|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold and Silver Price Forecast August 2025: Impact of Fed Policy, Market Resistance, and Volatility Trends

2025-08-19 @ 19:00

Gold and Silver Price Outlook: Navigating August 2025 Amid Fed Signals and Policy Uncertainty

August 2025 marks a pivotal period for precious metals traders and investors. The market landscape for gold and silver is currently shaped by heightened anticipation around upcoming Federal Reserve minutes and a closely watched speech by Fed Chair Jerome Powell. These events are expected to offer new insights into the central bank’s policy direction, directly impacting price volatility in the yellow and white metals.

Gold’s Record Rally Meets Resistance

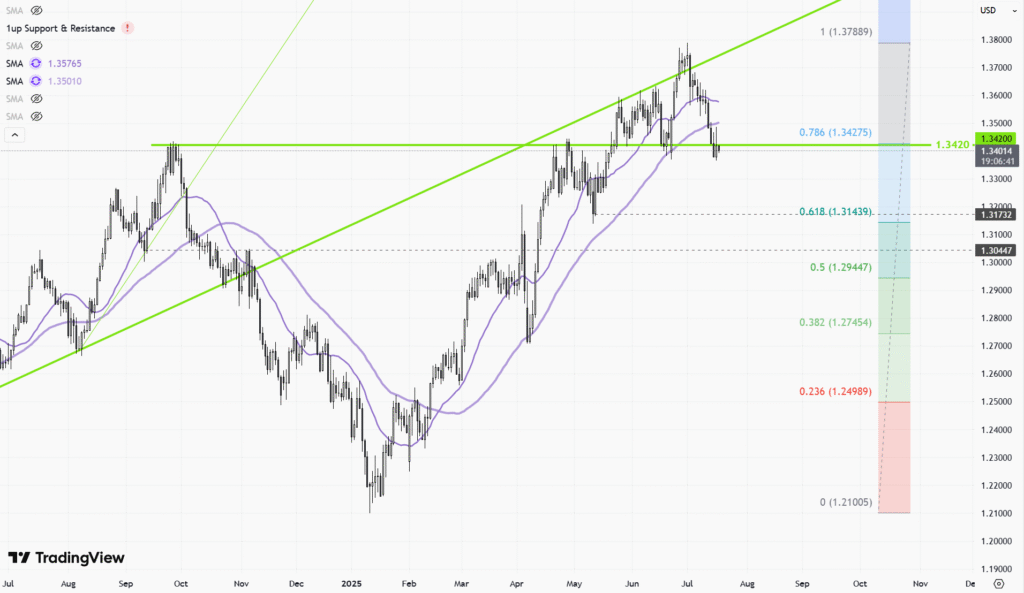

Early August witnessed gold futures climbing to stunning new all-time highs, lifting sentiment in both the physical and paper gold markets. However, technical signals and historical patterns indicate that this exuberance may soon be tempered by significant resistance. Notably, gold stocks—as represented by proxies such as the GDX ETF—have rallied to retest highs dating back to 2011, a critical area where previous rallies faltered.

Several market analysts point to similarities in asset behaviors reminiscent of the 2011 peak. In technical terms, gold’s current price action suggests it is facing overhead resistance and is more likely to consolidate or correct rather than advance in a straight line. Observers are watching for whether gold can hold these elevated levels or if a pullback is imminent as traders digest economic data and Fed commentary.

Drivers Behind the Latest Moves

Macro factors contributing to gold’s ascent include ongoing tariff stabilization, which has propelled the US Dollar Index higher. A stronger dollar often caps gold’s upside momentum because it raises the relative cost of gold for non-dollar holders. Additionally, declining uncertainty around trade policies has provided a boost to dollar strength, thus acting as a headwind for further gold gains.

At the same time, investor interest in gold remains robust, driven by its role as a hedge against economic and geopolitical uncertainty. The anticipation of dovish Federal Reserve signals or further global instability continues to underwrite bullish price projections from institutional analysts and AI-based models alike.

Consensus Price Forecasts for Gold in 2025

Price predictions for gold in 2025 vary considerably, reflecting both bullish sentiment and caution about sustained rallies.

Major financial institutions and AI models offer the following outlooks:

– Goldman Sachs and J.P. Morgan forecast gold at $3,700 and $3,675 respectively by year-end.

– Bank of America, UBS, and Macquarie project gold in the $3,500+ range.

– ANZ and the Société Générale also estimate prices reaching or exceeding $3,500.

– Other notable forecasts, such as those by Commerzbank and HSBC, offer a broader range between $2,750 to $3,215, with some expecting an average near $2,900 in Q4.

– AI-driven consensus aggregates suggest gold may fluctuate between $2,477 and $3,026 in 2025, though actual prices in July reached above $3,200.

– User-driven sites and market polls show sentiment tilted towards levels near $3,679.

Ultimately, while the consensus remains bullish, investors should be cautious of volatility at current elevated price levels. These forecasts imply that while further upside is possible, corrections and sudden bouts of profit-taking are likely as policy decisions unfold in real time.

Silver’s Trajectory: Volatility and Opportunity

The silver market has experienced notable swings throughout the first half of 2025, offering both challenges and opportunities to traders. As of August, silver opened at $26.82 per ounce and surged to intra-month highs near $29.90 before settling closer to $28.48. This represents more than a 6% rally within the month. Such price movement reflects silver’s characteristic volatility, often exaggerated by shifts in risk sentiment and changes in industrial demand.

Forecasts for subsequent months highlight this volatility:

– September projections see a potential retracement to $27.44, a nearly 4% decline.

– October may witness further pullback with prices possibly dipping to $25.74.

– Looking ahead to the year-end, silver is generally expected to recover and retest highs near $30, with December averages projected at $28.10 and potential closing values around $28.58.

Market participants should remain mindful of silver’s dual role as both a precious and industrial metal. Economic growth concerns, changes in technology-driven demand, and central bank rhetoric all feed into the price dynamics.

Key Takeaways for Precious Metals Investors

- The current environment is defined by uncertainty around Fed policy and macroeconomic conditions. Both gold and silver prices exhibit sensitivity to changes in interest rate outlooks and currency strength.

- Technical analysis points to possible short-term corrections for gold, especially as prices test long-standing resistance zones. Silver, meanwhile, offers tactical trading opportunities amid volatility.

- Long-term forecasts skew bullish, but investors should exercise disciplined risk management, particularly given the rapid run-up in prices seen this summer.

- Central bank commentary, especially from the Federal Reserve, will remain the primary market catalyst in the coming weeks.

As always, assessing your portfolio and trading strategies in light of updated forecasts and evolving market narratives is crucial. Staying informed, agile, and attentive to both macro shifts and technical signals will help navigate what promises to be an eventful stretch for gold and silver market participants.