|

| Gold V.1.3.1 signal Telegram Channel (English) |

“US Dollar Volatility: How Political Uncertainty and Economic Data Surprises Are Impacting the Global Currency”

2025-10-03 @ 00:01

The U.S. dollar experienced significant volatility this week, driven by a combination of political uncertainty, economic data surprises, and a government shutdown that rattled financial markets. After several sessions of consecutive losses, the dollar’s decline accelerated, raising concerns among investors about the near-term outlook for the world’s reserve currency.

Recent data shows the dollar index (DXY), which measures the greenback’s value against a basket of major world currencies, hovering around 97.7 after four straight sessions in the red. This marks a drop of 0.08% from the previous day and a decline of nearly 0.5% over the past month. Over the last year, the dollar has weakened by more than 4%, reflecting shifting economic and political dynamics both in the U.S. and globally.

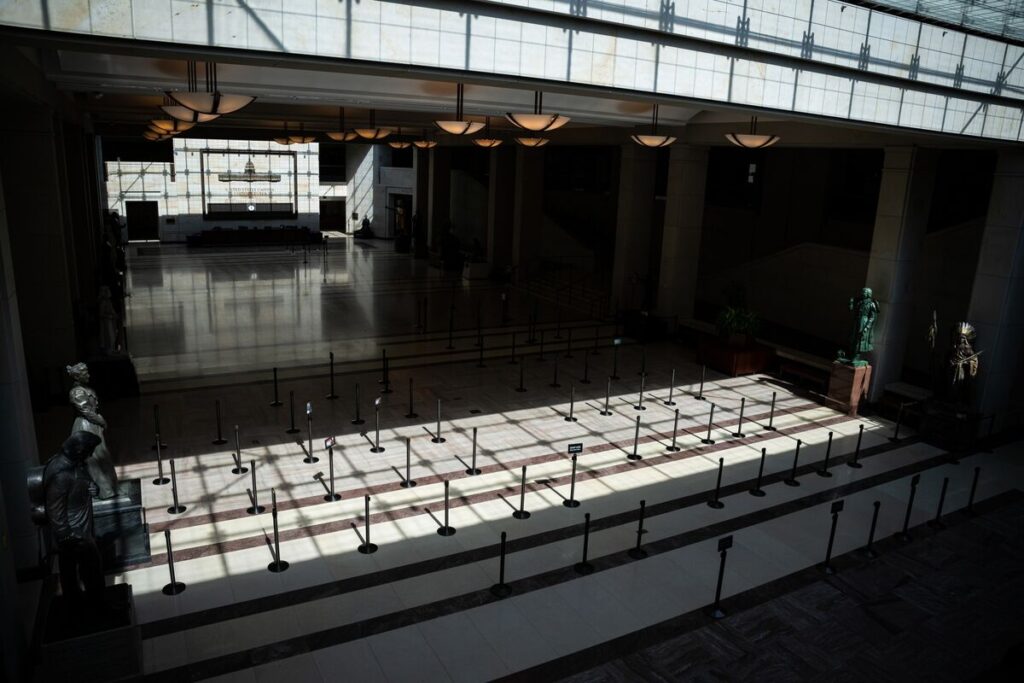

One of the main drivers of the recent slide was the first U.S. government shutdown in nearly seven years, which began after Congress failed to reach an agreement on a temporary funding measure. Markets generally dislike the uncertainty created by a shutdown, and this event is no exception. As federal agencies remain shuttered and government workers go unpaid, the functioning of key parts of the U.S. economy is disrupted. Importantly for financial markets, the shutdown has led to delays in the release of crucial economic data, including the highly anticipated September nonfarm payrolls report. This leaves investors with less clarity, increasing risk aversion and putting downward pressure on the dollar.

Compounding these issues, the latest jobs data revealed unexpected weakness in the labor market. Private payrolls, as measured by ADP, fell by 32,000 in September—well below expectations for an increase of 50,000 jobs. The report attributed part of the miss to data adjustments tied to missing information in the Quarterly Census of Employment and Wages, yet the result still points to softer-than-expected labor market conditions. Weak jobs data often leads investors to question the strength of economic growth and can cause them to adjust their expectations for monetary policy, typically resulting in a weaker currency.

Political developments have also weighed heavily on market sentiment. The Supreme Court has scheduled a high-stakes hearing regarding President Donald Trump’s attempts to remove Federal Reserve Governor Lisa Cook. The controversy was fueled by Trump’s public accusations against Cook and his calls for the central bank to cut interest rates more aggressively. This has raised fresh concerns about the independence of the Federal Reserve, an issue that is closely watched by global investors. Any perception that the central bank could be subject to political pressure tends to undermine confidence in the dollar and U.S. financial assets.

Looking ahead, the dollar faces several headwinds. Analysts expect the dollar index to edge lower to around 96.6 by the end of the current quarter, reflecting continued market worries about U.S. fiscal stability and economic momentum. Over the next twelve months, however, forecasts suggest the dollar could rebound to above 102, but much will depend on how quickly the government resolves the shutdown, how labor market data evolve once full reporting resumes, and whether the Federal Reserve can maintain its credibility and independence amid the political drama.

For global investors, a weaker dollar has broad implications. On the one hand, a declining greenback can provide a boost to U.S. exporters by making American goods cheaper overseas. On the other hand, it can exacerbate inflationary pressures by raising the cost of imports. For emerging markets, a softer dollar often reduces the burden of dollar-denominated debt and supports capital inflows, though the benefits can be offset if global uncertainty remains high.

In the near term, market participants are likely to remain cautious. The government shutdown could persist if political gridlock continues, keeping critical economic data out of reach and prolonging uncertainty. Meanwhile, the labor market’s sudden soft patch adds to concerns that the U.S. economy might be losing steam just as political battles intensify. Against this backdrop, currency markets will be paying close attention to any signs of movement in Washington, as well as to statements from Federal Reserve officials about their next policy steps.

Overall, the dollar’s recent slide is a direct reflection of the mounting political and economic challenges facing the United States. As events unfold, investors will need to remain nimble, watching for shifts in government policy and central bank decisions that could shape the dollar’s path in the months ahead.