|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Trend 22/07 – Failed to clear 2450

Gold Trend 22/07 – Failed to clear 2450

2024-07-22 @ 17:11

Entering a consolidation cycle after gold failed to stay above 2450.

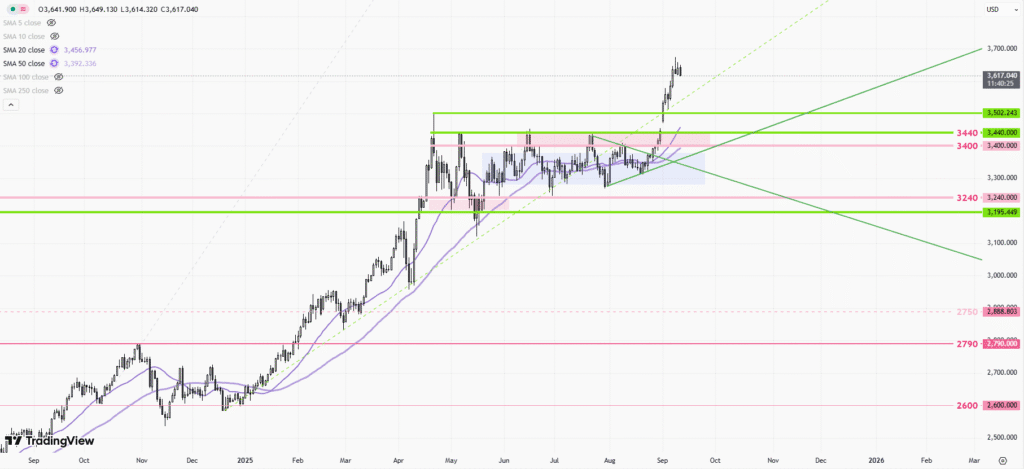

Gold price broke through the previous historical high of 2450(1) early last week on Tuesday, triggering a round of buying and rising to a weekly high of 2483 within 24 hours. However, the upward momentum failed to carry on at a high level. According to the market data from CME, gold futures showed significant new short positions entering the market on Wednesday. Short-selling accelerated after the U.S. released manufacturing data on Thursday, when the price fell below the key support of 2450(2), and the market closed near 2400 before the weekend. After the false break above 2450, it will be hard for gold to return back above 2450 in the near term without any consolidation. This week, focus on Thursday and Friday’s U.S. GDP and the core inflation data.

1-hr chart > Gold price supports the previous week’s low of 2390-2400. Before the next move, take advantage of the 2391-2440(3) range early this week. If the gold price breaks below 2385(4), the downside target will be 2350(5).

Daily chart > The decline in gold prices is accelerating, with a single-day drop of more than $40 on Friday. The short-term support is at 2400(7), and the lower target can grasp the 20-day moving average.

Weekly chart > Gold prices are on a L-T upward trend that originated from 2018. Last week’s peak has created a reversal signal on the chart (10). The target below can now be aimed at the bottom of the range 2300 (11).

P. To