a significant milestone, as the precious metal has now accomplished all previously identified bullish targets.

Market sentiment remains overwhelmingly positive for gold, with institutional and retail investors alike showing renewed confidence in the precious metal’s trajectory. The sustained upward pressure reflects broader economic uncertainties and monetary policy considerations that continue to favor gold as a safe-haven asset.

Technical Analysis and Price Action

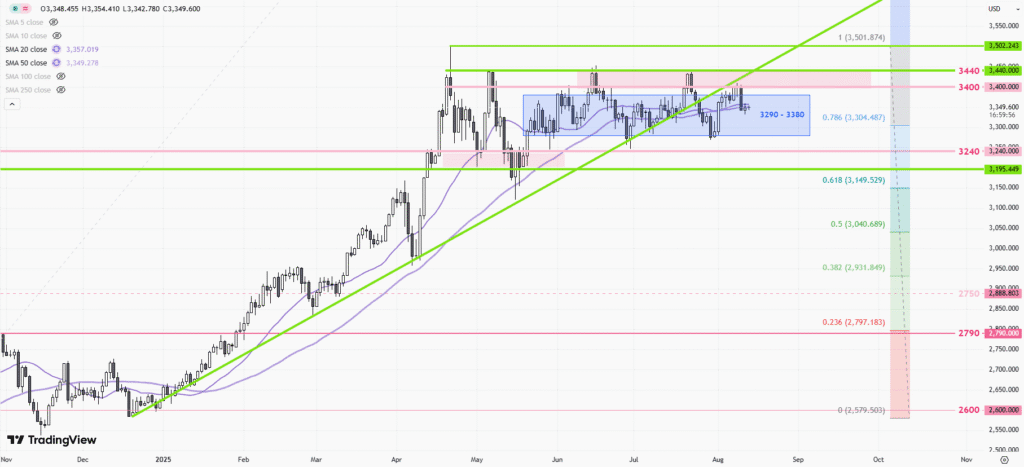

From a technical standpoint, gold’s chart pattern reveals a compelling bullish narrative. The price action has been characterized by consistent higher highs and higher lows, forming a textbook uptrend structure that technical analysts find particularly encouraging. The metal’s ability to break through previous resistance levels with conviction suggests strong underlying demand.

Key support levels have held firm throughout recent volatility, providing a solid foundation for continued upward movement. The breakout above the $3,970 threshold represents a crucial technical development that could pave the way for even more ambitious price targets in the coming sessions.

Volume analysis supports the bullish thesis, with increased trading activity accompanying price advances. This combination of rising prices and expanding volume typically indicates genuine buying interest rather than speculative froth, lending credibility to the current rally.

Fundamental Factors Driving Performance

Several fundamental factors continue to underpin gold’s strong performance. Central bank policies worldwide remain accommodative, with many institutions maintaining relatively dovish stances that tend to support precious metals. Additionally, ongoing geopolitical tensions and economic uncertainties have reinforced gold’s appeal among investors seeking portfolio diversification.

The precious metal has gained approximately 2.7 percent over the past week alone, reflecting the intensity of current buying pressure. This performance comes amid broader market volatility, highlighting gold’s role as a portfolio stabilizer during uncertain times.

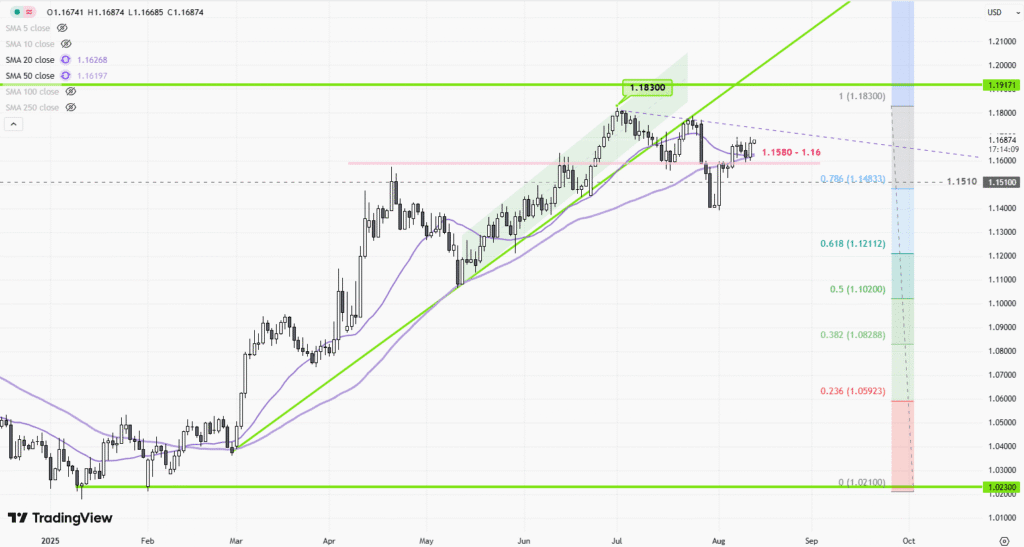

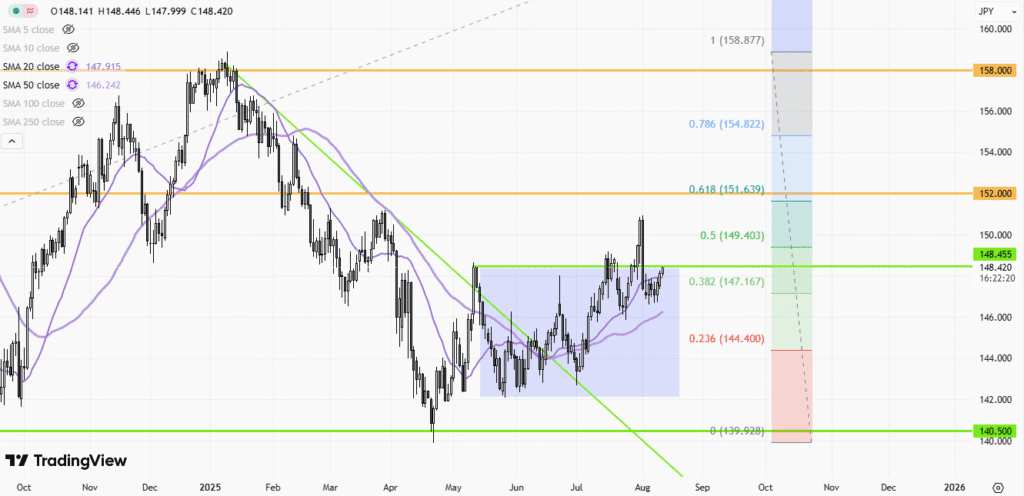

Currency dynamics also play a crucial role in gold’s pricing mechanism. Dollar weakness in certain periods has provided additional tailwinds for the precious metal, making it more attractive to international buyers and supporting overall demand.

Looking Ahead: Key Levels to Watch

As gold approaches historically significant price levels, traders and investors are closely monitoring several key technical markers. The ability to maintain momentum above the current support zones will be crucial for continued upside potential. Any sustained break above the $3,986 level could open the door to even more ambitious price targets.

Market participants are particularly focused on how gold responds to upcoming economic data releases and central bank communications. These events could provide the catalysts needed for the next phase of the precious metal’s journey, whether that involves consolidation at current levels or further breakout attempts.

Strategic Considerations for Investors

The current market environment presents both opportunities and challenges for gold investors. While the bullish momentum appears strong, prudent risk management remains essential given the precious metal’s elevated price levels. Investors should consider position sizing carefully and maintain awareness of potential volatility around key technical levels.

The confluence of technical and fundamental factors suggests that gold’s bull market may have additional room to run. However, markets rarely move in straight lines, and some degree of consolidation or pullback could provide better entry opportunities for those looking to establish or add to positions.

As we move through October, gold’s performance will likely continue attracting attention from across the financial spectrum, from individual investors to major institutions seeking exposure to this historically reliable store of value.