2025-05-07 @ 13:13

The Shanghai Gold Exchange has announced plans to establish an offshore gold vault in Hong Kong, marking a significant step forward in China’s effort to internationalize yuan-denominated gold. This move is set to strengthen Hong Kong’s role as a global hub for gold trading by improving the efficiency of physical gold delivery and capital flow. It also signals the beginning of a new “Shanghai pricing, Hong Kong delivery” model. As geopolitical tensions rise, gold priced in Chinese yuan is gaining traction among global investors, drawing increased attention in the market for its potential as a strategic asset.

2025-05-07 @ 13:07

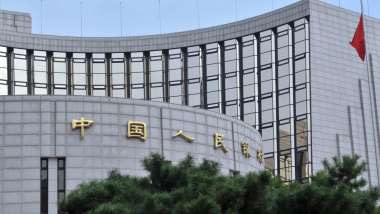

The People’s Bank of China has cut the Standing Lending Facility (SLF) rate and injected additional liquidity into the financial system. This move is aimed at lowering borrowing costs and supporting the real economy, particularly small and medium-sized enterprises. Alongside the recent reductions in the reserve requirement ratio (RRR) and relending rates, these measures reflect a stronger policy commitment to stabilizing economic growth. Investors are closely watching how these easing policies will impact consumer spending and business investment in the coming months.

2025-05-06 @ 13:33

**Oil Price Plunge Drags Down Hong Kong Energy Stocks**

Oil prices tumbled to a four-year low as OPEC+ unexpectedly ramped up production amid growing global economic uncertainty. Brent crude slipped toward the $60 per barrel mark, putting immediate pressure on major Hong Kong-listed energy stocks like CNOOC and PetroChina.

Investors are increasingly concerned about a widening imbalance between crude supply and demand, as well as escalating trade tensions, both of which could keep oil prices volatile and range-bound in the near term.

With energy markets facing heightened uncertainty, investors should closely monitor policy developments and be prepared to act quickly on potential shifts in the energy investment landscape.

2025-05-06 @ 00:56

The U.S. has imposed a 25% tariff on imported auto parts, sending shockwaves through the global automotive supply chain. This sudden move is expected to drive up vehicle prices for consumers while sharply increasing production costs for manufacturers. In response, companies like General Motors and Boeing are under intense market scrutiny as investors closely watch how industry leaders navigate the escalating trade tensions. The ripple effects are also being felt across the Hong Kong stock market, particularly in automotive and tech sectors. With shifting global trade dynamics, local investors should stay alert to upcoming policy changes and international economic developments.

2025-05-04 @ 19:31

This week, markets are keeping a close eye on interest rate decisions from both the U.S. Federal Reserve and the Bank of England. The two central banks appear to be taking different paths—while the Fed remains cautious and signals a wait-and-see approach, the Bank of England may be gearing up to accelerate rate cuts. As a result, the U.S. dollar continues to strengthen, while the British pound faces downward pressure. Investors should stay alert to the latest economic data and policy signals to navigate shifting global market trends.

2025-05-04 @ 19:24

Warren Buffett announced he will step down as CEO of Berkshire Hathaway at the end of 2025, marking the close of a legendary six-decade investment career. Speaking at the company’s annual shareholders meeting, Buffett shared candid insights into the future of the market and officially named Greg Abel as his successor. From Berkshire’s massive cash reserves and strategic moves in Japan, to a clear-eyed assessment of AI and the global economy, the event underscored the enduring legacy of value investing and signaled a new era for Berkshire Hathaway.

2025-05-02 @ 23:47

The euro saw sharp fluctuations against the U.S. dollar as a wave of major economic data was released from both the United States and the Eurozone. A rise in core inflation and stronger-than-expected job numbers have added uncertainty to market expectations surrounding future interest rate decisions by both the Federal Reserve and the European Central Bank. Investors should closely monitor upcoming policy signals and key technical levels to stay ahead in the forex market.

2025-05-02 @ 23:38

In April, the U.S. economy added 177,000 non-farm jobs, surpassing market expectations and signaling continued strength in the labor market. Job growth was led by the healthcare sector and e-commerce logistics, which remained key drivers of employment. The unemployment rate held steady at 4.2%. Notably, the pace of average hourly wage growth slowed, a trend that could help stabilize inflation and give the Federal Reserve more flexibility in setting future interest rate policy.

2025-05-01 @ 02:45

The U.S. economy stumbled at the start of 2025, with first-quarter GDP contracting at an annualized rate of 0.3%. Meanwhile, inflation rose to 3.5%, fueling fresh concerns about stagflation—a troubling mix of slowing growth and rising prices. A sharp shift in trade policy, coupled with a surge in imports, played a major role in dragging down economic performance.

The Federal Reserve now faces a difficult balancing act: whether to cut interest rates to stimulate growth or maintain higher rates to keep inflation in check. Diverging opinions across financial markets reflect the growing uncertainty, as inflation expectations climb and consumer data sends mixed signals.

Adding to the complexity are rising global tariff risks and a strengthening U.S. dollar, both of which could further strain the economic outlook. Investors and global markets will be keeping a close eye on how the U.S. navigates these mounting challenges in the months ahead.

2025-05-01 @ 02:40

U.S. core PCE inflation cooled to 2.6% year-over-year in March, marking its lowest level in 2024 so far and signaling a notable easing of inflationary pressure. With the data reinforcing expectations for a potential interest rate cut by the Federal Reserve in June, investor focus is shifting. Strong consumer spending combined with a declining savings rate highlights both underlying risks and room for policy adjustment. These developments could have meaningful implications for the market outlook, making it critical for investors to stay alert to shifts in economic momentum and central bank strategy.