|

| Gold V.1.3.1 signal Telegram Channel (English) |

U.S. Government Shutdown 2025: Impact on Treasury Yields, Federal Reserve Decisions, and Market Volatility

2025-10-02 @ 20:00

U.S. Government Shutdown: A New Era of Uncertainty for Treasury Yields and Investors

The recent U.S. government shutdown, now in its initial days, has dealt a sharp blow to financial markets and investor confidence. What sets this shutdown apart is not merely the political gridlock—but the sudden blackout of crucial economic data. This loss of timely insight makes it significantly harder to assess the health of the U.S. economy, and it injects an unprecedented level of uncertainty into the decisions of the Federal Reserve and market participants.

Treasury Yields Face Whiplash

The shutdown immediately delayed vital economic reports, including the nonfarm payrolls and key inflation figures, both of which play a central role in guiding investor expectations for interest rate policy. With data streams from agencies like the Bureau of Labor Statistics halted, market participants and policymakers are effectively “flying blind.” Treasury yields, which reflect investor sentiment on economic growth, inflation, and Federal Reserve policy, have become especially volatile.

Recently, the 10-year Treasury yield hovered around 4.1%, showing muted activity as traders waited for clarity that never came. Short-term rates, meanwhile, have seen more pronounced swings due to competing expectations: some anticipate aggressive rate cuts if the economy falters, while others fear that a lack of data may force the Fed into inaction.

Federal Reserve’s Dilemma: Stimulus vs. Stability

The Federal Reserve, which began a rate-cutting cycle in September, faces a complex task. Signs of a slowing labor market suggest the economy needs fresh support, yet inflation remains stubbornly above target. Normally, the Fed would calibrate its response based on real-time data, but the shutdown has shut off these information channels. The central bank will have to rely on less comprehensive private-sector indicators such as credit card data, payroll provider reports, and retail company earnings. Unfortunately, these alternatives lack the scale and reliability of official figures.

Without a clear picture of labor market strength or consumer price trends, any decision the Fed makes at its upcoming meeting risks missing the mark. As a result, market volatility is likely to persist, with sharp moves in Treasury yields and equity prices as investors react to speculation rather than solid evidence.

Broader Market and Global Ripple Effects

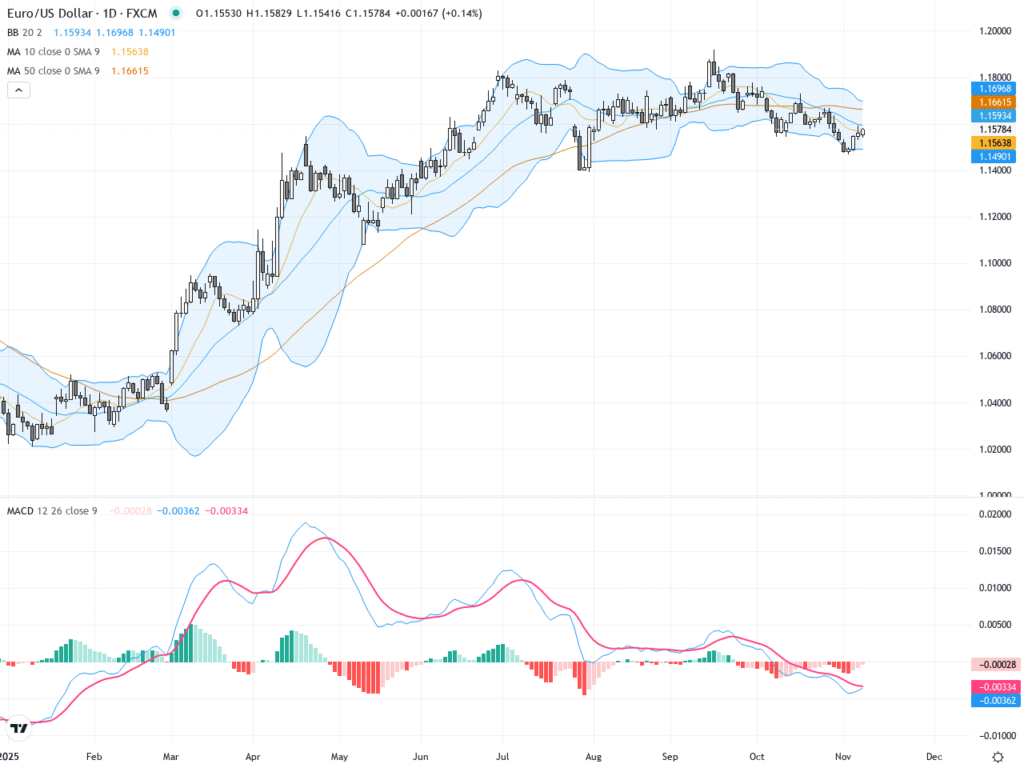

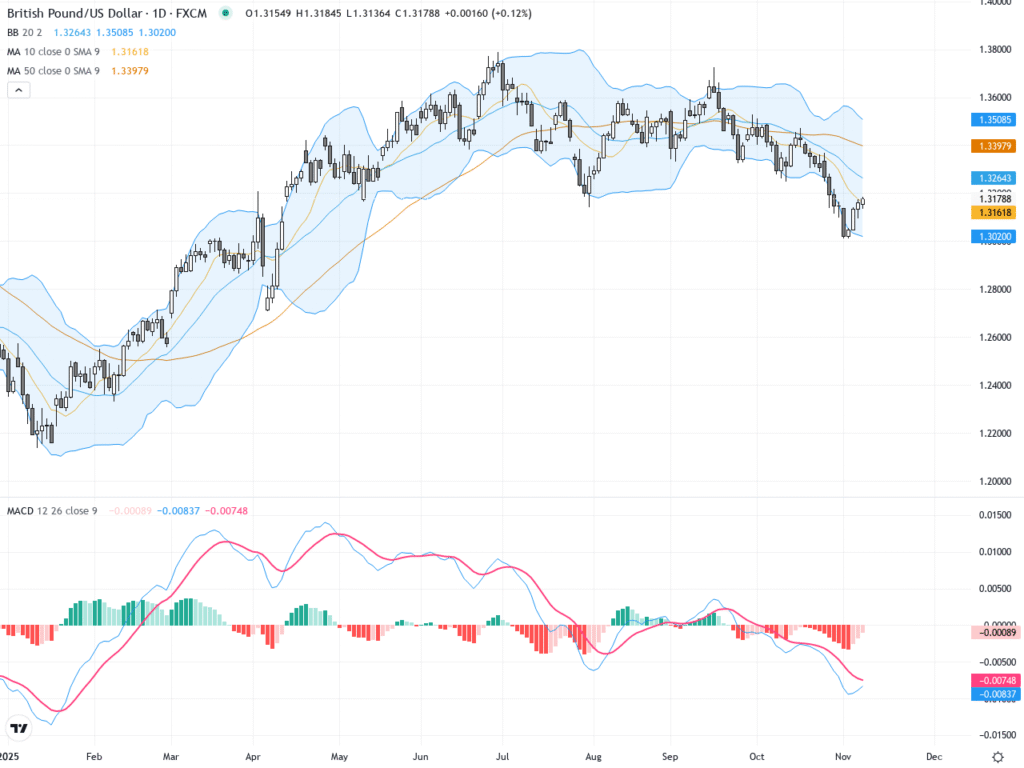

Market uncertainty is already manifesting in several ways. Expectations for rate cuts have increased, drawing down yields and boosting bond prices, but these moves rest on shaky foundations. If the Fed hesitates, yields could reverse course. The shutdown’s effects ripple well beyond domestic markets: countries like Canada, which often aligns monetary policy with the U.S., must now navigate without their usual signals. Globally, forecasts for U.S. growth are being downgraded, and investors are considering moves into alternate currencies such as the euro and Australian dollar.

The shutdown also impacts international trade, especially as U.S. government procurement slows. Sectors directly dependent on federal spending are seeing contracts deferred and payments delayed, adding another layer of risk for exporters and suppliers.

Corporate, Regulatory, and Social Disruptions

The shutdown’s impact isn’t limited to data flows or Wall Street. On Main Street, small businesses and large corporations are feeling pressure. Initial public offerings and energy project permits are on hold; IRS functions such as income verification have ceased, slowing mortgage and loan applications. The Small Business Administration can’t process new loans, leaving entrepreneurs stranded.

The public sector is equally affected: nearly three-quarters of a million federal workers are furloughed, and those labeled “essential” are working without pay. National parks and museums have shut their doors, tourism is declining, and crucial support programs—from nutrition assistance to veterans’ benefits—are interrupted. If the shutdown persists, these disruptions could begin to erode consumer confidence and spending—key drivers of U.S. economic growth.

Each week of a government shutdown typically shaves 0.1-0.2% off GDP growth. This episode is particularly perilous because the labor market is already showing signs of weakness, inflation remains a challenge, and agencies have signaled that some job cuts could be permanent rather than temporary—a stark shift from previous shutdowns.

What Should Investors Watch Next?

In the coming weeks, all eyes will be on the Federal Reserve’s October policy meeting and any signals around interest rates. Without authoritative government data, expect increased reliance on private indicators and, consequently, wider margins of error in forecasts. Market moves may be exaggerated as traders weigh each fragment of news and rumor.

For investors, caution is paramount. Diversification—both by asset class and geography—offers some protection in this uncertain environment. Perhaps most importantly, remember that volatility breeds opportunity as well as risk. Those able to adapt their strategies to rapidly changing conditions may fare best, but now more than ever, preparation and flexibility are essential.

The longer the shutdown lasts, the deeper the economic and financial repercussions could run. Missing data is no mere inconvenience; in a world where precision and timing matter, it’s an obstacle that could reshape the path of the U.S. recovery.