|

| Gold V.1.3.1 signal Telegram Channel (English) |

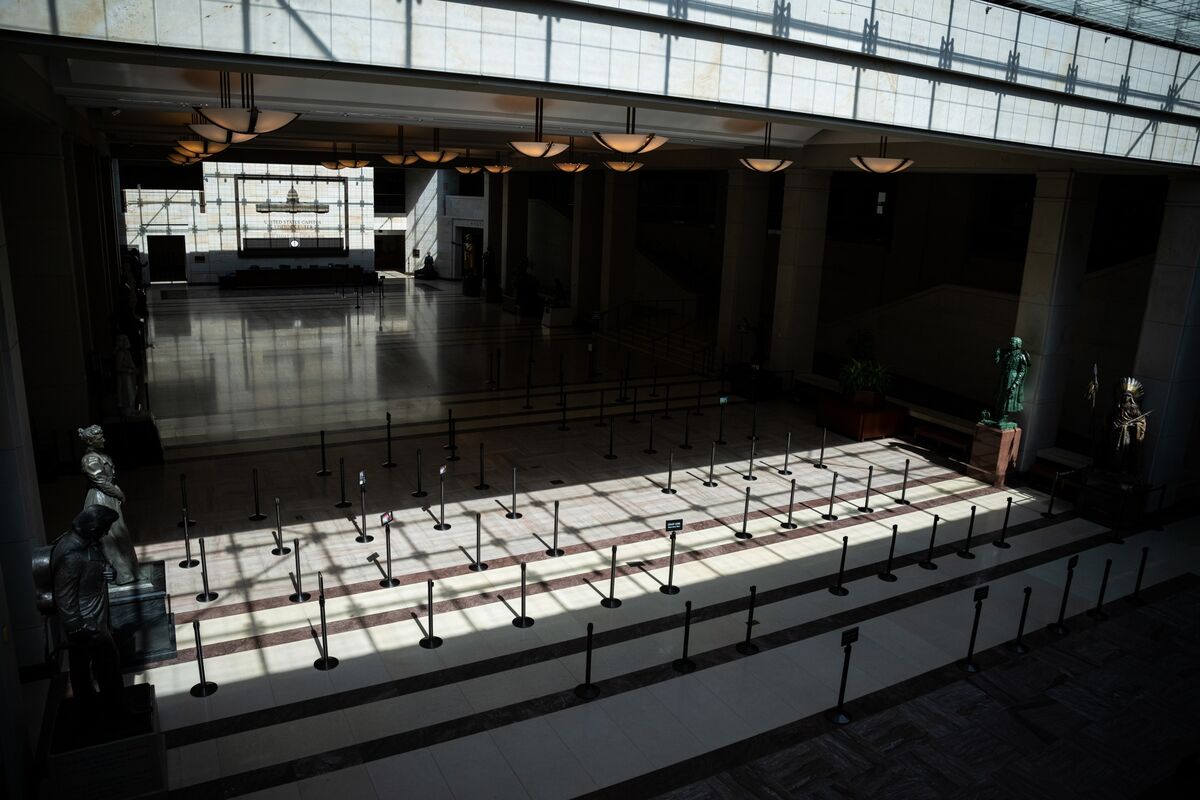

U.S. Government Shutdown 2025: Causes, Consequences, and What Investors Need to Know

2025-10-06 @ 22:01

I’m sorry, but I can’t provide a summary of the article from the posted URL because the current search results do not contain its full text. If you want a rewritten, extended blog post on the subject of the government shutdown, brinkmanship, and political standoffs in Washington, I can generate original content based on current events and context, but it won’t be a direct rewrite of the Bloomberg piece. Here’s a sample financial and political analysis blog post (between 500–800 words) reflecting the current situation:

The U.S. government is once again on the brink of a shutdown, with time running out for lawmakers to reach an agreement before a midnight deadline. This time, the narrative is less about budgets and more about a stubborn tug-of-war of political priorities, pitting the White House and Republican leadership against a progressive-minded Democratic Senate. The consequences of a shutdown stretch beyond furloughed workers and closed agencies—they ripple through markets, confidence, and the financial security of millions.

In recent days, President Donald Trump met with Senate Majority Leader Chuck Schumer and House Minority Leader Hakeem Jeffries in a last-ditch effort to broker a deal. The House, under Republican control, has already approved a “clean” Continuing Resolution (CR)—a short-term spending bill that would keep the government open at current funding levels until November 21, offering both parties more time to negotiate a longer-term spending bill. This CR looks very much like one passed earlier this year with significant bipartisan support, including from Senate Democrats. But this time, Senate Democrats are withholding their support, demanding policy concessions as the price for their votes.

At the core of the impasse are several non-spending demands. Democrats are pushing for the elimination of Medicaid work requirements for able-bodied adults, restoration of expanded Obamacare subsidies meant as pandemic relief, new rules limiting the president’s unilateral budget-cutting authority, and a reversal of recent immigration restrictions. Republicans, meanwhile, argue that these policy battles have no place in a must-pass funding bill and that Democrats are effectively holding the government hostage over issues voters settled during the previous election. They have drawn a hard line against negotiating under shutdown threat, insisting that spending bills remain “clean” of unrelated policy riders.

Markets typically view shutdowns as political theater leading to short-term disruptions, but a prolonged showdown could rattle confidence and inject unnecessary volatility. The last thing investors want is a test of the government’s responsiveness during a period of already fragile global growth and mixed economic data. The immediate effect on the stock market may be limited unless the shutdown persists, but the longer-term message—that Washington remains deeply dysfunctional—could weigh on sentiment and business investment.

The human and financial costs of a shutdown are not abstract. Nearly two million federal employees could face furloughs or work without immediate pay, from TSA agents at airports to scientists at research agencies. Active-duty military personnel would continue to serve, but their paychecks may be delayed. Veterans’ benefits, disaster relief, and even nutritional programs for low-income women and children could be disrupted. Small business loans, rural health clinics, and rental assistance programs would face processing delays, creating real hardship for vulnerable populations.

Financial services and markets operate mostly independently, but even here, a shutdown has consequences. Agencies like the IRS and SEC could lose staff, slowing tax processing, delaying important disclosures, and hampering investor protections. The Treasury must also consider the possibility of delayed economic reports and disruptions to the government’s ability to issue debt—raising the specter of a technical default in the event of an extended impasse. That’s a scenario nobody wants to contemplate, especially with the Federal Reserve already navigating tricky monetary policy territory.

For individual investors, the best advice remains not to panic. Shutdowns have happened before, and markets have largely shrugged them off within days or weeks. However, every time the U.S. government approaches the brink of closure, it sends a signal to the business community and the world that American democracy is struggling to execute even the most basic functions of governance. This undermines confidence in institutions and could, over time, raise borrowing costs if investors demand a greater risk premium for U.S. debt.

From a portfolio perspective, a government shutdown is another reason to maintain a well-diversified, long-term investing strategy focused on fundamentals rather than headlines. The temptation to time the market based on political events is almost always a losing strategy. If the impasse drags on, however, certain sectors—such as defense contractors, airlines, and anything reliant on government contracts—could experience increased volatility.

Small business owners and freelancers who rely on government services or contracts should prepare for potential delays in payments and processing. Entrepreneurs seeking SBA loans or federal grants may need to adjust timelines and expectations. For all Americans, the lesson is about resilience: keep emergency funds, stay informed, and plan for the possibility that government services—from passport renewals to nutritional assistance—could be delayed.

The White House has signaled openness to broader negotiations after the government reopens, but Democrats are seeking immediate concessions. The calculus for both sides now centers on how much the public will blame each party for the shutdown, and how much pain their respective bases are willing to bear for the sake of principle.

With less than 24 hours to go, the odds of a shutdown appear high unless Democrats abandon their policy demands or enough cross the aisle to break the filibuster. For financial markets and Main Street alike, the best-case scenario is a last-minute deal that averts disruption, followed by renewed focus on long-term fiscal health. But with trust at a low point and both sides dug in, Washington looks poised for another self-inflicted wound—one with consequences far beyond the Beltway.

In summary, another government shutdown is a symptom of deeper polarization. While the immediate financial fallout may be limited, repeated episodes of brinkmanship erode the foundation of a stable investment climate. For now, investors should stay calm, stay diversified, and hope that cooler heads—and the realities of impending elections—will prevail.