|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Price Surges in 2025: How Political Uncertainty and Technical Strength Drive the Bullish Momentum

2025-10-08 @ 05:00

Gold’s Bullish Momentum Persists as Political Risks Stir Investor Interest

Gold has continued its impressive upward run into October 2025, capturing the attention of both institutional and retail investors. The prevailing atmosphere of political uncertainty globally has driven a dependable flight to safety, making gold a preferred hedge against volatility and market stress. With key technical indicators aligning to sustain the bullish trend and analysts projecting further upside, gold is not only holding its ground but also carving out new highs in the current climate.

The Bullish Case for Gold

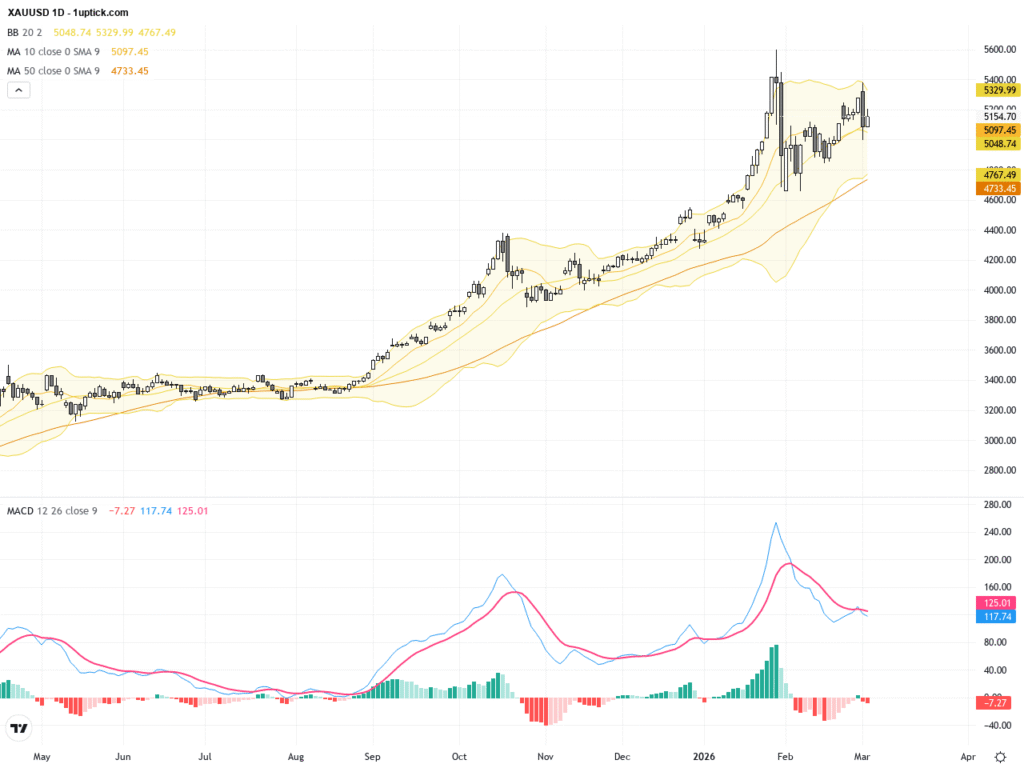

Recent price action demonstrates that gold remains locked within a strong rising trend. At the opening of October, gold was trading around $3,950 per ounce, and momentum indicators, especially the moving averages, confirm a bullish bias in the short term. The precious metal has convincingly broken above critical resistance areas, suggesting strong support from buyers. These upward surges often coincide with broader macroeconomic worries—geopolitical tension hotspots, upcoming elections, and concerns about inflation have all played their part in bolstering gold’s appeal to risk-averse investors.

Technical Signals Support the Rally

Technical analysis further validates the positive outlook for gold. The price has stayed comfortably above both the 50-day and 200-day simple moving averages, a classic indicator of ongoing strength. The Relative Strength Index (RSI) has bounced along the higher end, but without signaling an extreme overbought condition, suggesting there could still be room for further upside.

Market participants have also witnessed gold testing support levels before rebounding, often from zones close to $3,925. As long as prices remain above this threshold and avoid a decisive breakdown below support lines such as $3,895, the bullish scenario is expected to hold. Traders should also watch for a breakout above resistance levels like $3,975, which would further accelerate upward momentum, with targets projected above $4,000 in the near term.

Political Uncertainty: Gold’s Time to Shine

The current surge in gold prices is closely linked to increasing political uncertainty across the globe. With several important elections on the horizon and simmering geopolitical tensions, investors are looking for shelter from potential shocks. Gold’s historical reliability as a non-correlated asset and store of value during such periods cements its role as a staple in portfolio risk management.

Inflation expectations and central bank policies remain influential drivers. As doubts linger regarding the timing and scale of interest rate adjustments by major central banks, gold becomes an attractive asset for those seeking to preserve purchasing power. Added to this, robust central bank gold buying, particularly from emerging market nations seeking to diversify their reserves, adds another layer of long-term support for prices.

Forecast and Potential Scenarios

Short-term projections indicate that gold is likely to maintain its bullish momentum. If market volatility persists, a test of resistance at $4,005 is plausible. However, any downward breach of strong support—especially a daily close below $3,895—would signal caution for bulls, potentially inviting a pause or downside correction.

For longer-term investors, forecasts remain optimistic. If you were to invest $1,000 in gold today, projected models suggest a potential profit of approximately $267, representing a return on investment (ROI) of over 26% by the end of 2025. Projections for the remainder of the year see gold trading within a channel, with analysts expecting the metal to outperform many riskier asset classes, particularly if uncertainties persist.

Risk Considerations

While the current sentiment is upbeat, investors should remain vigilant. Gold often experiences short-term corrections—whether from swings in global risk appetite, sharp U.S. dollar rallies, or sudden resolution of key political events. Technical breaks below critical support lines could quickly turn sentiment bearish, even if only temporarily. For this reason, disciplined risk management and close monitoring of both technical and macroeconomic triggers are imperative for active traders and longer-term holders alike.

Conclusion

Gold’s enduring strength so far in 2025 underscores its unique qualities as both a safe haven and a strategic investment during turbulent periods. Ongoing political uncertainty, persistent inflation fears, and a favorable technical set-up continue to provide a strong foundation for further gains. As the global financial landscape remains unsettled, the case for gold as a portfolio anchor has rarely been more compelling. Both seasoned traders and long-term investors would do well to keep gold in sharp focus as markets navigate the months ahead.