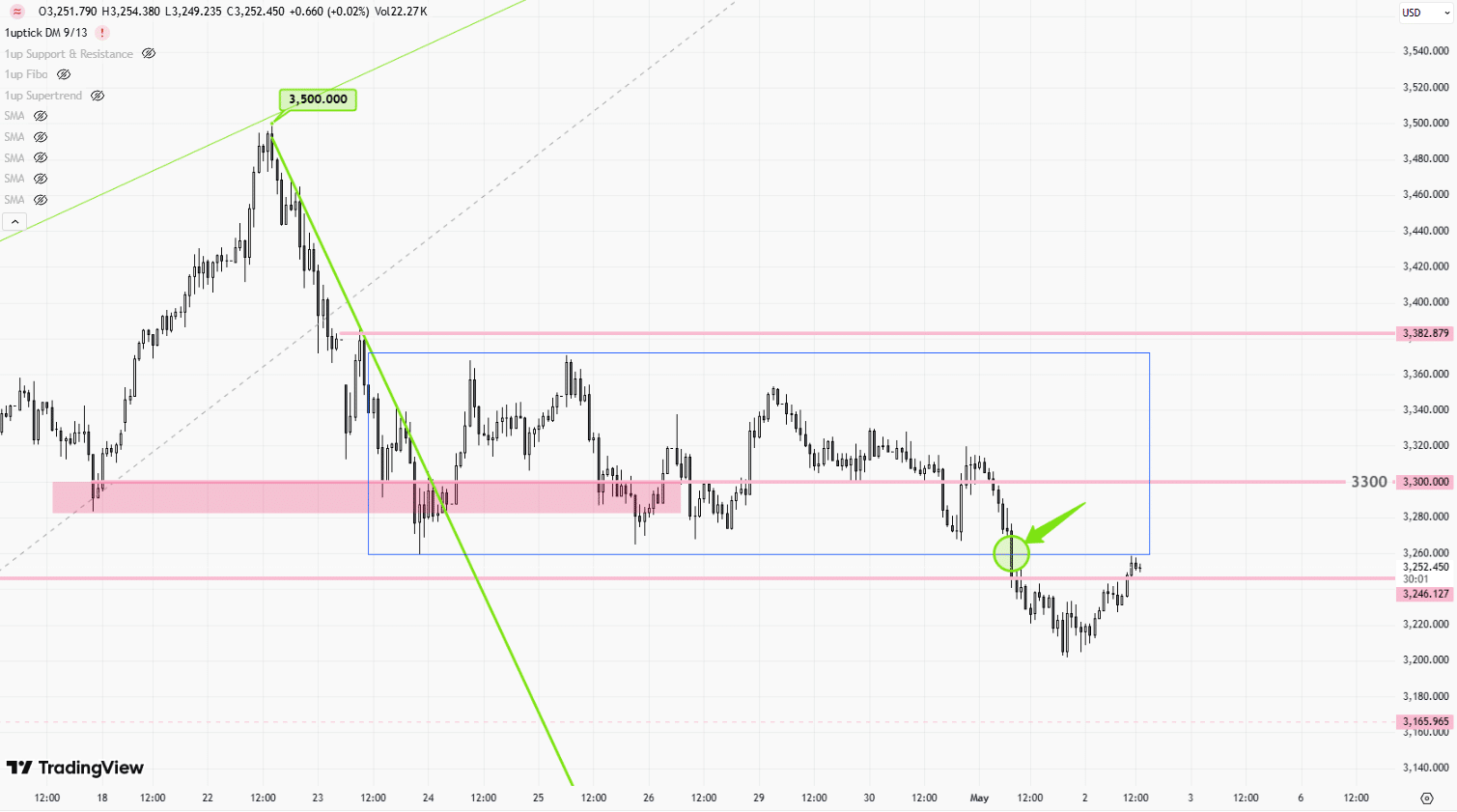

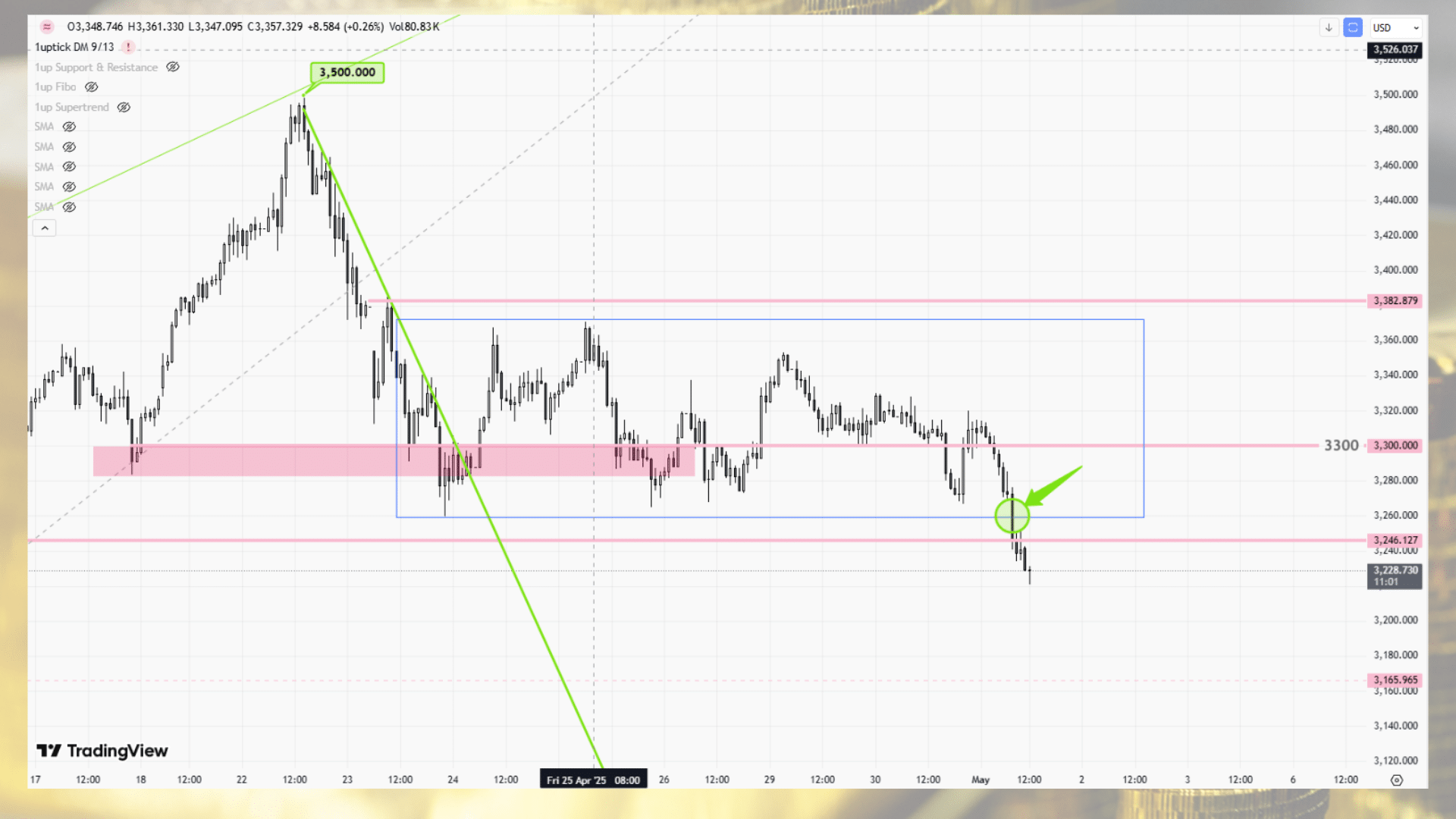

[Daily Closing 🔔] Gold – Gold Price Outlook and Technical Analysis: Key Reasons Behind the Recent Decline and Support Levels

Spot gold fell for a second consecutive day on Thursday, closing at $3,288 per ounce. The drop came as reports of a potential U.S.-U.K. trade agreement lifted market risk sentiment, weakening demand for safe-haven assets like gold. Although China’s easing of gold import restrictions offered some support, it wasn’t enough to reverse the decline, and ongoing geopolitical tensions failed to push prices higher.

From a technical perspective, the key support level to watch is $3,270. Future price movements are likely to be influenced by any official announcements from the U.S. and U.K., as well as evolving expectations around Federal Reserve interest rate policy. Investors should closely monitor updates on global economic conditions and central bank decisions, as these will play a crucial role in shaping gold’s near-term direction.