|

| Gold V.1.3.1 signal Telegram Channel (English) |

USDCAD: Faces Strong Resistance at 1.4150, Technical Pressure Brewing

2025-12-02 @ 08:01

The US dollar against the Canadian dollar has experienced significant downward pressure over the past 24-48 hours, reflecting a market repricing of expectations for a Federal Reserve rate cut in December. USD/CAD slipped from yesterday’s closing price of 1.40004 to a four-week low of 1.3937, representing a decline of approximately 0.17%, signaling sustained bearish momentum. The core drivers of this decline stem from two key factors: first, market traders are increasing their bets on a potential Federal Reserve rate cut in December, which weakens the US dollar’s appeal; second, Canada’s robust third-quarter GDP data—growing 2.6% year-over-year, far exceeding market expectations of 0.5%—has significantly boosted demand for the Canadian dollar and accelerated the US dollar selloff. The Canadian dollar has performed strongly over the past week, appreciating approximately 0.9%, marking its best performance since May.

For the average investor, this amounts to a “double punch” scenario: weakening Fed rate cut expectations diminish the US dollar’s attractiveness as a high-yield currency, while Canada’s solid economic data provide fundamental support for the Canadian dollar. On the technical side, USD/CAD has confirmed a break below the critical 1.4050 support level, currently establishing a new local support near 1.3937. According to technical analysis, if the US dollar against the Canadian dollar continues to decline, the next target will point below 1.3465. However, if the US dollar rebounds and surpasses the key 1.4335 resistance level, it will signal a potential continuation of gains toward 1.4685 and above. Current market sentiment is distinctly bearish, but traders should closely monitor Federal Reserve official commentary and any policy signals from the Bank of Canada regarding the exchange rate.

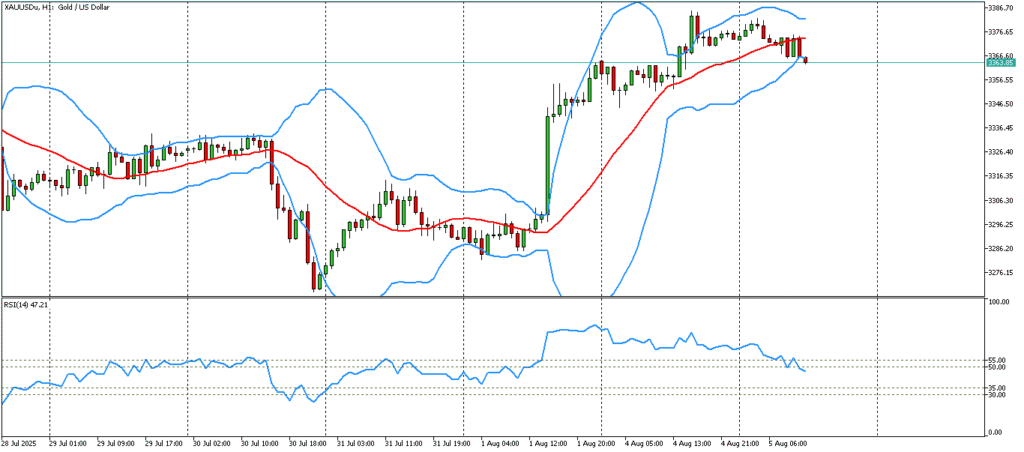

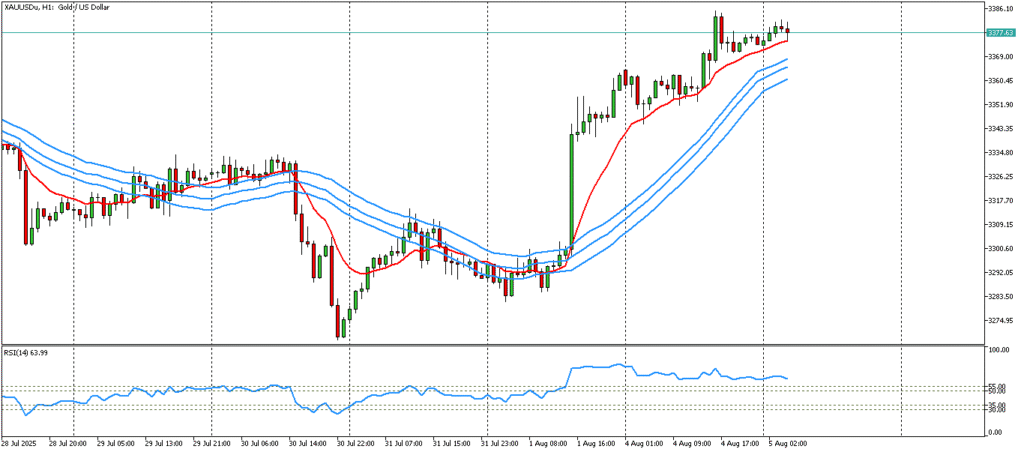

The daily chart reflects a clear downtrend over recent weeks, with USDCAD repeatedly rejected at the 1.4150 resistance and recently dipping below the 50-day moving average (1.40214) but staying above the 200-day moving average (1.38418). Price action shows choppy decline with Bollinger Bands flattening and MACD indicating bearish momentum, suggesting short-term pressure with a weak consolidative trend.

On the hourly chart looking at the last 3-5 days, USDCAD has traded in a volatile manner, retreating from resistance around 1.4100 to bounce near the 1.3950 support. The 50 and 200-period moving averages are intertwined, Bollinger Bands contracting mildly indicating lower volatility. The MACD recently formed a bearish crossover, signaling weakening short-term momentum, and RSI is neutral to slightly oversold, confirming increased selling pressure.

Technical Trend: Overall trend is cautiously bearish, with market sentiment oscillating amid Fed policy uncertainty and technical resistance.

Technically, USDCAD is encountering strong resistance between 1.4150 to 1.4100. The recent MACD bearish crossover combined with multiple failed breakouts signals likely further downside risk. Recent bearish engulfing candlestick patterns underline sellers’ dominance in the near term. Price action suggests watching the 1.3950 support for signs of buying interest or breakdown for trade entry or stop-loss management.No major economic events directly impacting USDCAD are scheduled for today. The key event is Federal Reserve Chair Jerome Powell’s speech early morning Hong Kong time, which may influence USD sentiment. Other data releases focus on Europe and Australia and are unlikely to directly affect USDCAD. Traders should monitor the speech’s tone and upcoming oil price reports, given their indirect impact on the Canadian dollar and USD.

Resistance & Support

<

p style=”padding: 10px; margin: 20px 0; border: solid 1px #fa003f; border-radius: 5px;”>The above financial market data, quotes, charts, statistics, exchange rates, news, research, analysis, buy or sell ratings, financial education, and other information are for reference only. Before making any trades based on this information, you should consult independent professional advice to verify pricing data or obtain more detailed market information. 1uptick.com should not be regarded as soliciting any subscriber or visitor to execute any trade. You are solely responsible for all of your own trading decisions.