U.S. Dollar Weakness Signals Structural Strain: How Investors Can Navigate Growing Forex Market Divergence

The U.S. dollar has been weakening recently, even as U.S. equities and bonds have shown signs of recovery. This downward trend is being driven by narrowing interest rate differentials, capital outflows, and growing pressure from…

Pound Sterling Rallies as UK Rate Cut Aligns with New UK-US Trade Deal, Boosting Market Confidence

The Bank of England has announced an interest rate cut, coinciding with a newly signed trade agreement between the UK and the US—an unexpected combination that’s reshaping market expectations. Despite the rate drop, the British…

U.S. Tariff Hike Pressures Japan’s Inflation and Rate Outlook—BOJ’s Ueda Warns of Export Strain Impacting Corporate Pricing and Yen Exchange Rate

U.S. Tariff Hikes Threaten Japan's Inflation Outlook as BOJ Faces Tough Choices Rising U.S. tariffs could deal a serious blow to Japan’s inflation expectations, according to Bank of Japan Governor Kazuo Ueda. He warns that…

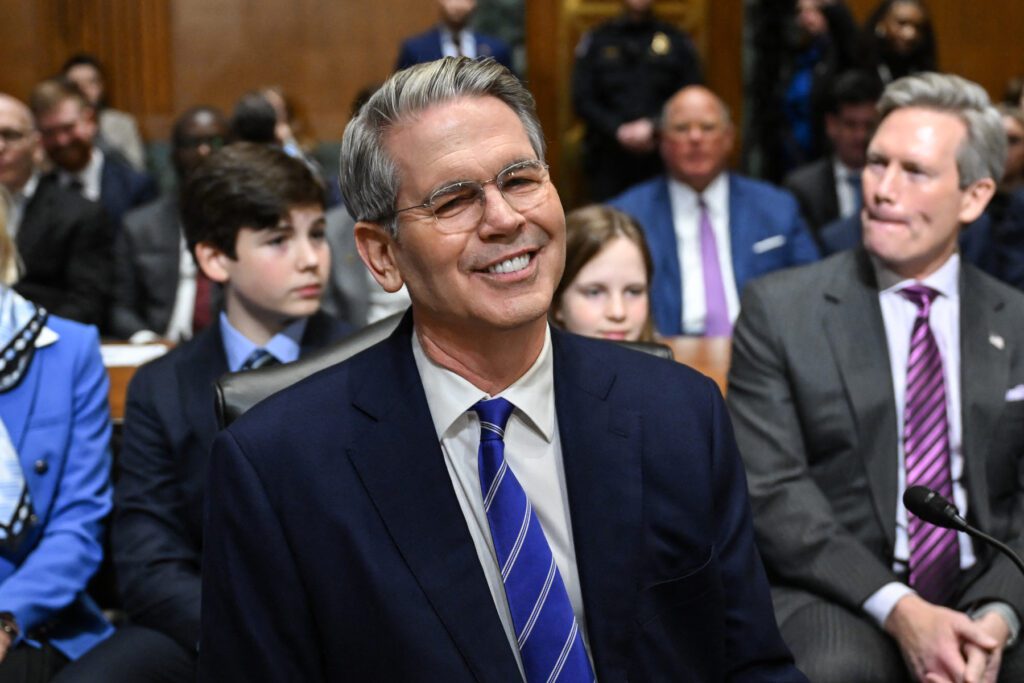

U.S. Stocks Climb as Treasury Secretary Signals Positive Outlook; Washington Seeks New Trade Deals with 17 Nations

U.S. Treasury Secretary Signals Trade Breakthrough, Boosting Stock Market The U.S. stock market rallied after the Treasury Secretary hinted at positive developments in international trade. The United States is currently working with 17 countries on…

GBP/USD Approaches Key Resistance at 1.3285 as Fed Rate Decision and UK PMI Data Drive Market Direction

The British pound is currently testing a critical resistance level at 1.3285 against the US dollar, with traders closely watching two key catalysts: the upcoming Federal Reserve interest rate decision and the release of UK…

This Week’s FOMC Meeting Puts Interest Rates in Focus as Strong Jobs Data and Inflation Shift USD, EUR, and JPY Exchange Rates

This week, all eyes are on the U.S. Federal Reserve's FOMC meeting, with markets closely watching for signals on the direction of interest rates. Despite signs of slowing economic growth, the labor market remains resilient,…

Asia Stocks Rally as U.S.-China Trade Talks Resume and China Cuts Interest Rates, Boosting Market Confidence

High-level trade talks between the U.S. and China are set to resume, fueling optimism across global markets. At the same time, China has rolled out a series of interest rate cuts aimed at boosting economic…

Shanghai Gold Exchange Plans Vault in Hong Kong to Boost Yuan-Priced Gold Trading and “Shanghai Pricing, Hong Kong Delivery” Model

The Shanghai Gold Exchange has announced plans to establish an offshore gold vault in Hong Kong, marking a significant step forward in China’s effort to internationalize yuan-denominated gold. This move is set to strengthen Hong…

Latest FX Analysis

GBPUSD-Daily

Latest Gold Analysis

Gold Trend 07/04 – Gold Enters a Consolidation Phase

1uptick Insight