|

| Gold V.1.3.1 signal Telegram Channel (English) |

US Economy: Storm Clouds Gather as Tech Stocks Soar

US Economy: Storm Clouds Gather as Tech Stocks Soar

2025-10-12 @ 09:00

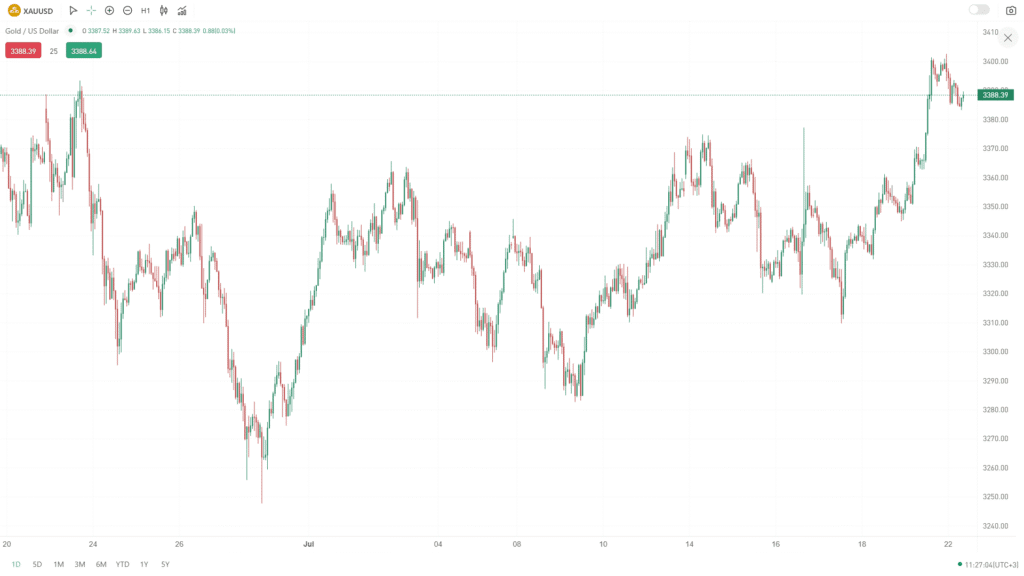

In 2025, the US economy appears robust with tech stocks—driven by AI, semiconductors, and cloud computing—leading Wall Street to fresh records. However, underneath this boom, economists warn of significant headwinds that could shake investors’ confidence.

Trade policy shifts and elevated tariffs are driving up consumer prices, putting pressure on household spending. Real consumer spending growth is projected to slow from 2.1% in 2025 to 1.4% in 2026. With immigration rates dropping, population and aggregate demand growth are also likely to decelerate.

Most notably, America’s recent economic strength relies heavily on the tech sector. Experts stress that if tech investments lose momentum—even briefly—GDP growth could dip below 1% and tip the economy closer to recession. While businesses continue to bet heavily on emerging technologies, wage gains are moderating and unemployment is expected to reach 4.5% in 2026.

Still, the innovation cycle remains strong. Corporate America is charging ahead with AI and other investments, likely cushioning the deceleration in consumer-driven growth. Whether the economy weathers the storm will largely depend on the resilience of tech investments and wise policy tweaks.

For investors, this climate calls for diversified strategies. While big tech remains attractive, allocating to defensive sectors and global markets can help balance risk. The US economic outlook remains a mix of threats and opportunities—agility and caution will be key over the next 12 months.