|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Price Correction Amidst US CPI Release: What Investors Need to Know – Market Outlook for 2025

2025-10-24 @ 20:01

Gold prices have entered a phase of correction as markets prepare for the release of the latest US Consumer Price Index (CPI) data. After reaching impressive highs earlier this year, gold (XAU/USD) has recently retreated, with investors closely watching upcoming economic reports and developments in US monetary policy.

Recent Gold Price Performance

As of October 24, 2025, gold prices have slipped to just over $4,060 per troy ounce, dropping about 1.5% from the previous day. Even with this recent pullback, gold has gained more than 47% compared to the same period last year, a reflection of continued concerns surrounding inflation, geopolitical tensions, and global economic uncertainty.

Over the past month, gold’s momentum has been notable, rising over 8%, but the current correction signals that the market is taking a breather ahead of the key US inflation print. Short-term forecasts suggest continued volatility as traders digest fresh macroeconomic data and reassess expectations for US interest rates.

Factors Driving the Gold Price

- US Inflation and Federal Reserve Policy: The upcoming CPI report is critical. Higher-than-expected inflation could prompt the Federal Reserve to maintain or even raise interest rates, typically a bearish factor for gold, as higher rates increase the opportunity cost of holding non-yielding assets. Conversely, signs of cooling inflation may renew hopes for rate cuts, potentially supporting gold prices.

- Geopolitical Risks: Gold has benefitted from persistent geopolitical concerns, particularly in major conflict regions, as investors seek the safety of tangible assets during times of uncertainty.

-

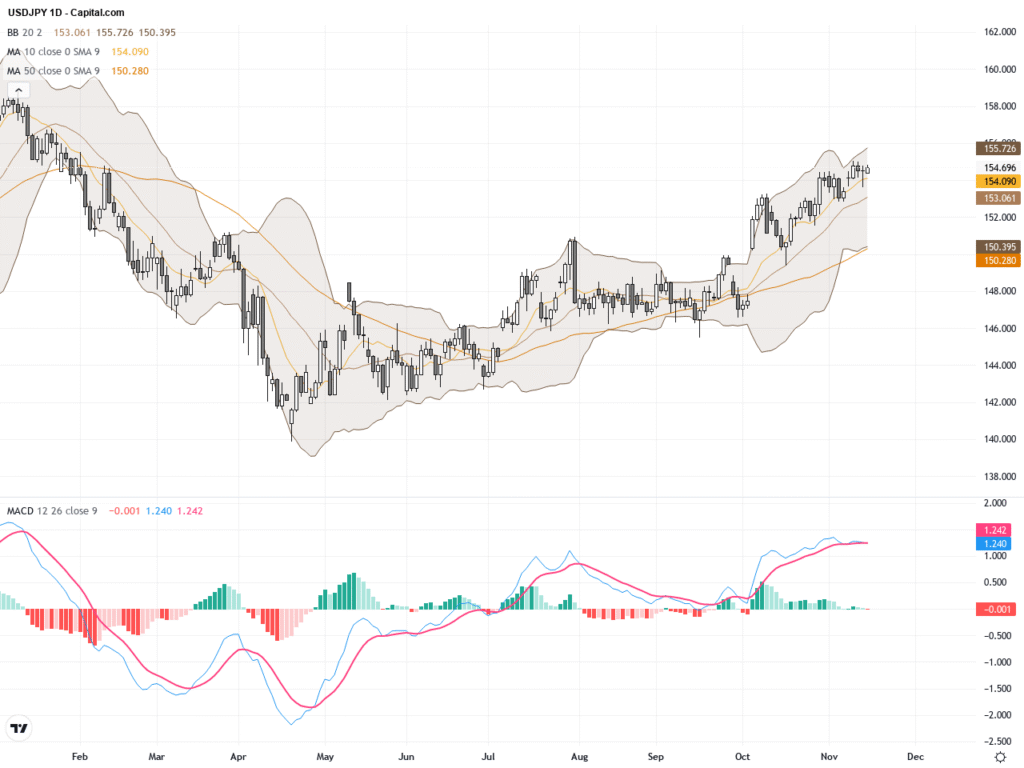

Currency Movements: The strength of the US dollar remains a key consideration. A strengthening dollar often puts downward pressure on gold prices, as it becomes more expensive for holders of other currencies.

Market Sentiment and Short-Term Forecasts

In the very near term, gold is expected to remain volatile as markets grapple with the dual forces of central bank policy and broader risk sentiment. Algorithmic models predict a marginal increase—around 1%—for gold over the next week, but the outlook can shift rapidly in response to headline economic data.

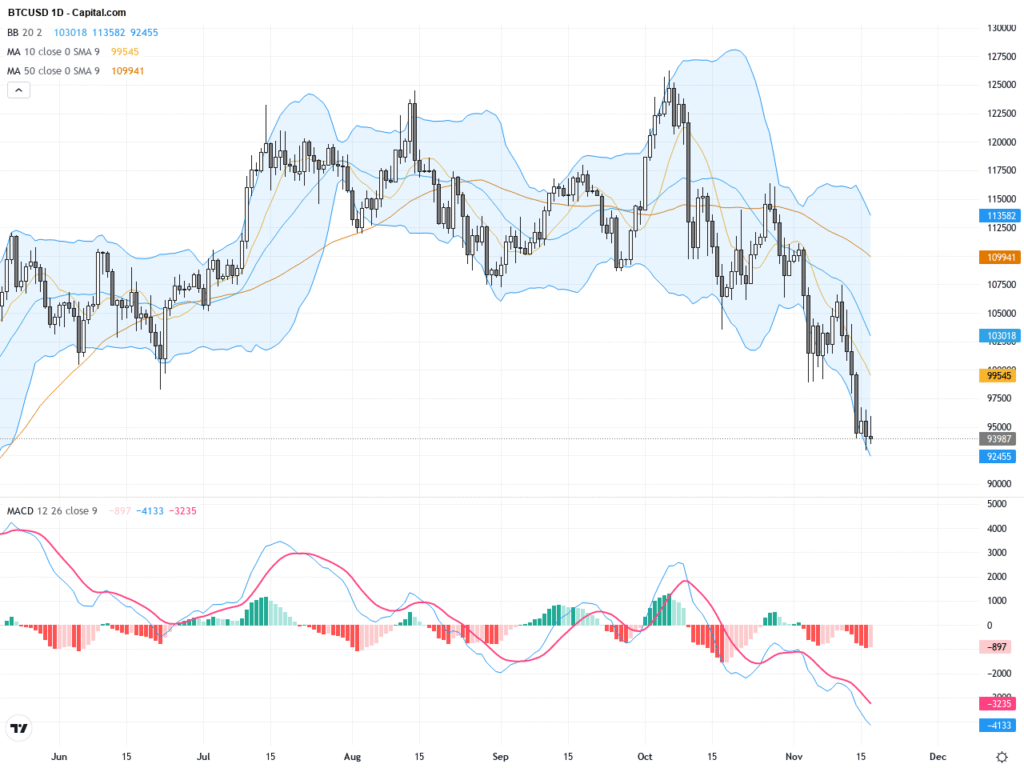

Technical indicators show gold is trading above its 50-day and 200-day simple moving averages, suggesting the broader trend remains constructive, although the short-term pullback has led to some moderation in sentiment.

Medium and Long-Term Gold Price Outlook

Analyst price targets for 2025 vary widely, reflecting uncertainty over both economic growth prospects and central bank policy. Forecasts for gold by the end of 2025 commonly range between $2,000 and $3,700 per ounce, though some algorithm-based projections place gold above $4,000. The consensus view among major banks and research firms sees gold holding above previous records, but the range of predictions points to considerable debate over future monetary policy, global growth, and risk appetite.

Beyond 2025, some long-term models foresee the potential for gold prices to climb even higher if global inflation remains above trend, central banks slow their rate-hiking cycles, or new geopolitical crises erupt. However, if inflation moderates and the global economy stabilizes, gold could face pressure to consolidate at lower levels.

What Should Investors Watch Going Forward?

- US Economic Data: Beyond the CPI, employment and GDP data will provide crucial signals on the health of the US economy and future interest rate moves.

-

Statements from the Federal Reserve: Any hint of policy shifts will be closely scrutinized and could trigger sharp moves in the gold market.

-

Global Events: Escalating geopolitical risks could quickly boost demand for gold as a safe haven, while easing tensions might reduce its appeal.

-

Technicals: Key support and resistance levels, including the psychologically important $4,000 threshold, will be watched for signs of further correction or renewed upward momentum.

Conclusion

Gold continues to act as a barometer for investor anxiety around inflation and broader macroeconomic risks. While its recent correction reflects a market pausing for direction ahead of important data releases, the underlying dynamics that have driven gold to historic highs remain in place. The landscape for gold in 2025 is shaped by a tug-of-war between persistent inflationary pressures, central bank actions, and an unpredictable geopolitical backdrop. For investors, caution and adaptability will be key as volatility is likely to remain elevated in the months ahead.