Japanese Yen Slides Further: USD/JPY Breaks 148.85, Eyes 150 Level

The Japanese yen continues to weaken against the US dollar, weighed down by disappointing export data and expectations of ongoing monetary easing by the Bank of Japan. The USD/JPY pair has broken above the 148.85…

U.S. Inflation Matches Expectations in June, Core CPI Slightly Below Forecast; Tariff Risks Could Push Prices Higher and Influence Fed Policy

U.S. inflation data for June came in as expected, with the Consumer Price Index (CPI) rising 2.7% year-over-year. Core inflation—a measure that excludes food and energy—came in slightly below market forecasts. However, a new round…

China’s Q2 2025 GDP Beats Expectations, but Weak Consumer Demand and Housing Market Raise Concerns

China’s economy grew by 1.1% in the second quarter of 2025, slightly outpacing market expectations. This suggests that recent efforts to stabilize growth are beginning to show results. However, momentum remains fragile amid sluggish domestic…

Bank of Japan May Raise Rates Again in October as Inflation and Price Pressures Mount

The Bank of Japan may raise interest rates again in October, drawing renewed attention from global markets. A former chief economist noted that with reduced trade uncertainty and rising inflation, the likelihood of another rate…

EUR/USD Eyes Key Technical Support at 1.1670, Could Test 1.2000 by Year-End

The euro has seen increased volatility against the US dollar recently, drawing attention to the key support level at 1.1670. With shifting policy dynamics and trade developments between the EU and the US, a short-term…

Pound Sterling Set for Volatile Week as GDP and Inflation Data Shape Interest Rate Outlook

The British pound is approaching a pivotal week, with markets closely watching the UK’s latest GDP, retail sales, and inflation reports. A cooling job market and weakening business confidence, coupled with a strengthening US dollar,…

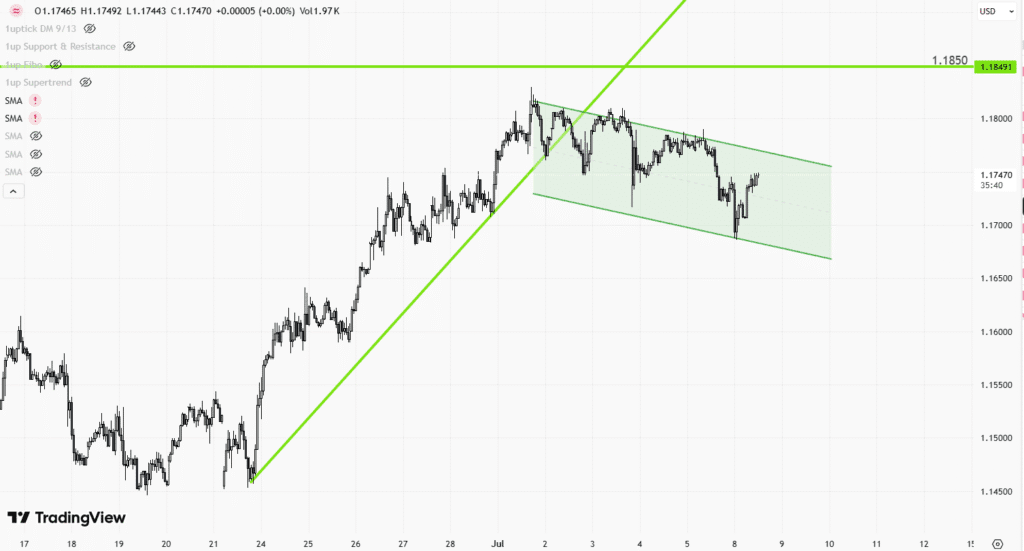

Euro Rebound Forms Bull Flag Pattern Against Dollar, Eyes Breakout Above 1.1805 Toward 1.1965 Amid US-EU Tariff and US Data Watch

The euro rebounded against the U.S. dollar at the key technical support level of 1.1686, forming a bullish flag pattern—a signal that the upward trend could continue. A decisive break above 1.1805 may open the…

Argentina Soybean Meal Reenters Chinese Market, Reshaping Global Ag Supply Chains and Challenging U.S. Export Dominance

After a six-year hiatus, Argentina has resumed soybean meal exports to China—a move that signals a renewed chapter in global agricultural trade. With U.S.-China trade tensions continuing to rise, China is actively looking to diversify…

Latest FX Analysis

GBPUSD-Daily

Latest Gold Analysis

Gold Trend 07/04 – Gold Enters a Consolidation Phase

1uptick Insight