|

| Gold V.1.3.1 signal Telegram Channel (English) |

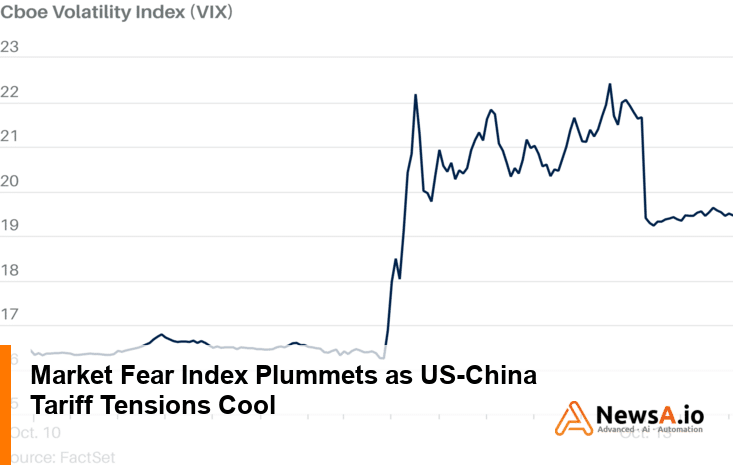

Market Fear Index Plummets as US-China Tariff Tensions Cool

Market Fear Index Plummets as US-China Tariff Tensions Cool

2025-10-14 @ 09:00

Investors cheered on Monday as the Cboe Volatility Index (VIX)—Wall Street’s widely tracked fear gauge—tumbled to as low as 16.3 for October 2025, marking some of the lowest volatility seen this year. This sharp move comes after President Donald Trump adopted a more conciliatory approach towards China, soothing investor concerns about escalating tariffs and trade tension.

The VIX, often called the ‘fear index,’ typically rises during periods of heightened uncertainty. When it falls below 20, markets are widely seen as stable and investor anxiety is considered low. After reaching panic levels above 80 during the 2020 pandemic, the current VIX levels reflect confidence returning to equities.

Recent data also points to steady US inflation and only mild moves in oil prices, even after recent global tensions. This stability, coupled with less severe tariff anxieties, has encouraged renewed inflows into US equities, with tech and consumer stocks leading gains.

However, experts advise caution. With the US presidential election campaign heating up and ongoing geopolitical uncertainties, volatility could rise again in the coming months. Investors should continue to monitor economic and policy signals and stay agile with their portfolios.