|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Trend 22/02

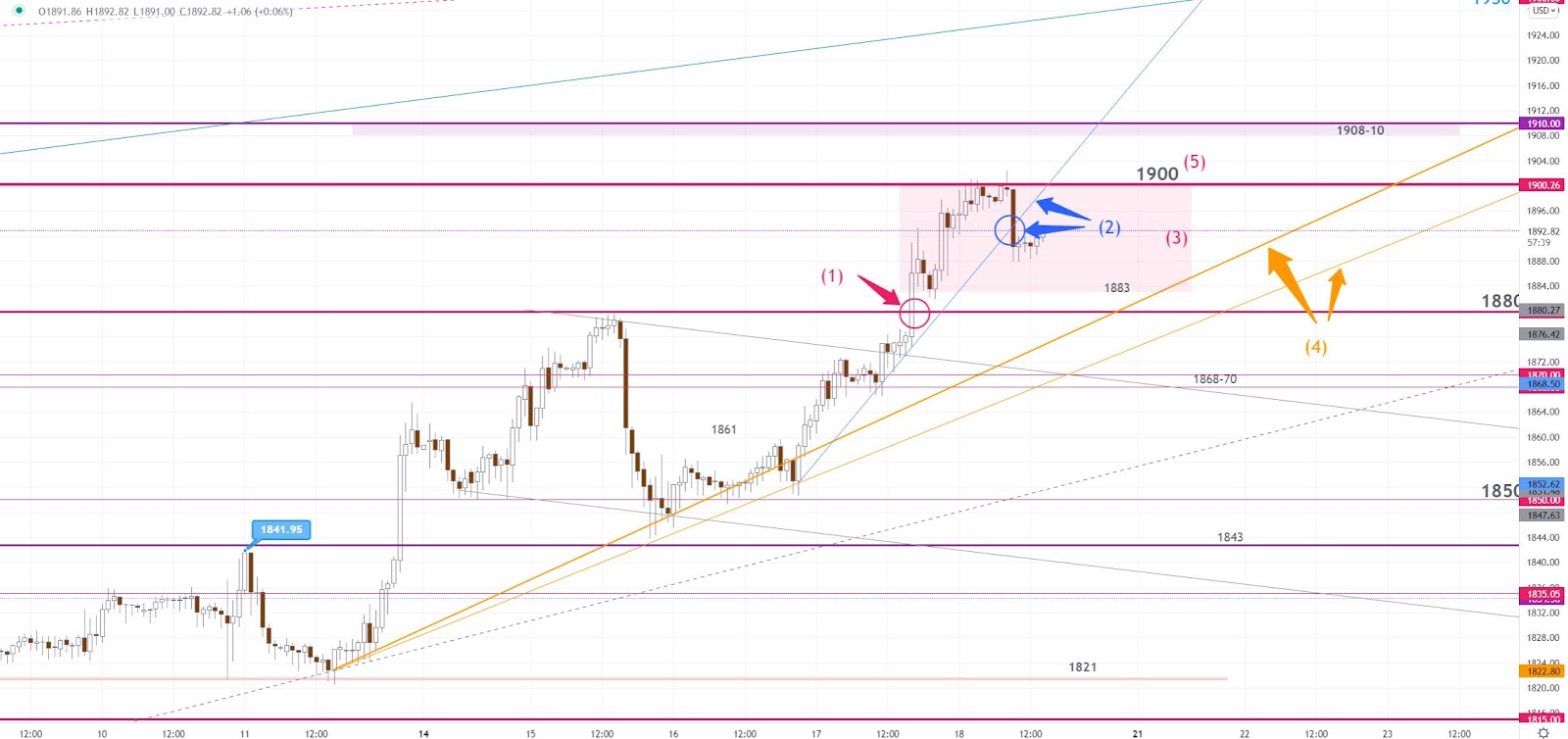

The gold market closed near the 8-month high yesterday. The trading day began at 1897 and the price has quickly jumped to a new recent high of 1908 early in the Asian session. However, the price has a drawback to below 1900 very soon, and it was traded between 1887-97 the majority of the day. […]

黃金走勢 21/02

黃金上週五在高位橫行。開市在1898即沖高到全日最高1902後隨後往下,全日整體在1890-95之間震蕩。收市前買盤支持繼續,收市在1897。 黃金自上週五脫離短線上升支持線(1)後,較急的上升趨勢開始放緩,短線已進入高位震蕩模式(3)。今早開盤後價格已造出新高1908,未來48小時若金價能收市在1900以上,將會是價格繼續上升的訊號。下方支持可留意上升趨勢線(2)。。 日線圖 – 黃金脫離三角形結構(4)後,趨勢在上升通道(5)當中,現時阻力區在1900-08(7)。在突破阻力區(7)前,日線圖上的調整區間可參考1870-1900(6)。 短線阻力:190819001895 現價:1892 短線支持:18881880-831876

黃金走勢 22/02

金市昨日相對平靜。開盤在1897,早段沖至全日高位1908後,隨後整體在1887-97內震蕩。直至美盤中後段再次突破1900(1),全日收市在1903,上升5美元。 1小時圖 – 黃金在昨日收市前突破橫行區間(2),終於企穩1900之上。昨日提及的上升支持線(3)繼續有效,現時上升正受阻於1908-10阻力區。若能往上突破,上方目標會在1930附近。消息仍然主導短線走勢。 連續2日的先跌後反彈(4),在日線圖形成了相對明顯的買入訊號,現時金價正糾纏在上次高位1900-08(5),隻要能往上突破上方目標會在1950附近。 短線阻力:192019151910 現價:1908 短線支持:1903-0018931888

Gold Trend 21/02

Gold stayed near the 8-month high last Friday. The price has hit the 8-month high very early in the Asian session at 1902 after the market opened at 1898. The price was basically bounded by the 1890-96 range throughout the Asian and European sessions. Buying resumed at the US session, with the day ending near […]

Gold Trend 18/02

Gold topped 1900 yesterday. Buying began early in the Asian and European session as the price has carried the buying momentum from the day before. The price broke through the key 1880(1) resistance and the move has continued until it reached day-high 1901. The price ended up closing at 1889, up by USD 28. Once […]

黃金走勢 18/02

承接前日的反彈,昨日黃金突破往上。開市在1869,早段亞洲時段買盤開始進場,穩步上楊,在歐盤直接沖破關鍵阻力1880(1),上升趨勢一直持續到美盤收市。全日最高接近1901,收市在1989,上升28美元。 昨日往上突破繼續由消息主導,突破1880後的第一個上方目標1900已經到達。今早亞盤從1898回落到早段低位1887,跌穿了昨日較急的短線上升趨勢線(2),上升趨勢在亞/歐盤將暫時放慢,而早段短線交易區間會在1883-1900(3)。昨日提及的上升趨勢線(4)繼續有效,關鍵阻力繼續留意1900(5),若在較後時段抽升,下一目標會在1908-10附近。 日線圖 – 走勢如昨日部署,雖然冇人能知突發消息何時出現,但技術上突破關鍵阻力1880(6),預期1900目標已達。現時金價正受阻於1900,若繼續往上,上方第一目標會在1908。 短線阻力:190819001895 現價:1892 短線支持:18881880-831876