|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold and Silver Price Forecast 2025: Inflation, Fed Policy, and Key Technical Levels to Watch

2025-08-18 @ 19:00

Gold and silver prices are under intense scrutiny as traders navigate shifting expectations for U.S. Federal Reserve policy and react to recent signals from inflation data. The precious metals market is at a pivotal point, with every new economic metric having the potential to sway sentiment, prompt sharp moves, and redefine key technical levels.

Inflation and Fed Rate Cut Hopes:

Rising or sticky inflation has been the dominant theme in recent months, keeping investors guessing about the Fed’s willingness and ability to cut interest rates this year. Hopes of rate cuts had earlier fueled bullish moves in both gold and silver, but each new inflation print and central bank speech now triggers swift market reactions. Strong inflation data tends to temper expectations for imminent Fed easing, often prompting a pullback in gold and silver as the dollar firms and Treasury yields climb.

Recent U.S. data releases have shown inflation running hotter than the Fed’s 2% target, making the timing of the first rate cut less certain. As a result, gold—which thrives in lower-rate environments—has experienced bouts of volatility after soaring to new record highs earlier this year. Many traders now focus on upcoming economic releases and Fed communications, knowing that evidence of cooling inflation could quickly revive the rally.

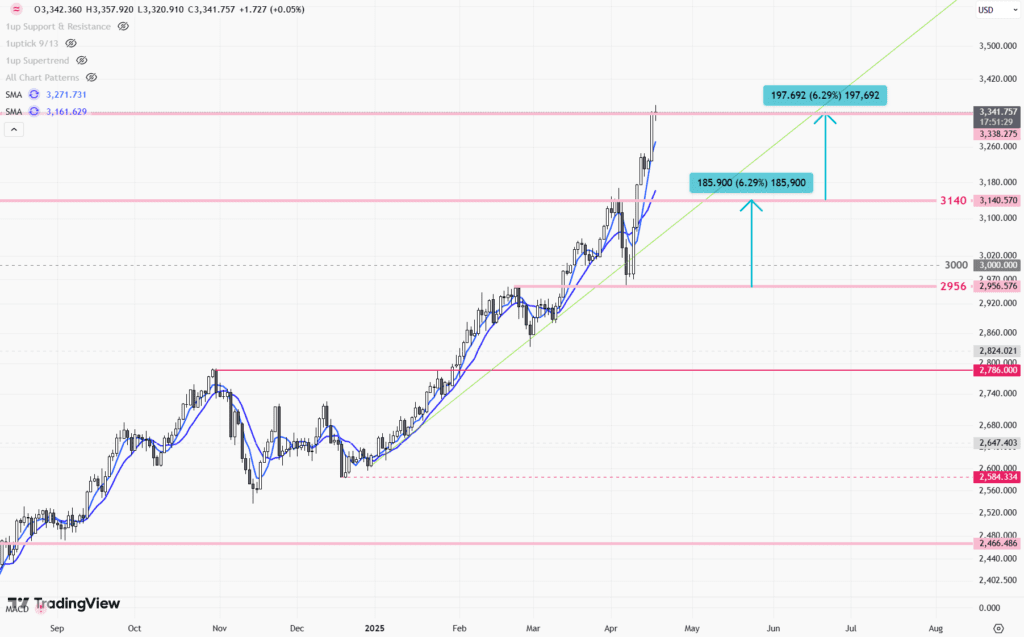

Gold Technical Outlook:

After reaching all-time highs, gold’s price momentum stalled as sellers emerged and investors booked profits. Technical analysts point out that price patterns now resemble those seen at significant market tops, like 2011. Key resistance levels have formed near recent highs, while strong support zones remain closer to prior consolidation areas.

Should gold’s price break decisively above resistance, it would likely spark another round of buying as momentum traders join in. Conversely, a decisive move below support could trigger stop-loss selling and usher in a deeper correction.

Market forecasts for gold in 2025 vary widely but generally remain optimistic. Some leading financial institutions see gold reaching or exceeding $3,500 per ounce this year, with more bullish scenarios targeting as high as $3,900 if macroeconomic conditions align. This optimistic view hinges on factors like continued central bank buying, escalating geopolitical tensions, and persistent inflation concerns. Even more moderate projections from major banks suggest gold prices will stay well above the long-term averages.

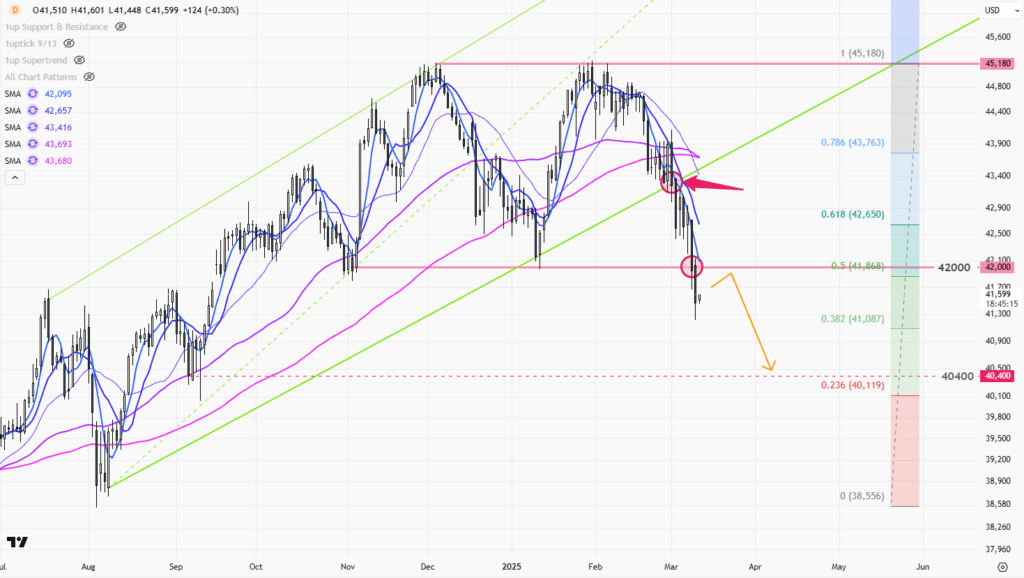

Silver’s Mixed Prospects:

Silver shares many drivers with gold, most notably its role as an inflation hedge. However, silver is also heavily influenced by industrial demand due to its uses in electronics, solar energy, and manufacturing. This dual characteristic often leads to heightened volatility, especially when economic growth prospects are uncertain.

Silver prices have oscillated in recent months, influenced by both the broader moves in gold and unique supply-demand factors. Technical projections for silver in the coming months suggest potential for both upside and downside. Analysts identify the $28 to $30 range as a major battleground: a successful breakout above could signal a new bull leg, while repeated failure at these levels might lead to another retreat toward the mid-$20s.

Forecasts for the remainder of 2025 suggest silver is likely to trade in a broad range, with brief surges possible if bullish catalysts emerge. On the downside, silver remains vulnerable to any global growth slowdown, which dampens industrial demand and weighs on sentiment.

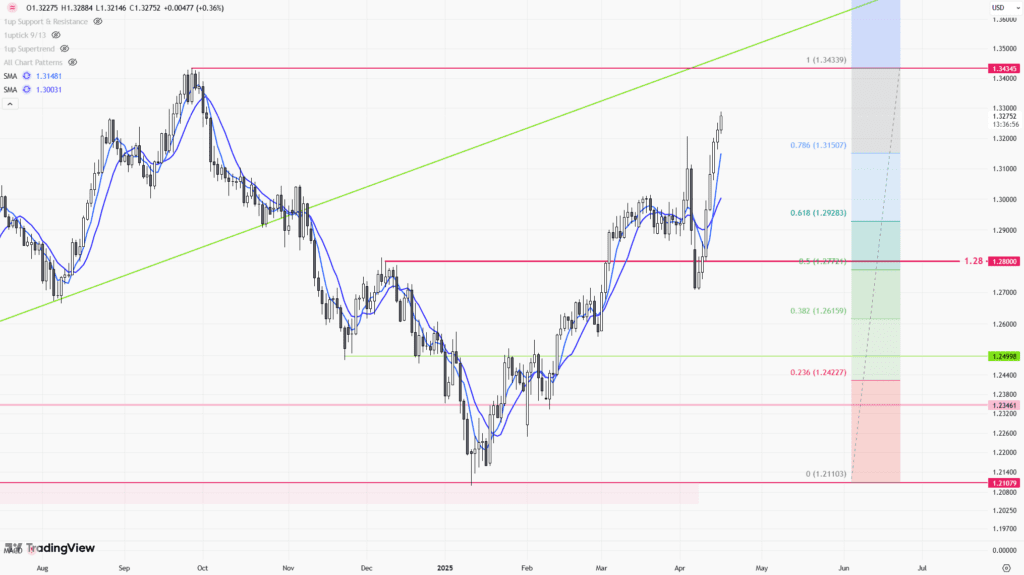

Key Levels and What Traders Are Watching:

For both gold and silver, technical levels matter now more than ever. In gold, traders are watching to see if the metal can sustain moves above previous all-time highs, confirming the next phase of the bull market. Support levels just below these highs will be crucial—failure to hold could accelerate downside momentum.

For silver, the battle lines are clearly drawn at the $28 and $30 marks. Consistent closes above these figures could mark the start of an extended rally, while repeated failures would make silver vulnerable to deeper corrections.

Macro Themes Still Reign:

Beyond the charts, broader themes continue to drive precious metals. Persistent inflation, the strength of the U.S. dollar, global political and economic instability, and central bank actions remain the fundamental catalysts. Traders and investors are keenly aware that sudden changes in any of these variables could reshape the landscape for gold and silver in an instant.

For now, markets remain in a wait-and-see mode, with every data point dissected for hints about the Fed’s policy path. The balance between inflation concerns and Fed flexibility will likely dictate the next decisive move in precious metals, making upcoming economic reports and central bank meetings essential events for anyone trading or investing in gold and silver.

Stay tuned as this pivotal phase for precious metals continues to unfold—volatility is almost guaranteed, and underlying long-term trends remain very much in play.