|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Rally Surges Past $4,100: Key Drivers, USD Impact, and What Investors Should Expect Next

2025-11-20 @ 02:00

Gold’s Recent Rally: A Closer Look at What’s Driving the Surge

Gold has climbed beyond $4,100 per ounce, surprising many investors and sparking a fresh wave of interest in the precious metals market. This surge comes amid volatile trading conditions, dominated by a “risk-off” sentiment as global uncertainties push investors toward safe havens. But while the current price action looks impressive, underlying market dynamics suggest that gold’s rally may be facing significant headwinds in the near term.

Why Gold Is Rallying Now

The run-up in gold prices is closely linked to a cautious atmosphere in global markets. Investors have been reducing exposure to riskier assets, favoring defensive plays such as gold amid geopolitical tensions and fluctuating economic data. Historically, gold shines brightest during periods of uncertainty, serving as a hedge against currency devaluation and systemic risks.

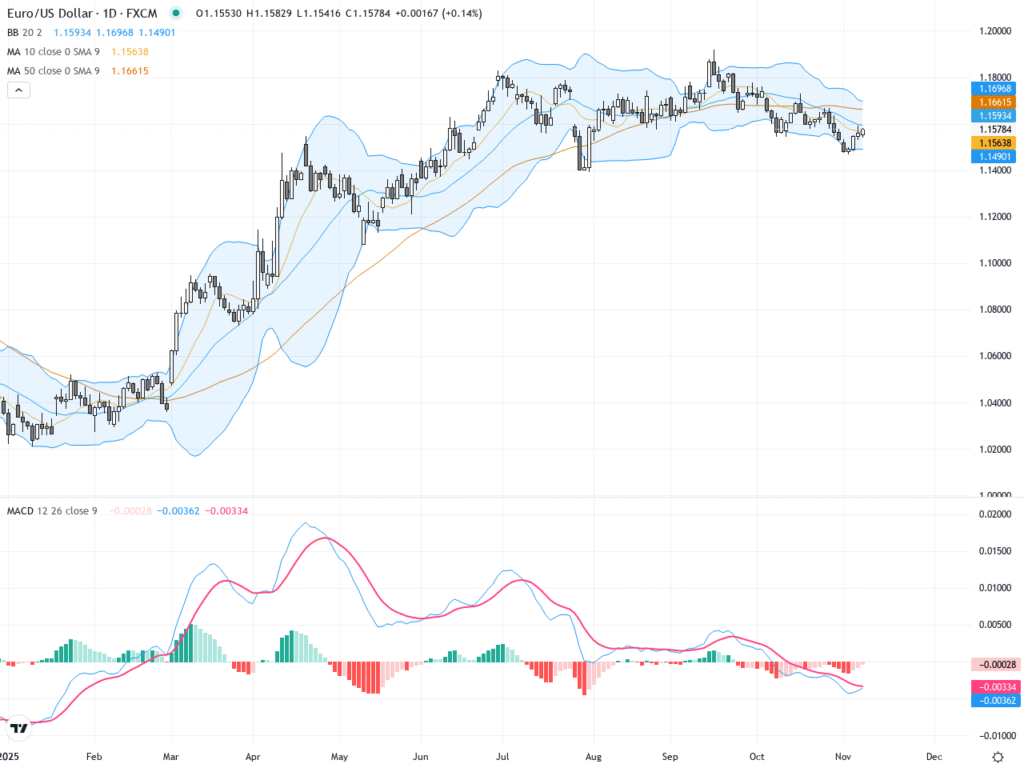

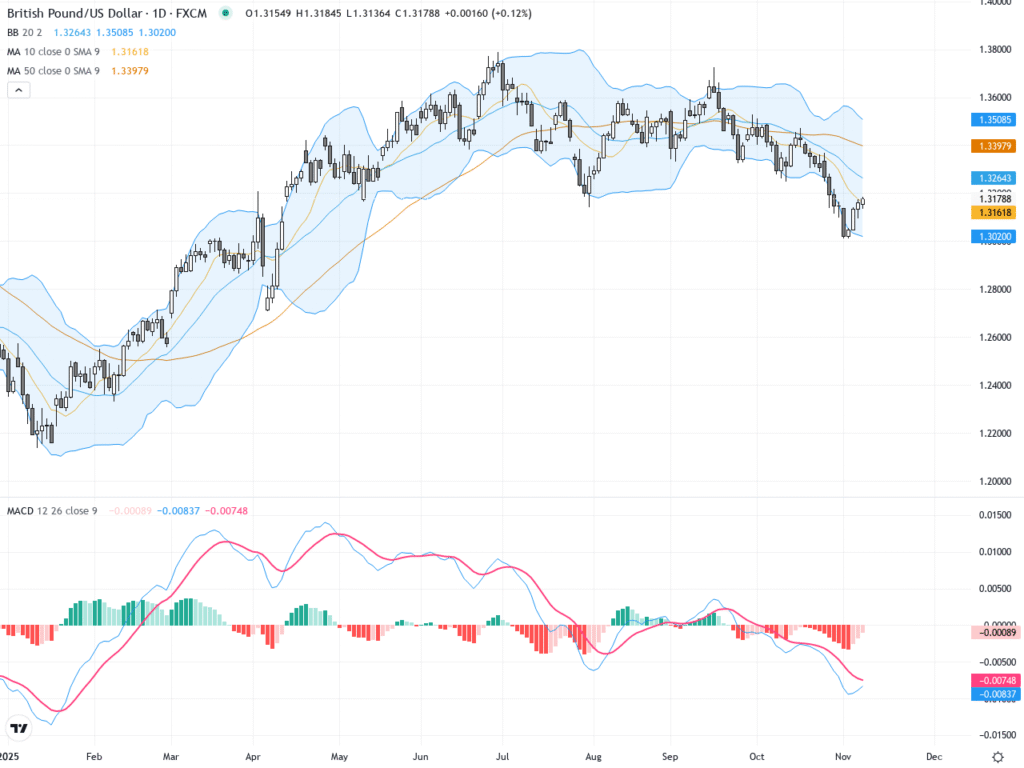

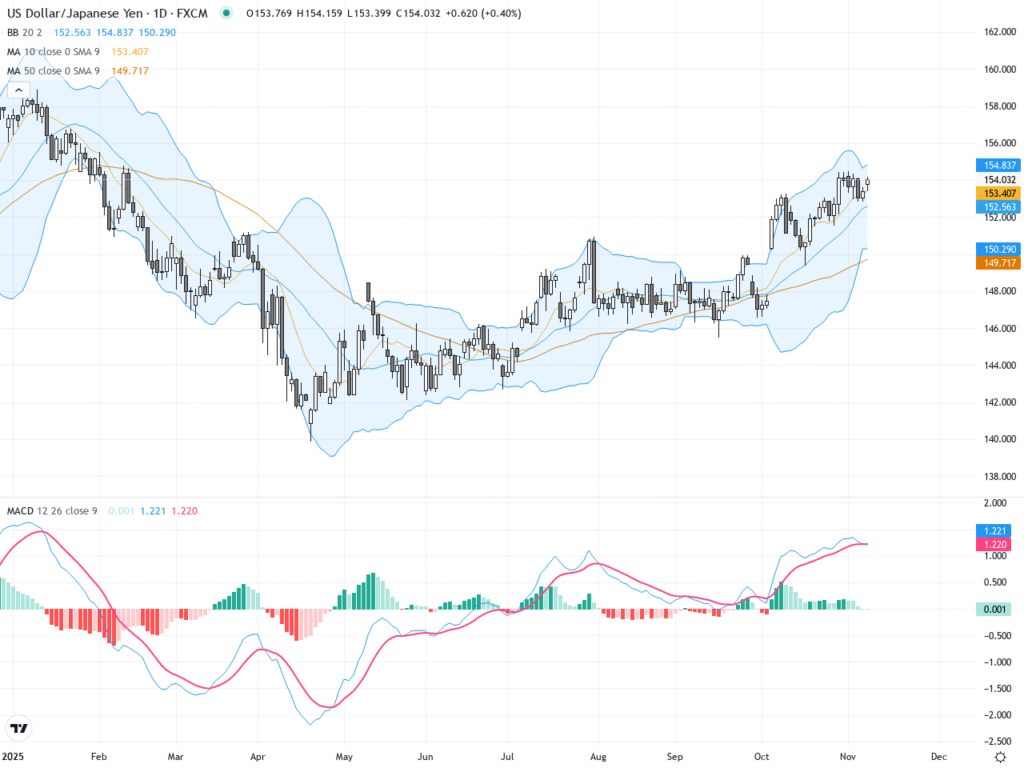

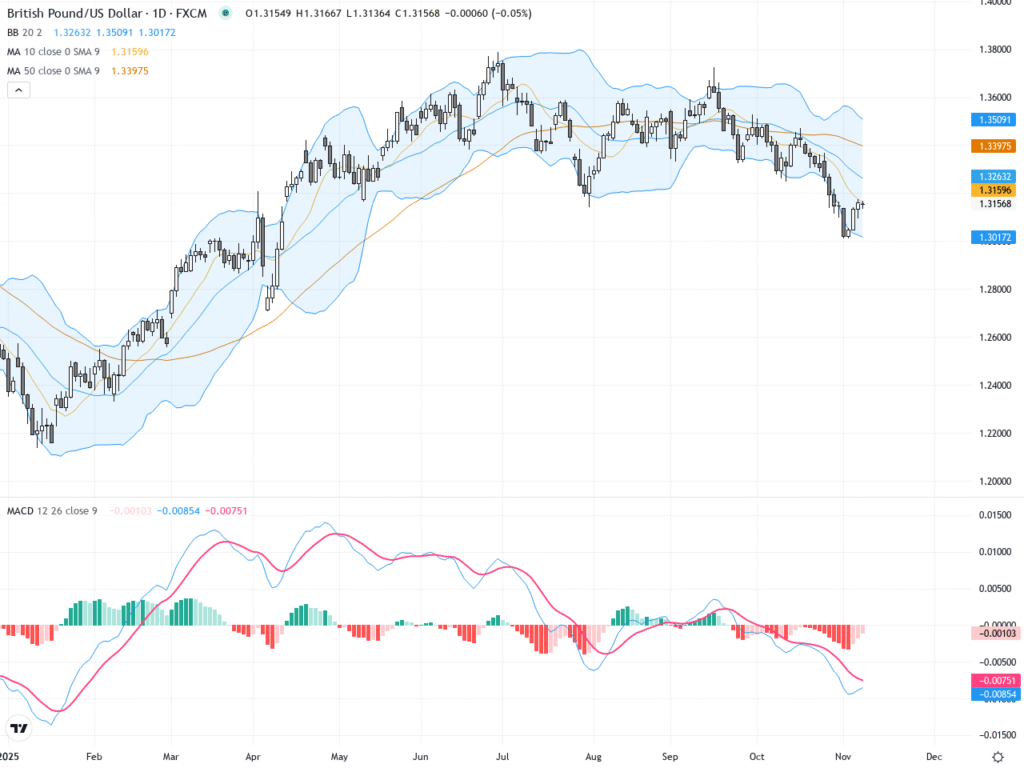

However, the recent upswing also coincides with important movements in currency markets, particularly the US Dollar Index (DXY). Several months ago, the perception of US dollar weakness helped fuel gains in the precious metals sector. Now, with the dollar rebounding decisively and breaking above key resistance levels, a potential turning point is emerging that could affect gold’s trajectory.

The Role of the USD Index

The USD Index’s recent rally is a critical factor to watch. As it climbs toward the important 100 threshold, breaking previous resistance lines, its strength typically exerts downward pressure on gold prices. This inverse relationship is rooted in gold’s status as a dollar-denominated asset: when the dollar strengthens, gold tends to become more expensive for holders of other currencies, reducing demand and triggering corrections.

Currently, the dollar’s comeback has not yet translated into an immediate decline in gold prices. Gold is taking a breather after a brisk short-term drop, with many investors still unconvinced about the durability of the USD rally. If the dollar continues to gain momentum, however, it could add fuel to the bearish sentiment already present in the precious metals sector.

Market Signals: Correction or Continuation?

Technical indicators point to a market in transition. While gold and silver prices have remained relatively firm in the face of the USD breakout, this may reflect lingering skepticism rather than genuine strength.

Notably, silver recently completed a classic correction at the 38.2% Fibonacci retracement level, setting the stage for a potential rebound. Meanwhile, mining stocks—which often lead moves in the broader precious metals market—have exhibited a pattern of upward thrust followed by sharp reversals, echoing conditions seen before previous declines.

Broader Market Implications

The impact of currency swings isn’t confined to precious metals alone. Bitcoin, often touted as “digital gold,” has shown cracks beneath the surface. The cryptocurrency recently broke below its rising support line, with the latest upswing interpreted as a mere confirmation of this breakdown. Looking ahead, interim support around $70,000 is expected, but the longer-term outlook remains precarious if risk aversion intensifies further.

Short-Term and Long-Term Gold Forecasts

Looking towards November and beyond, forecasts for gold prices are mixed. Algorithmic predictions suggest that gold may pull back, with estimates pointing to levels near $4,016 by the end of the month. This implies a modest correction, particularly if the dollar’s resurgence continues to influence market sentiment.

Historical price data reinforces the narrative of heightened volatility. Gold has climbed over 50% in the past year, reaching an all-time high in October. But the recent month has seen a notable pullback, reflecting the ongoing tug-of-war between bullish and bearish forces.

What Should Investors Watch Next?

For investors, the key to navigating this environment lies in monitoring central bank policy, currency fluctuations, and risk sentiment across global markets. The direction of the USD Index is likely to remain the primary driver for gold in the coming weeks. If the dollar solidifies its breakout and pushes decisively past the 100 mark, expect further downside in precious metals and related assets.

On the flip side, any signs of renewed dollar weakness or escalating risk in equity markets could reignite gold’s rally, offering a second wind for the sector. As always, diversification and risk management remain essential, as corrections in one segment can swiftly ripple through portfolios.

In conclusion, gold’s impressive rally above $4,100 is a testament to its enduring allure in times of uncertainty. But with currency markets in flux and technical signals flashing caution, investors should brace for potential reversals and remain vigilant for the next big move in this ever-changing landscape.