Federal Reserve Chair Powell Signals Shift Toward Balancing Inflation Control and Labor Market Stability in Historic Jackson Hole Speech

Federal Reserve Chair Jerome Powell, in his pivotal 2025 Jackson Hole speech, signaled a shift in monetary policy toward balancing inflation control with labor market stability. Acknowledging inflation risks remain elevated while the labor market…

U.S. Government’s 10% Stake in Intel: Impact on the Semiconductor Industry and Tech Supply Chain

The U.S. government is set to acquire a **10% equity stake in Intel**, marking a significant move in the semiconductor industry and technology supply chain. This investment is tied to funding from the CHIPS Act…

Federal Reserve Chair Jerome Powell Signals Cautious Rate Cuts as Inflation Moderates in Final Jackson Hole Speech

Federal Reserve Chair Jerome Powell delivered his final address at the Jackson Hole Economic Policy Symposium, signaling cautious considerations for future interest rate cuts. Powell emphasized the resilience of the U.S. economy, noting that inflation…

Federal Reserve Chair Jerome Powell Signals Potential September Rate Cut Amid Labor Market Uncertainty

Federal Reserve Chair Jerome Powell hinted at a possible interest rate cut as soon as the mid-September meeting, amid evolving economic conditions and labor market uncertainty. He emphasized that any decision will be data-driven, focusing…

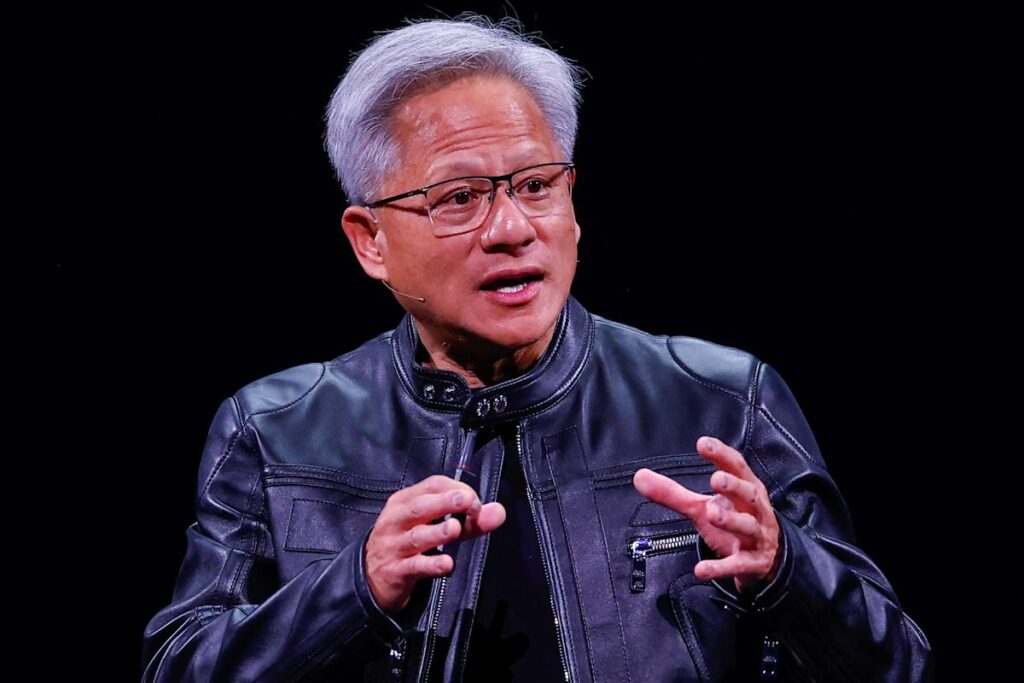

Nvidia Blackwell Ultra: Revolutionizing Data Centers into High-Performance AI Factories for the Next Era of AI Reasoning and Scalability

Nvidia Blackwell Ultra is transforming data centers into powerful AI factories designed for the next generation of AI reasoning and scalability. Featuring 72 Blackwell Ultra GPUs and 36 Nvidia Grace CPUs in a liquid-cooled rack-scale…

Federal Reserve Chair Powell’s Jackson Hole Speech: What It Means for Inflation, Interest Rates, and the Market Outlook

Federal Reserve Chair Jerome Powell’s Jackson Hole speech highlights the U.S. economy’s resilience amid recent policy changes, with near-maximum employment and inflation declining from pandemic highs but still above target. Powell emphasized the ongoing balancing…

Nova Sky Stories: How Jeffrey Katzenberg and Kimbal Musk Are Revolutionizing Live Entertainment with Drone Light Shows

Nova Sky Stories, led by innovators Jeffrey Katzenberg and Kimbal Musk, is transforming live entertainment with cutting-edge drone light shows that create stunning aerial artistry. Their technology, developed with Intel’s pioneering expertise, features synchronized swarms…

Tesla Launches AI-Powered In-Car Voice Assistants Using DeepSeek and Doubao for China’s Market

Tesla has launched AI-powered in-car voice assistants specifically for the Chinese market by integrating local Chinese AI technologies DeepSeek and ByteDance’s Doubao. This strategic move enables Tesla vehicles in China to handle voice commands for…

Latest FX Analysis

USDCAD-Daily

Latest Gold Analysis

Gold Trend 07/04 – Gold Enters a Consolidation Phase

1uptick Insight