Japan’s 30-Year Bond Yields Surge to 20-Year High as Central Bank Shift Triggers Market Turmoil and Capital Outflows

Japan’s 30-Year Government Bond Yields Hit 20-Year High as Policy Shift Jolts Markets Yields on Japan’s 30-year government bonds have surged to their highest level in two decades, underscoring growing market turbulence sparked by a…

Trump Demands $61 Billion, Sparks Talk of 51st State—Canada Stunned as Carney Rejects ‘Golden Dome’ Deal to Defend Sovereignty

Former U.S. President Donald Trump recently proposed that if Canada wants to join the "Gold Dome" missile defense system, it must either pay a staggering $61 billion or agree to become the 51st state of…

Gold Dips Below $3,300 Short-Term, but Goldman Sachs Predicts Rebound to $3,600

Recently, gold prices in Hong Kong have slipped below $3,300 per ounce, weighed down by a stronger U.S. dollar and a decline in safe-haven demand. Despite short-term pullbacks, major institutions like Goldman Sachs remain optimistic…

U.S. Durable Goods Orders Fall 6.3% in April, Beating Forecasts as Core Orders Rise, Highlighting Manufacturing Resilience

U.S. durable goods orders fell 6.3% in April, snapping a four-month streak of gains. Despite the decline, the drop was less severe than economists had expected. Core capital goods orders—a key measure of business investment—edged…

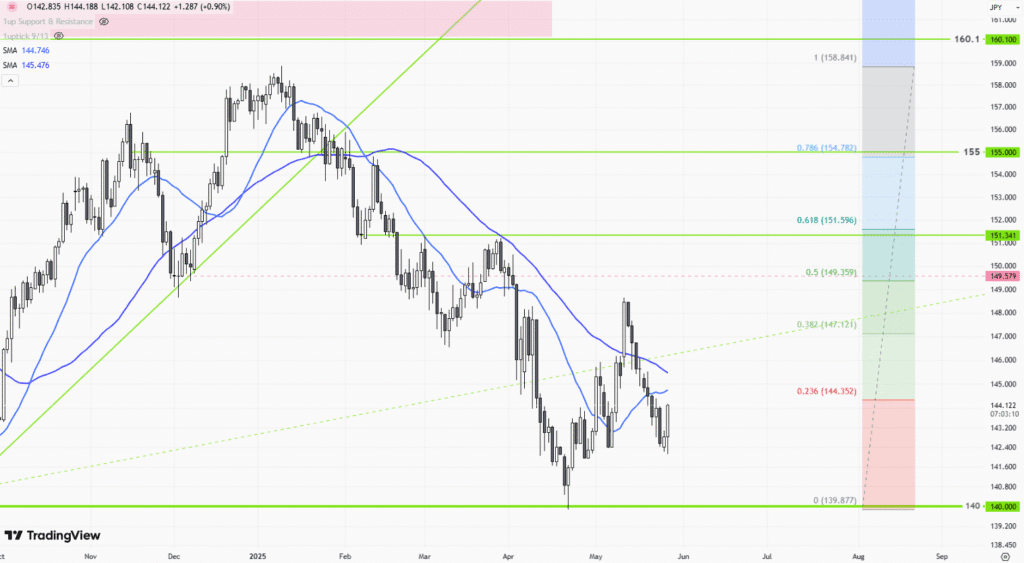

USD/JPY Finds Support Near 140, Eyes Rebound Toward 146 as Interest Rate Policies Drive Momentum

The US dollar has recently found support around the 140 level against the Japanese yen, sparking speculation about a potential rebound. Heightened volatility in the currency pair is being driven by falling Japanese government bond…

British Pound Hits Nearly 3-Year High Against US Dollar, Charts Signal More Upside Ahead

The British pound has shown strong upside momentum recently, briefly hitting a nearly 39-month high of 1.36 against the U.S. dollar, with gains exceeding 8% since the start of the year. Although a short-term pullback…

Bank of Japan Signals Possible Rate Hike as Markets Watch Policy Shift Closely

The Bank of Japan has signaled a potential interest rate hike, drawing close attention from global markets. Governor Kazuo Ueda indicated that if Japan’s economy continues to recover steadily, the central bank may consider adjusting…

Yen Rises to Multi-Month High on Strong Japan Inflation and Tightening Signals – U.S. PCE Data in Focus

On May 27, 2025, the Japanese yen climbed to its highest level in nearly a month, supported by stronger-than-expected inflation data and signals from the Bank of Japan hinting at tighter monetary policy. At the…

Latest FX Analysis

GBPUSD-Daily

Latest Gold Analysis

Gold Trend 07/04 – Gold Enters a Consolidation Phase

1uptick Insight