|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Prices Surge to Historic Highs in 2025: Key Drivers, Technical Outlook, and Investor Insights

2025-11-26 @ 02:01

Gold prices have been on a remarkable journey through 2025, captivating both everyday investors and seasoned traders. After shattering records in October by breaching $4,300 per ounce, gold remains a focal point of the financial markets as it searches for direction in late November, hovering near the $4,133 level. This environment of elevated prices, coupled with underlying uncertainty, has left traders and investors asking: What’s driving the current price action, and where might gold go next?

Why Has Gold Rallied in Late 2025?

Several factors have converged to push gold to historic highs. Chief among them is speculation that the U.S. Federal Reserve will begin cutting interest rates in response to cooling inflation. Lower rates generally weaken the U.S. dollar and reduce the opportunity cost of holding non-yielding assets like gold, making it more attractive to investors. Alongside monetary policy shifts, ongoing geopolitical tensions—such as the persistent Russia-Ukraine conflict and instability in the Middle East—have amplified gold’s appeal as a safe-haven asset during times of uncertainty.

Another significant driver has been sustained demand from central banks around the world. In 2025, central banks are projected to acquire more than 900 tons of gold, surpassing the levels seen in jewelry and technology sectors. This institutional interest helps establish a firm floor under gold prices and can create upward pressure when other market conditions align. It also serves as a long-term vote of confidence in gold’s role as a hedge against currency fluctuations and economic instability.

Technical Analysis: Levels and Patterns to Watch

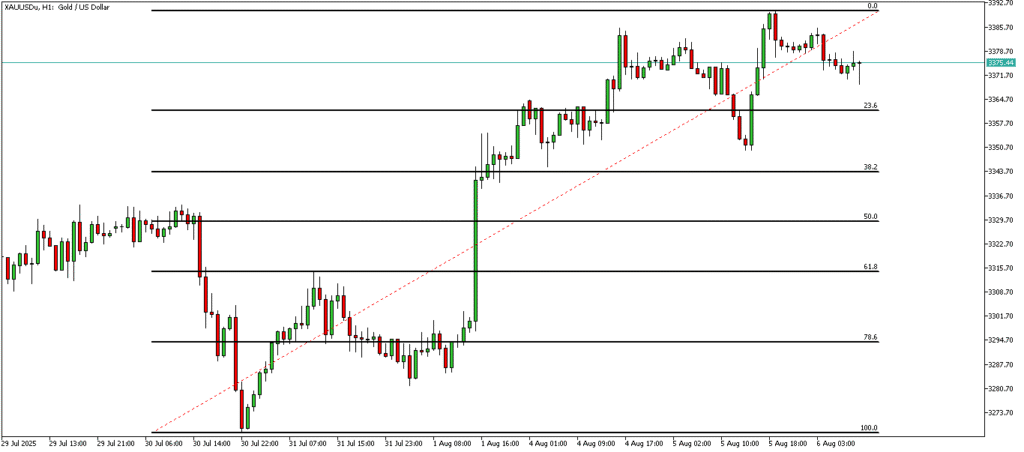

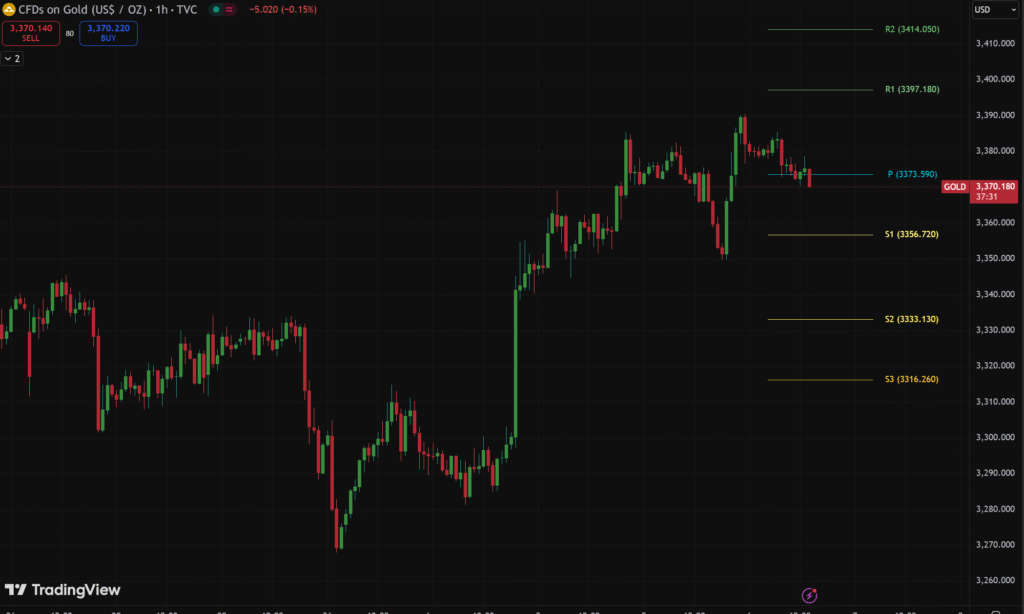

Looking at the charts, gold’s price action has recently formed what technical analysts refer to as a “bull pennant” pattern—a consolidation phase following a sharp rally that often signals potential for further upward movement if resistance is broken. The current trading range has been between $4,046 and $4,145, suggesting a period of market indecision but with underlying bullish momentum. The all-time high remains at $4,379, set in mid-October.

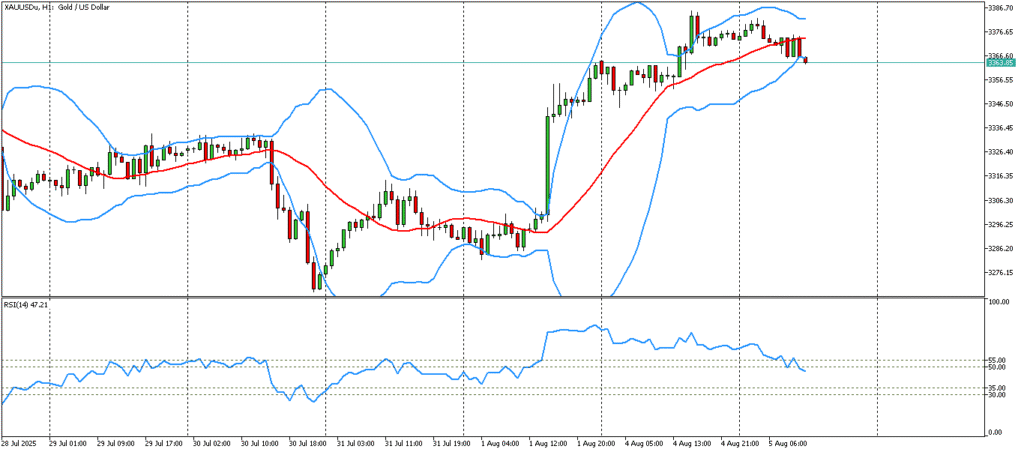

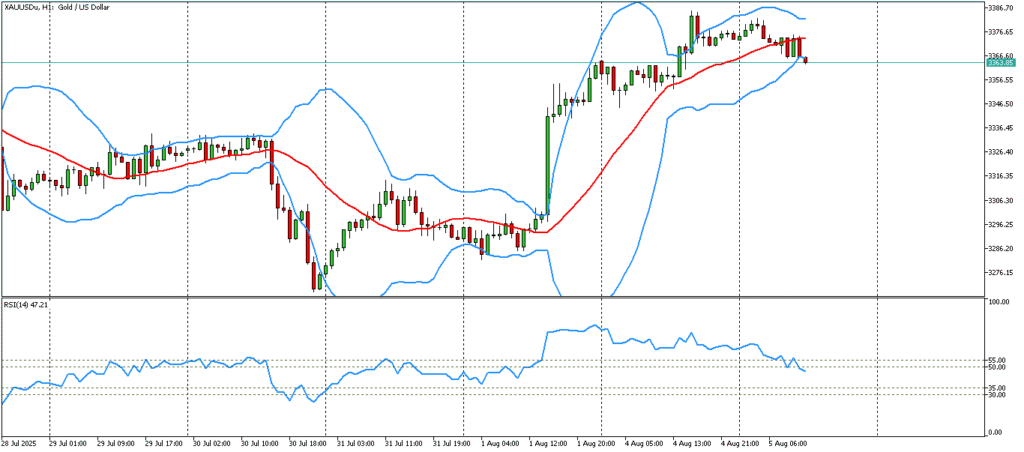

One key technical level to monitor is the $4,360 resistance zone. If buying pressure intensifies and gold decisively breaks above this mark, an influx of momentum-driven traders could drive prices to new highs. However, with the Relative Strength Index (RSI) climbing sharply to around 77, there are also warning signs that the market may be approaching overbought territory. This could prompt some traders to take profits and trigger short-term pullbacks, even as the longer-term trend remains positive.

Short-Term and Long-Term Outlooks

In the near term, analysts expect gold’s narrative to revolve around further central bank activity, the pace of U.S. interest rate changes, and developments in key geopolitical hotspots. Volatility is likely to remain elevated as the market reacts to economic data and policy announcements. Should inflation cool more rapidly or diplomatic breakthroughs emerge in global conflict zones, gold could see corrective movements. On the other hand, any flare-up in tensions or unexpected economic shocks can quickly reignite demand.

Longer-term expectations appear bullish. Persistent inflation pressures, widespread debt concerns, and uncertainty about global growth prospects provide a strong fundamental backdrop for gold. Analyst forecasts for the remainder of 2025 suggest gold could continue to test higher levels, with projections ranging from consolidation around the $4,100-$4,200 zone to potential moves closer to the $4,500 mark if bullish catalysts persist.

Practical Considerations for Investors

Given the recent 58% year-to-date gain in gold prices—from approximately $2,600 at the start of the year—investors should consider reviewing their asset allocations to ensure their gold exposure still aligns with their overall risk preferences. While gold remains a trusted store of value and a hedge against uncertainty, its rapid ascent also means that short-term corrections are possible as the market digests gains.

For traders, watching key technical levels and momentum indicators will be critical for navigating near-term volatility. For longer-term investors, a diversified portfolio that includes gold can help buffer against macroeconomic uncertainties and currency swings.

Conclusion

The current phase of the gold market highlights the metal’s enduring allure during times of uncertainty and its capacity to reach new highs when structural and cyclical factors align. As central banks accumulate reserves, monetary policy pivots, and geopolitical risk remains a fixture, gold stands out as both a tactical and strategic asset for the foreseeable future. Investors and traders alike will continue to watch closely as gold charts its path in the final weeks of 2025.