|

| Gold V.1.3.1 signal Telegram Channel (English) |

Copper Prices Swing Amid Global Economic Uncertainty—Tariff Signals Offer a Positive Indicator, but Investors Should Stay Cautious

2025-04-16 @ 11:20

Lately, the global base metals market has seen heightened volatility, driven by unpredictable policy shifts and macroeconomic uncertainty. Among these, copper has taken center stage as the most closely watched commodity. Although the U.S. has recently signaled a potential easing of tariffs, sparking some optimism among investors, the broader market remains under pressure. Many analysts continue to hold a cautiously bearish outlook over the medium term.

One of the short-term boosts for market sentiment came from the U.S. government’s announcement of adjustments to tariffs on select Chinese imports. The move was interpreted as a gesture to ease trade tensions and give businesses more flexibility with sourcing. While this helped lift sentiment temporarily and pushed copper prices slightly higher, the rally was short-lived. Prices quickly pulled back, underscoring the market’s continued concern over weak underlying demand.

On the supply side, there have been a few supportive developments. China’s copper imports have picked up, coinciding with seasonal inventory restocking by local smelters. There’s also a sense of urgency among buyers concerned about future tariff increases, prompting them to stock up while prices remain relatively low. In parallel, the U.S. has been actively buying scrap copper for strategic reserves, draining supply from global spot markets. This has led to tighter conditions and higher premiums, particularly evident in the widening price gap between U.S. and Asian copper markets.

Despite these factors, the broader trend for copper still leans downward. Some forecasting models suggest that if the U.S. proceeds with higher import tariffs in the second quarter, it would raise domestic copper costs and widen regional price disparities. This could prompt traders to concentrate shipments into the U.S., straining supply elsewhere and distorting global trade flows. As a result, several research firms have revised down their short- to medium-term copper price forecasts.

Beyond trade policy, structural shifts in supply chains are also reshaping traditional trade patterns in the copper market. South American exporters are increasingly rerouting shipments toward North America, drawn by elevated prices despite higher tariff risks. Meanwhile, Asian buyers are stepping up raw material sourcing from Africa, hoping to cushion themselves against rising costs and future supply disruptions.

In the financial markets, sentiment remains cautious. Hedge funds have significantly ramped up short positions, reaching the highest levels seen since the same time last year. In the options market, the cost of downside protection has jumped noticeably, with put options commanding a larger premium than equivalent call options. This reflects a widespread expectation of potential price corrections ahead.

Still, it’s not all gloom. Some in the market believe China could introduce new stimulus measures targeting the power grid and infrastructure sectors. These areas are heavy users of copper, especially in high-density applications like transmission lines. Should these policies materialize, they could provide a much-needed lift to demand and possibly change the narrative heading into the second half of the year.

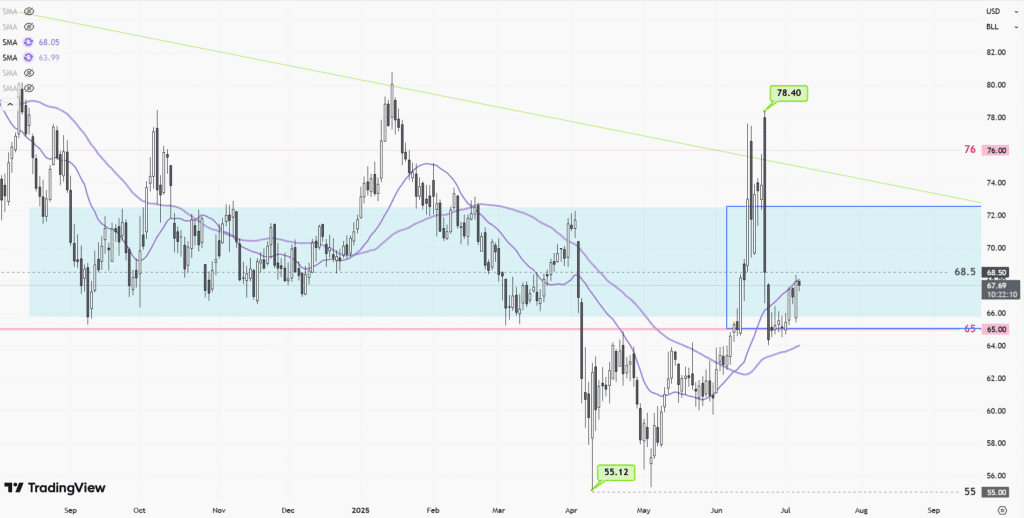

From a technical perspective, London copper prices are currently trading within a narrow range, hovering between key support and resistance levels. A break below certain moving averages could trigger further downside, but if the price holds firm, there’s room for a rebound. That said, most observers agree that any sustainable recovery would require a meaningful pickup in real demand—without it, any bounce may prove short-lived.

In summary, while the softening in U.S. tariff policy offered a brief respite, the copper market continues to wrestle with weak fundamentals, shifting global supply dynamics, and macroeconomic headwinds. Analysts are generally advising a cautious approach: stay grounded when evaluating rebound opportunities and consider hedging through diversified cross-regional strategies. With the spring seasonal peak nearing its end, the path forward will largely depend on how China’s domestic demand evolves and how international trade policy unfolds in the months ahead.

![[Daily Closing 🔔] Gold – Gold Prices in New York Swing Sharply as Geopolitical Tensions and Dollar Strength Drive Market Uncertainty](https://int.1uptick.com/wp-content/uploads/2025/05/2025-05-22T235933.071Z-file-1024x576.png)

![[Daily Closing 🔔] Gold – Gold Prices Climb to New Highs on Tuesday as Weaker Dollar Boosts Safe-Haven Demand](https://int.1uptick.com/wp-content/uploads/2025/05/2025-05-22T004512.731Z-file-1024x576.png)