2025-04-29 @ 12:27

Spot gold has shown a dip-and-rise pattern over the past 24 hours, rebounding sharply as uncertainty over U.S.-China trade talks and increasing demand for safe-haven assets pushed prices higher. Gold briefly touched an intraday high of $3,338 before closing at $3,347.80. A weakening U.S. dollar and falling Treasury yields also contributed to gold’s upward momentum.

With key U.S. economic data—including GDP and non-farm payrolls—set to be released soon, market attention is intensifying. From a technical perspective, gold still holds short-term bullish momentum. Traders are closely watching the resistance level at $3,370 and the support zone near $3,260.

Stay updated with the latest gold price trends and market analysis to make informed trading decisions.

2025-04-28 @ 13:55

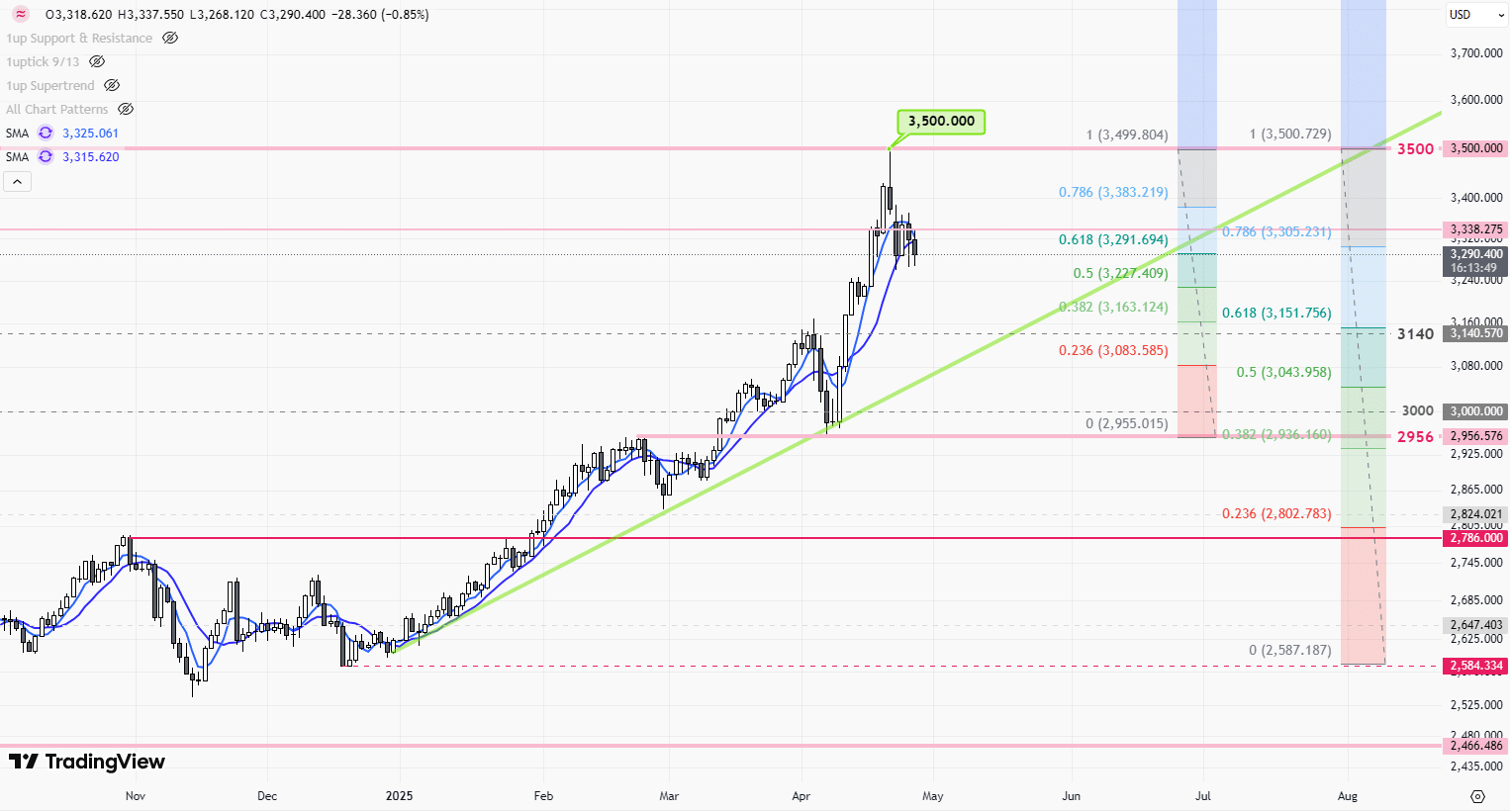

Spot gold (XAU/USD) fell 4.18% last week, pressured by escalating geopolitical tensions, shifting Federal Reserve policy expectations, and a stronger US dollar. After reaching a record high, gold prices pulled back sharply, with technical selling further accelerating the decline. Strong US economic data added momentum to the dollar’s rally, weighing heavily on bullion. Looking ahead, investors should keep a close eye on the upcoming Federal Reserve meeting and the US non-farm payroll report, as well as monitor the People’s Bank of China’s gold reserve activity — all critical factors that could shape the next moves in gold prices.

2025-04-26 @ 15:33

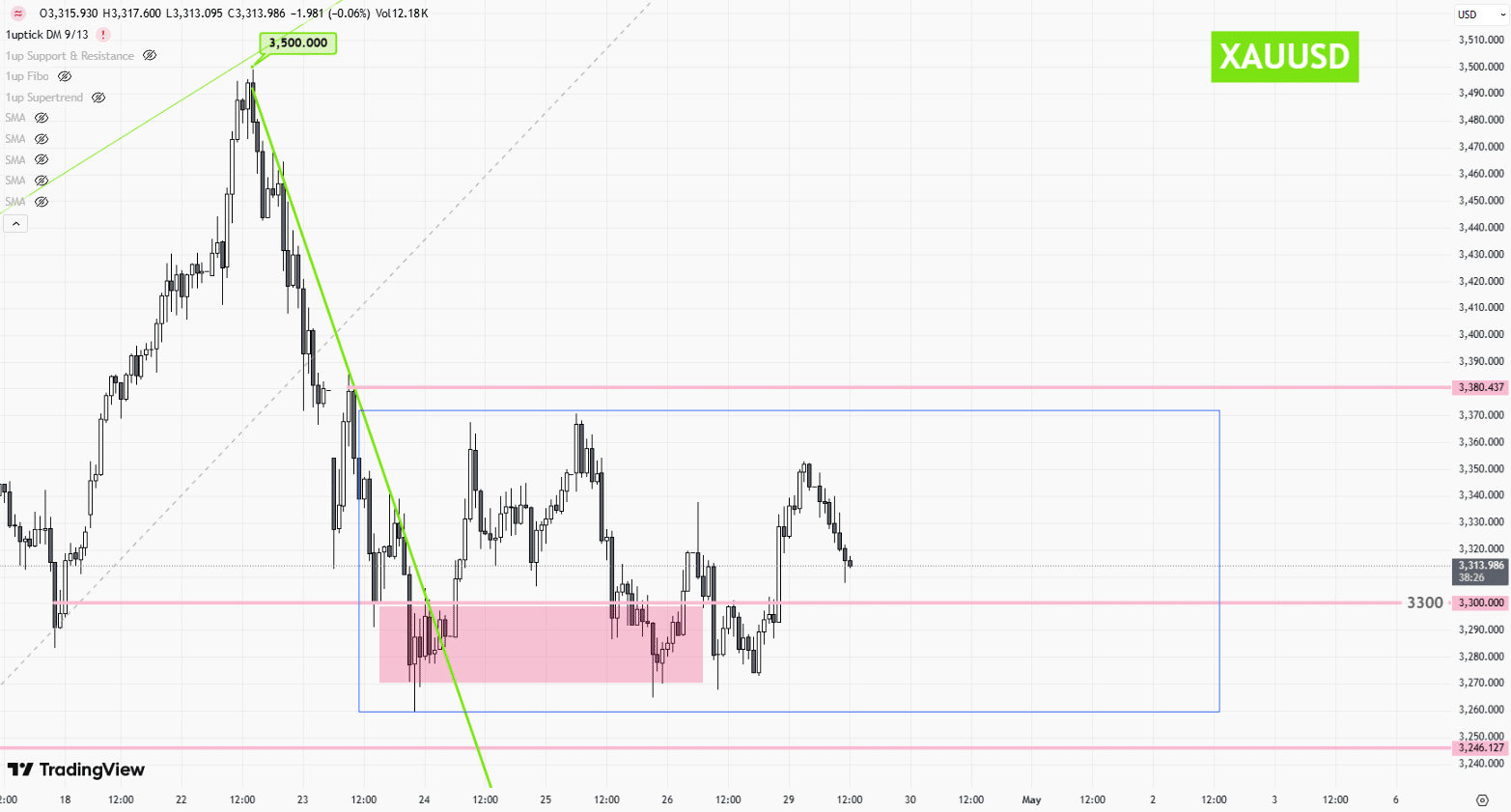

Spot gold prices tumbled 2.55% on Friday, erasing gains from earlier in the week as improving U.S.-China trade relations and a stronger dollar dampened safe-haven demand. On the technical side, gold broke below the key $3,300 support level, intensifying selling pressure across the market. While short-term momentum has weakened, the medium- to long-term outlook for gold remains supported by continued central bank buying and elevated geopolitical risks. Looking ahead, investors should closely monitor the upcoming core PCE data release within the next 24 hours, developments in U.S.-China negotiations, and the market’s reaction around the crucial $3,260 support level.

2025-04-26 @ 13:11

Between April 21 and 25, 2025, the EUR/USD pair experienced sharp fluctuations, driven by political uncertainties, economic data releases, and technical market dynamics. After reaching recent highs, the euro retreated and entered a consolidation phase. Currently, the exchange rate is finding support around the 1.1300 level, while immediate resistance is focused near 1.1380.

Looking ahead to next week, all eyes will be on the U.S. Federal Reserve’s interest rate decision and the Eurozone’s upcoming CPI inflation report. A clear breakout above the key resistance zone could open further upside potential for the euro against the dollar.

Stay tuned for the latest EUR/USD technical analysis and market insights to navigate the evolving forex landscape confidently.

2025-04-26 @ 13:09

West Texas Intermediate (WTI) crude oil futures saw notable volatility last week, slipping about 1.85% amid geopolitical tensions, OPEC+ production debates, and mixed demand data. Investors are now closely watching U.S. rig counts and China’s industrial profit figures, with oil prices likely to face fresh short-term swings.

2025-04-25 @ 14:51

Spot gold held near its recent highs at the April 25 close, with price action consolidating as risk sentiment shifted on developments in U.S.-Asia trade talks. While safe-haven demand has slightly eased, the broader trend for gold remains upward. On the technical side, $3,200 is emerging as a key support level. In the near term, all eyes are on the core PCE data and the progress of U.S.-China negotiations, which could heavily influence market direction. Investors should watch gold’s behavior around the $3,300 mark, as a sustained push above this zone could open the door to a breakout toward $3,400. Staying informed on global economic factors is crucial for navigating gold price movements in a volatile market.

2025-04-24 @ 16:57

Bitcoin has seen a strong rally in recent days, climbing 11.3% in just one week and breaking past the $93,000 mark. The surge comes amid a combination of factors, including a looser regulatory stance on stablecoins in the U.S., technical breakouts, and rising institutional inflows. These developments have significantly boosted investor sentiment, reinforcing Bitcoin’s role as both a hedge and a store of value. If BTC continues to hold above $90,000, it could be poised to test the $100,000 resistance level in the near term. For real-time Bitcoin price updates and in-depth crypto market analysis, stay tuned to the latest cryptocurrency news and investment trends.

2025-04-24 @ 12:40

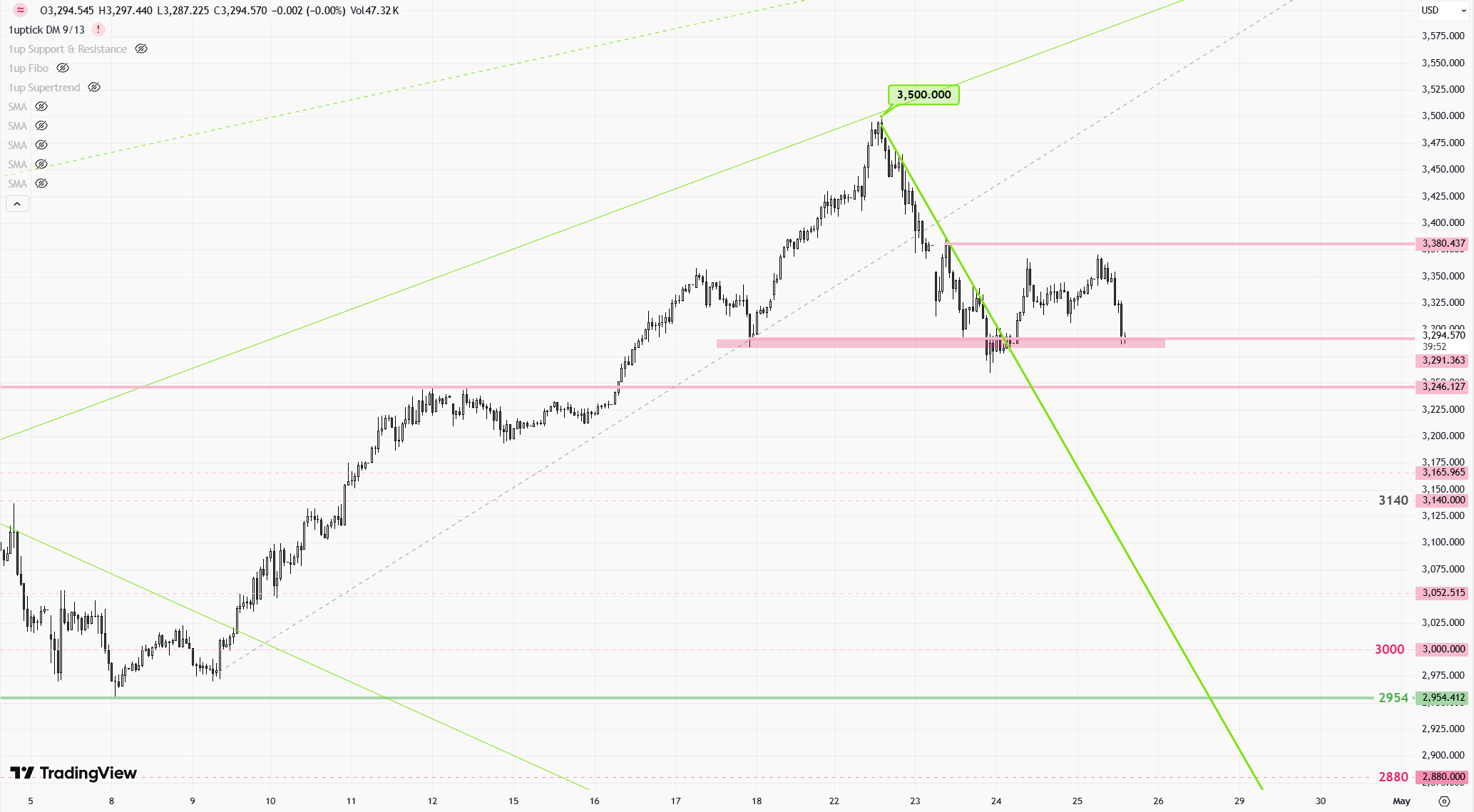

Spot gold pulled back after five consecutive days of gains, as a rebound in the U.S. dollar and optimism around trade negotiations weighed on prices, briefly dragging gold down to $3,260 per ounce. In the short term, technical indicators suggest a consolidation phase, with investors largely staying on the sidelines. However, ongoing geopolitical tensions and expectations of continued monetary easing continue to support the medium- to long-term outlook for the gold market.

2025-04-22 @ 12:08

Gold Prices Hit Record High Amid Weaker Dollar and Rising Global Tensions

Spot gold surged to an all-time high of $3,473.10 in the past 24 hours, driven by a weakening U.S. dollar, escalating U.S.-China trade tensions, and a surge in safe-haven demand. The technical indicators point to a strong bullish trend, with clear short-term support and resistance levels.

Investors are closely watching upcoming U.S. retail sales data and potential countermeasures from China, both of which could impact market sentiment. With strong momentum in play, gold prices may continue rising in the near term.

Staying updated with real-time gold price movements and recognizing key trend reversals are essential strategies for effective gold trading.

2025-04-22 @ 11:48

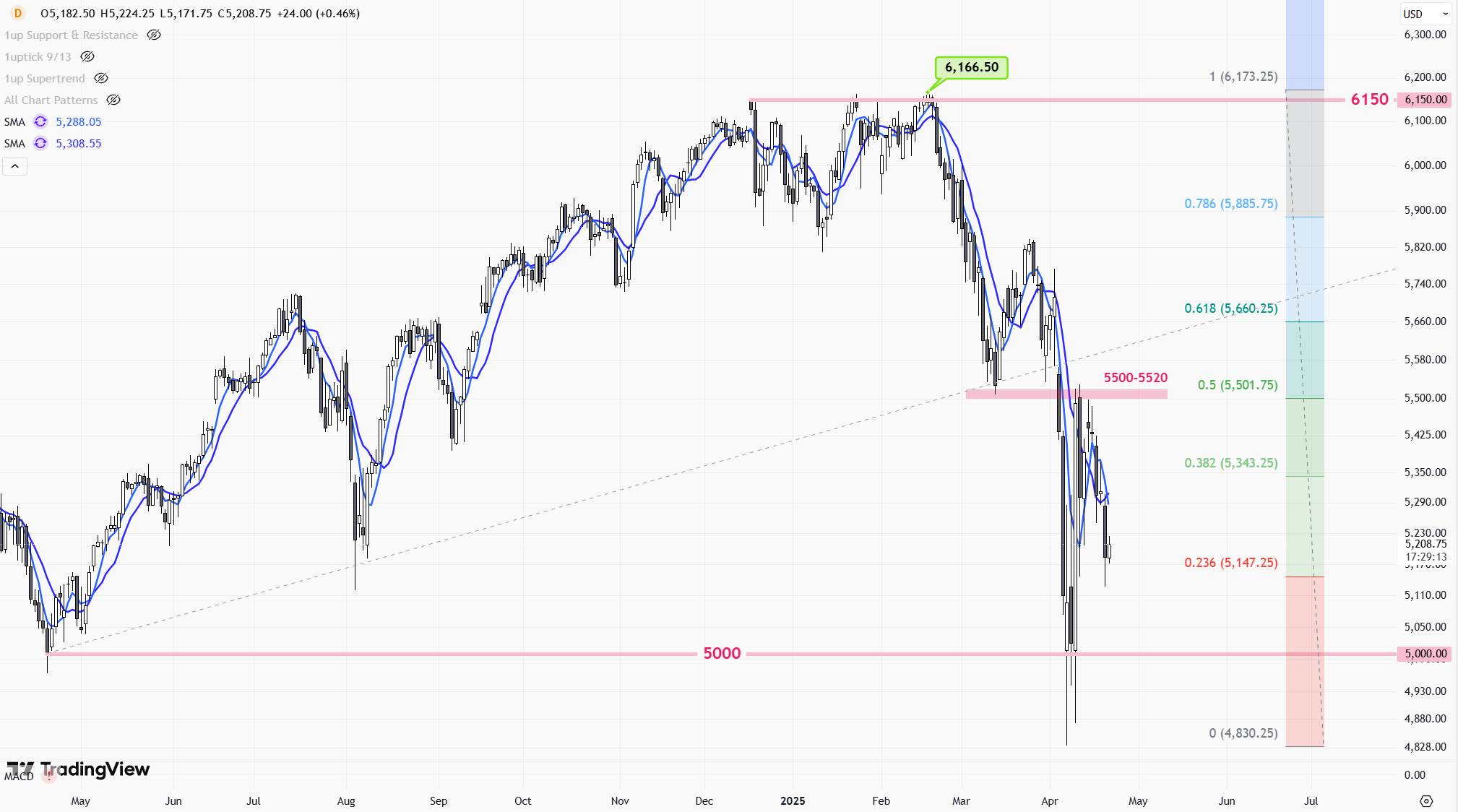

On April 21, 2025, U.S. stocks saw a broad selloff triggered by rising geopolitical tensions and renewed trade uncertainties. All three major indices closed sharply lower, with the S&P 500 recording its biggest single-day drop in nearly two weeks. Technology shares led the decline, while comments from former President Donald Trump rattled investor confidence, intensifying risk-off sentiment across the market.

In this article, we break down the latest market movements, key policy factors influencing investor behavior, and provide actionable investment strategies to navigate increased volatility. Discover what’s driving the current downturn and how to position your portfolio amid evolving global risks.