|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Price Outlook 2025: Navigating Consolidation Below $4,000 Amid USD Strength and Market Uncertainty

2025-11-06 @ 02:00

Gold continues to capture the attention of investors as it navigates a period of consolidation below the significant $4,000 per ounce threshold. This phase is marked by cautious trading, uncertainty about future direction, and a reassessment of both bullish and bearish factors shaping the precious metal’s near-term outlook.

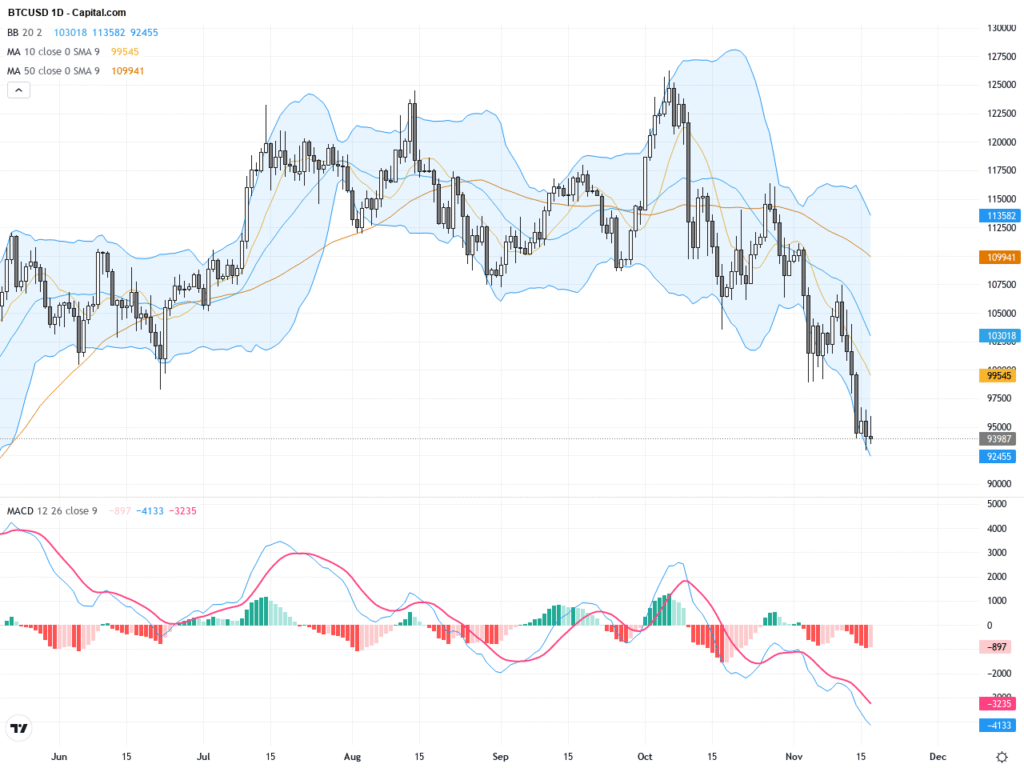

Recent months saw gold soar to impressive highs, propelled by global economic tensions, strong central bank demand, and widespread concerns about inflation. However, after peaking, gold has entered a period of sideways movement, with investors pausing to digest mixed signals from the US economy, monetary policy trends, and shifts in the currency markets.

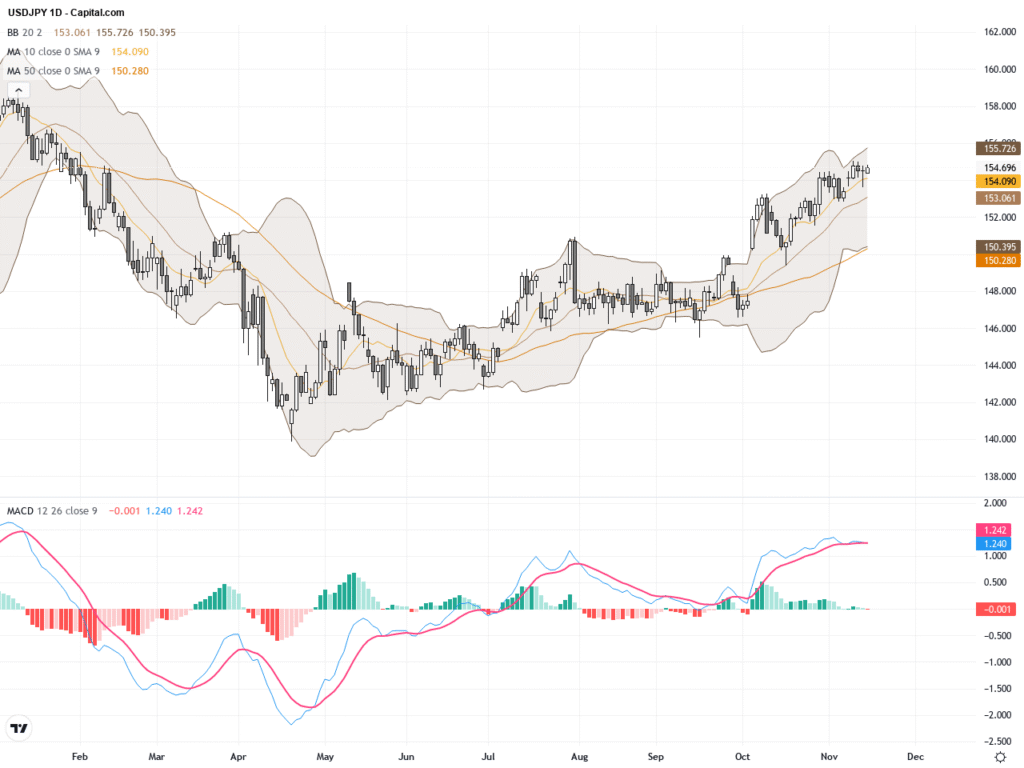

One factor exerting notable pressure on gold is the strengthening of the US dollar. After a period of apparent weakness, the US Dollar Index has staged a significant comeback, fueled in part by the Federal Reserve’s decisions regarding interest rates. Despite the Fed opting to cut rates once more—a development that would typically weigh on the dollar—the currency has defied expectations by advancing. This unusual move has created headwinds for gold, as a stronger dollar tends to reduce the appeal of dollar-denominated commodities for investors using other currencies.

Gold’s inability to breach and hold above $4,000 is a clear sign that the medium-term uptrend has lost momentum. Recent market action suggests that the euphoria seen earlier in the year has given way to a more cautious approach. Investors who locked in profits at the recent highs, particularly around $4,150, have benefitted from taking money off the table as conditions shifted. Silver, which often follows gold’s lead, also experienced a significant run-up before correcting at notable technical levels.

While gold prices have pulled back in recent weeks, this doesn’t necessarily signal a sharp reversal or the start of a prolonged downtrend. Instead, the market appears to be in a consolidation or “breather” phase, common after major rallies. Some analysts believe that this pause is allowing the market to reset expectations and gauge how deeply the USD’s resurgence will impact the entire precious metals complex.

Central bank activity remains a source of support for gold, but recent forecasts suggest demand may moderate as many institutions already achieved substantial additions to their reserves earlier in the year. This changing demand landscape, when combined with the currency effect, raises the likelihood of further choppy, range-bound trading as 2025 progresses.

Current projections for gold prices in 2025 vary widely, reflecting the current uncertainty. While some algorithm-driven forecasts envision prices recovering to or even above $4,000 in the near future, a consensus is emerging that the next major move will hinge on currency dynamics and global risk appetite. If the US dollar continues its upward march, gold may experience further downward pressure, though strong support is likely near recent lows as long-term investors step in.

Market watchers are closely monitoring several technical and psychological levels. A decisive break above $4,000 would be seen as a bullish signal, potentially attracting fresh buying interest. Conversely, a clear fall below recent consolidation zones could trigger additional selling, especially if major support levels fail to hold.

Traders and investors should keep a close eye on central bank policies, emerging inflation data, and geopolitical developments—all of which could tip the balance in gold’s favor or intensify the challenges. The interplay between the Federal Reserve’s moves and broad-based sentiment toward risk assets will be especially crucial as the global economy continues to evolve.

In the short term, gold appears set to remain in its consolidative phase, with neither bulls nor bears firmly in control. Caution is warranted as the precious metal tests support and resistance zones ahead of the year-end. For longer-term investors, periods of consolidation can provide attractive entry points, but patience and a focus on underlying macroeconomic trends remain essential in navigating the current market landscape.